The post Aave Price Prediction 2025, 2026 – 2030: Will AAVE Price Hit $500 In 2025? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the AAVE token is $ 313.05094133.

- AAVE price could surge to a maximum of $526 in 2025.

- Aave with a potential surge could go as high as $1,161 by 2030.

Aave is quickly becoming the centerpiece of the DeFi space, breaking records and attracting institutional interest. Its upcoming Aave V4 Liquidity Hub testnet, expected in September 2025, will replace separate markets with a shared liquidity pool. This lets custom markets tap into network-wide funds, making it more appealing for large-scale builders.

The fundamental strengths of the protocol such as borrowing, lending, staking, liquidity pools, and flash loans. Still holds significant prominence in the industry, which could help the digital asset move higher candles.

Are you one of the many who are considering Aave Price Prediction? Then look no further as this write-up decodes the possible price forecast for 2025, 2026 – 2030, and the years in between!

Table of Contents

Overview

| Cryptocurrency | Aave |

| Token | AAVE |

| Price | $ 313.05094133  -2.22% -2.22% |

| Market cap | $ 4,764,041,259.7910 |

| Circulating Supply | 15,218,102.3303 |

| Trading Supply | $ 644,097,647.5575 |

| All-time high | $666.86 on 19th May 2021 |

| All-time low | No Data |

Aave (AAVE) Price Prediction 2025

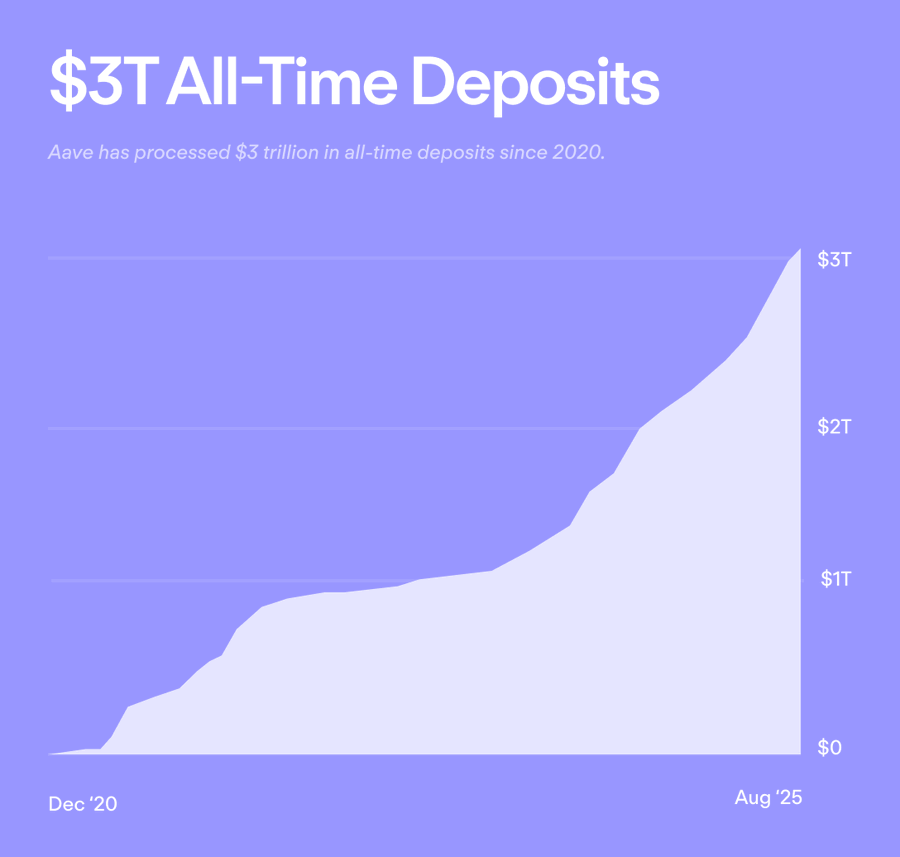

Aave has reached $3 trillion in cumulative deposits. With $66.3 billion in total value locked, Aave commands a leading share of the market. This milestone marks an important step in proving the strength and resilience of decentralized finance.

Notably, if it manages to resist the challenges and continues to rise, then the AAVE price could close in the year 2025 with a potential high of $526.

However, the asset would plummet to a bottom of $234 if bears predominate in the space. Successively, factoring in the bullish and bearish targets, the average price could be at $430.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $234 | $430 | $526 |

Also, read Avalanche Price Prediction!

Aave Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 406 | 511 | 617 |

| 2027 | 498 | 599 | 700 |

| 2028 | 609 | 712 | 812 |

| 2029 | 673 | 810 | 947 |

| 2030 | 798 | 979 | 1,161 |

Aave Price Targets 2026

According to forecast prices and technical analysis, Aave’s price may reach a minimum of $406 in 2026. The maximum price could hit $617, with an average trading price around $511.

Aave Crypto Price Prediction 2027

Looking forward to 2027, AAVE’s price may reach a low of $498, with a high of $700 and an average forecast price of $599.

Aave Price Forecast 2028

In 2028, the price of a single AAVE may reach a minimum of $609, with a maximum of $812 and an average price of $712.

Aave Coin Price Prediction 2029

By 2029, Aave’s price may reach a minimum of $673, with the potential to hit a maximum of $947 and an average of $810.

Aave Price Prediction 2030

In 2030, the AAVE token may touch its lowest price at $798, hitting a high of $1,161 and an average price of $979.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Wallet Investor | $434.66 | $507.21 | – |

| priceprediction.net | $429.48 | $623.98 | $2,948 |

| DigitalCoinPrice | $767.84 | $1,056.16 | $2,204.91 |

*The targets mentioned above are the average targets set by the respective firms.

CoinPedia’s AAVE Price Prediction

According to CoinPedia’s AAVE price prediction, this crypto token is expected to gain significant traction this Altseason. Moreover, with the increasing number of investors and the adoption process, the AAVE price could hit a new ATH.

If the coin gains some hype in the coming months, then the AAVE price can hit a high of $526 in 2025. On the flip side, a rise in bearish influence can drop AAVE to $234 in 2025.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $234 | $430 | $526 |

Also, read Arbitrum Price Prediction!

FAQs

AAVE is an open-source, decentralized, and non-custodial liquidity token that thrives on facilitating users to lend and borrow cryptocurrencies.

Considering the fundamentals of the protocol, AAVE is a profitable investment if considered for the long term.

The price of AAVE could surge to a maximum of $526 in 2025.

The circulating supply of AAVE is 15,010,000 tokens.

The price of the altcoin could escalate to $1,161 by 2030 if the bullish sentiment sustains. Conversely, it could close the year with a low of ~$800.

AAVE is available for trade across prominent cryptocurrency exchange platforms such as Binance, Huobi Global, FTX, KuCoin, etc…