Cardano (ADA), the proof-of-stake blockchain network known for its smart contracts, has defied recent predictions of a fall from the top 10 cryptocurrency rankings by market cap.

In a surprising move, ADA has instead become the top performer among major coins, experiencing a 7% surge in the last 24 hours. This price action has ignited discussions about ADA’s potential to revisit its 2021 glory days, when it reached a peak of $3.10.

A Tale Of Two Whales: Retail Accumulation Vs. Profit Taking

The recent price increase can be attributed to two key factors: a surge in buying pressure and a potential upcoming “battle of the whales.”

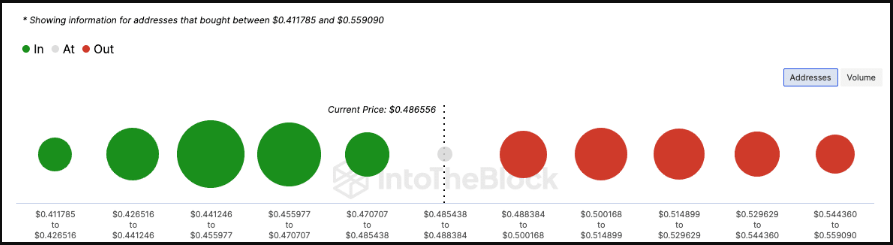

On-chain data reveals that retail investors, the so-called “whaley” masses, have been accumulating ADA aggressively, particularly between $0.48 and $0.50. This large cluster of buyers could act as a support system if the price reaches that level.

However, lurking beneath the bullish sentiment is a potential obstacle. Data shows that only 40% of current ADA holders are in profit.

A price increase to $0.49 could be particularly significant, as it could push the ratio of holders in loss below 55%. This milestone could trigger further buying pressure as more investors see an opportunity to move into profit territory.

Whales Return? On Volume And Market Cycle

Cardano’s price rally is also being fueled by a significant rise in trading volume, reaching a weekly high of $461 million according to Santiment. This surge in activity indicates growing interest in ADA, which could propel the price further upwards.

But can this momentum be sustained? The answer might lie with the “original whales,” the large investors who hold a significant portion of the cryptocurrency.

Interestingly, the current distribution of ADA shares some similarities with the market conditions in 2021, when the price hit $3. Back then, whales held roughly 6% of the total supply. Today, that number sits at nearly 7%, suggesting a potential return of these big players.

However, analysts caution that the success of this “whale comeback” narrative depends heavily on the broader market cycle. If the current bull market reaches its peak, ADA’s price growth could be restricted, hindering its ability to revisit its all-time high.

Can ADA Defy The Odds?

Cardano’s recent price surge has instilled a sense of cautious optimism in the cryptocurrency community. While the strong buying pressure from retail investors and the potential return of whales are positive signs, the profitability of current holders and the unpredictable nature of the market cycle pose challenges.

In the coming weeks, it will be crucial to observe whether ADA can overcome the selling pressure at $0.49 and sustain its upward trajectory. If trading volume continues to rise alongside the price, and if the current bull market holds, ADA might just surprise everyone and revisit its much-anticipated $3 mark.

Featured image from Pexels, chart from TradingView