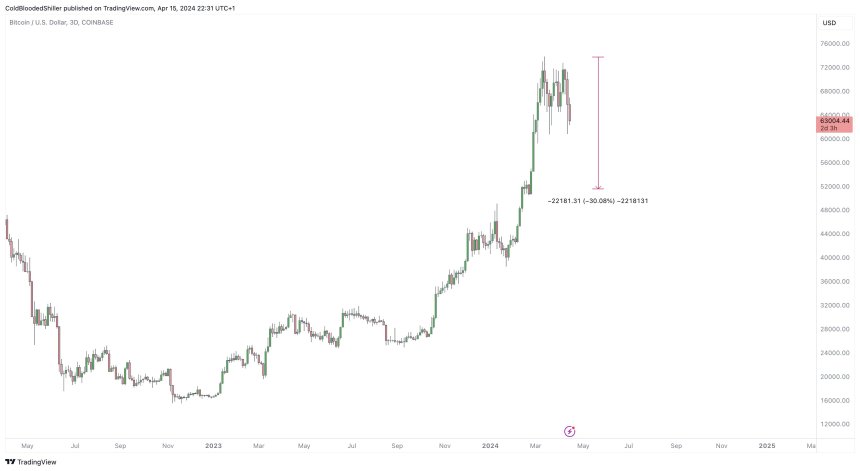

Popular cryptocurrency expert Cold Blooded Shiller has made a grim prediction that Bitcoin may be on the verge of a significant correction and could crash as low as 30%, given the current heightened volatility in the market.

Bitcoin Could Be Poised For 30% Pullback

Cold Blooded Shiller believes it is important to note that Bitcoin is holding up and now showing much more strength, regardless of the different factors influencing the nascent sector, such as ETFs, fundamentals, and Halving.

Given that pullbacks of 30% are historically common for BTC, Shiller foresees the potential for this to repite this cycle. Should the trend manifest, the price of BTC could fall as low as $51,000 in the upcoming months.

The post read:

With the historical tendency to produce -30% pullbacks, what happens to the landscape if BTC does head down for a -30% correction and into the $51,000?

Cold Blooded Shiller drew attention to a previous post offering investors insights on taking advantage of this development when it happens. Shiller is confident that BTC might undergo the correction mentioned above, and the impact on altcoins would likely be around -50%.

The expert believes some investors are eager to profit in the bull cycle but neglect the risk involved in this period. “I keep referencing buy anywhere you want with risk management that supports -30% downside and ensure you can keep buying more,” he stated.

Thus, the analyst has stressed the need for investors to be well organized and understand what constitutes an opportunity-filled environment in a bull market. His post encourages investors to reassess their risk management and investing tactics to navigate the ever-changing crypto landscape successfully.

BTC Price Continues To Fall

The price of Bitcoin continues to move downward, falling to $63,000 after a recovery witnessed on Monday. Over the last 24 hours, the crypto asset has dropped by 5%, causing a general collapse in the market.

At the time of writing, BTC was trading at $63,854, indicating an over 10% decrease in the past week. On the last day, its trading volume increased by roughly 1%, while its market value fell by over 5%.

Given the current trajectory in the crypto market, BTC might suffer an even greater decrease in the next few days. Several analysts anticipate a further price decline before the Halving event in less than five days.