The crypto market experienced a downturn over the past weekend, with major assets, including Bitcoin, Ethereum, and Solana, seeing notable declines. As investors look to the week ahead, several critical events loom that could influence market dynamics. Here’s a detailed examination of the five pivotal events set to shape the crypto landscape this week.

#1 Spot Bitcoin ETF Launch In Hong Kong

On April 30, 2024, Hong Kong will witness the launch of its first spot Bitcoin ETFs, a landmark event for the region’s cryptocurrency market. Firms such as HashKey Capital and Bosera-HashKey have been greenlit by the Hong Kong Securities and Futures Commission (SFC) to offer these products, which permit direct investment into Bitcoin rather than derivatives.

Financial analysts from Bloomberg have set the investment potential for these ETFs at around $1 billion in assets under management (AUM) over the next two years. However, this figure pales in comparison to the AUM of US Spot ETFs, which, excluding the outflows from the Grayscale Bitcoin Trust (GBTC), have accumulated $29 billion.

On a contrasting note, Matrixport, a Singapore-based financial services firm, predicts that the influx of Chinese investors through the Stock Connect program could spur a demand reaching as high as $25 billion.

The ETFs are noteworthy for their “in-kind” creation and redemption mechanisms, differing from the cash-only transactions typical in US ETFs. This approach allows for the direct exchange of Bitcoin for ETF shares, which could enhance liquidity and reduce costs associated with asset management.

#2 Fed Interest Rate Decision

The Federal Reserve’s upcoming decision on interest rates, due on May 1, is perhaps one of the most consequential factors for the cryptocurrency market this week. Following a period of “higher-for-longer” interest rates to combat persistent inflation. Jerome Powell’s commentary will be crucial as the Fed will react for the first time to rising PCE, PPI, and CPI inflation data.

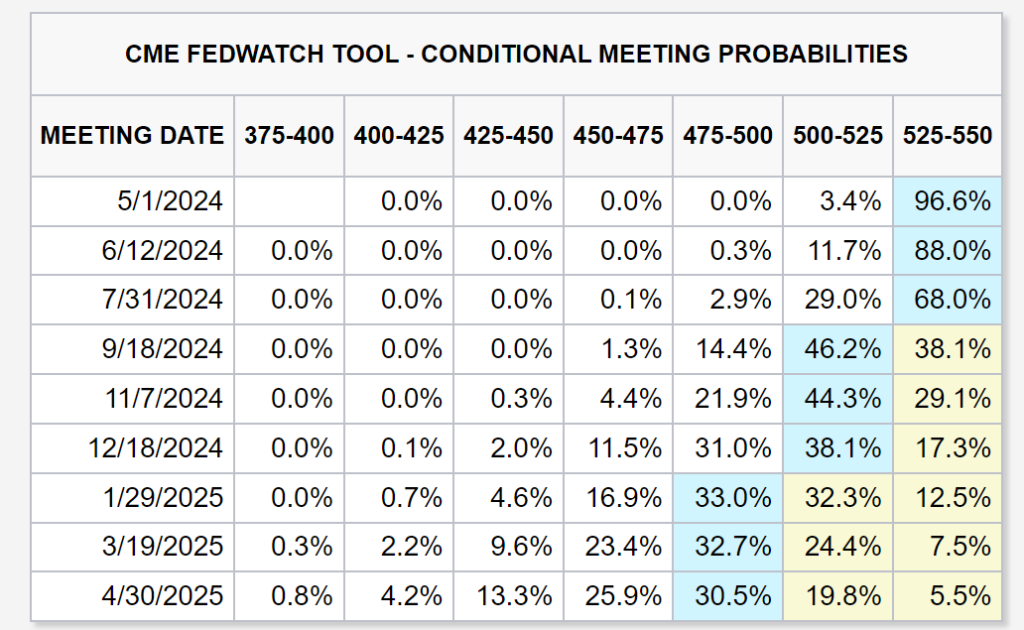

As of now, the market, guided by the CME FedWatch Tool, expects at most two rate cuts in 2024, a decrease from previous forecasts. With rates currently holding at a decades-high of between 5.25% and 5.5%, the crypto market is sensitive to any signals that might suggest a shift. A continuation of the current rate or any indication of a hawkish stance could dampen market sentiment, whereas hints at possible rate cuts could bolster it.

#3 Coinbase (COIN) Reveals Its Q1 Earnings

Coinbase is set to release its Q1 2024 financial results after the US market closes on May 2. Expectations are high, with projected revenues of $1.3 billion, marking a 71% increase from the same quarter last year. This anticipated growth in revenue is largely attributed to an increase in transaction revenues, driven by a sharp rise in Bitcoin and Ethereum prices, which respectively make up significant portions of Coinbase’s transactional income.

These results will also be the first since the US SEC’s approval of Spot Bitcoin ETFs, which likely contributed to the increased trading volumes. Investors and analysts will be particularly attuned to the earnings per share (EPS), expected at $0.97, signaling continued profitability and a robust turnaround from previous losses.

#4 Theta Network (THETA) Launches EdgeCloud

Theta Network is gearing up to launch its innovative EdgeCloud platform on May 1. This platform represents a significant step forward in decentralized computing, utilizing a distributed network of nodes to execute computing tasks like AI and media processing, rewarding participants with TFUEL, Theta’s native token.

The EdgeCloud platform promises cost efficiencies by utilizing idle CPU and GPU resources across its network, potentially undercutting traditional cloud service costs. Its launch could have significant implications for the decentralized computing space, offering scalable, flexible solutions with reduced latency by processing data closer to its source.

Theta EdgeCloud is almost ready for v1.0 release! Join Theta CTO @jieyilong as he walks through the EdgeCloud developer dashboard, coming May 1st. https://t.co/jj405Sy8tP pic.twitter.com/QzUq9bRdQ2

— Theta Network (@Theta_Network) April 22, 2024

#5 Solana’s Leading Money Market Releases KMNO Crypto Token

Kamino, a prominent DeFi platform on Solana, is slated to introduce its KMNO token on April 30. With a total supply of 10 billion and an initial circulating supply of 1 billion tokens, the KMNO launch is anticipated to significantly influence Kamino’s ecosystem. About 35% of the token supply is earmarked for community and grants initiatives, while another 20% is reserved for Kamino’s core contributors, locked up for 12 months with a 24-month linear vesting period thereafter.

KMNO tokens will also feature staking capabilities, potentially enhancing holders’ earnings and involving them in governance decisions, such as voting on user reward campaigns and protocol risk management, marking a critical step towards further decentralization and community-driven governance.

At press time, BTC traded at $62,396.