Alameda Research‘s holding in Worldcoin’s native token, WLD, has surged by over $50 million in the past day, thanks to the asset’s new all-time high.

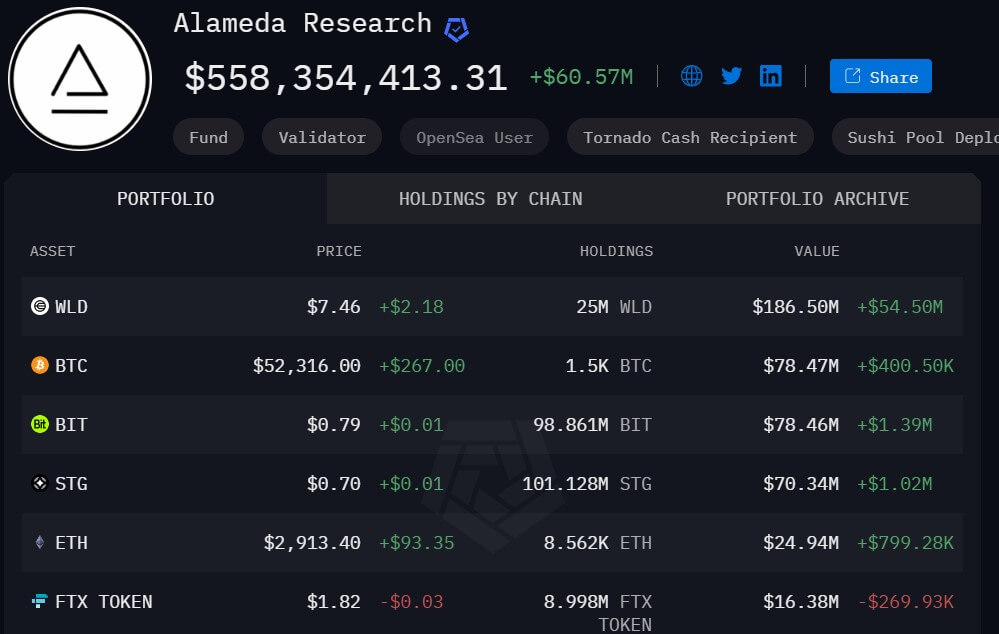

According to data from crypto analytics platform Arkham Intelligence, Alameda currently holds 25 million WLD tokens, valued at $186 million, constituting 33% of its portfolio worth.

Over the past months, Alameda and its affiliated company, FTX, have transferred substantial amounts of digital assets to crypto exchanges. SpotonChain, a blockchain analytics firm, disclosed that the companies had liquidated holdings in 91 different cryptocurrencies, totaling over $700 million across various networks, such as Ethereum and Solana, as part of their bankruptcy proceedings during the last four months.

However, Alameda’s intentions regarding its WLD holdings remain unclear, given its six-month digital asset ownership since August 2023.

Alameda’s portfolio also comprises 1500 Bitcoin valued at $78 million, over 8500 Ethereum estimated at around $25 million, and 9 million units of FTX’s native tokens valued at $16.38 million. The bankrupt firm’s crypto holdings are worth $558 million.

WLD prints new ATH amid record app usage

WLD skyrocketed by around 42% during the past day to reach a new all-time high of $7.63, according to CryptoSlate’s data. This surge continues a positive momentum that has seen it gain a staggering 191.26% during the past week, with the token leaping from $2.55 on Feb. 12 to its current valuation.

Market observers have attributed WLD’s rapid price growth to the significant achievement of World App, surpassing 1 million daily active users. World App is the first wallet application built for the Worldcoin project.

This sudden influx of users reflects the burgeoning interest and adoption the project has enjoyed despite the earlier setbacks of regulatory scrutiny across various jurisdictions, including the U.K., Kenya, Argentina, and others.

Meanwhile, the project aims to incentivize the community to search for bugs on the platform, offering rewards of up to $5000 to white hat hackers who discover critical bugs.

The post Alameda Research’s Worldcoin holdings jump $50 million as WLD hits new peak appeared first on CryptoSlate.