The post Analyst Says XRP Price Will Reach $100 In 2030, But This Ripple Rival Will Go From $0.015 To $150 In 2026 appeared first on Coinpedia Fintech News

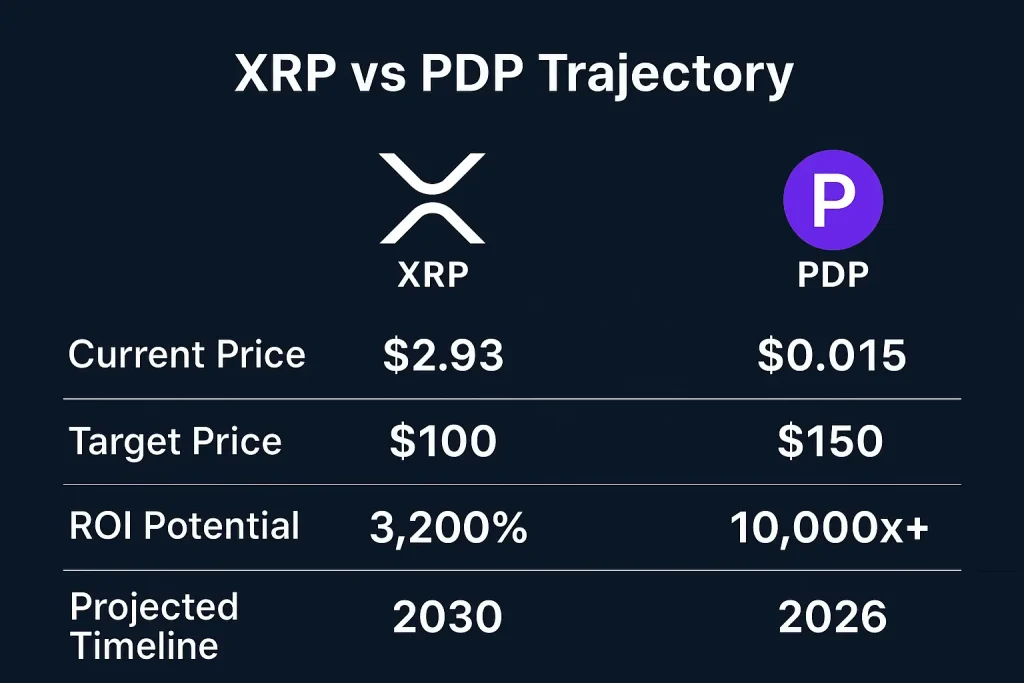

When a crypto analyst recently predicted that the XRP price could hit $100 by 2030, it reignited old conversations about whether Ripple’s token was still the sleeping giant of the industry. With XRP price currently hovering around $3.03, that projection implies a rise of more than 3,200%, echoing memories of 2017’s parabolic run. Meanwhile, attention is starting to gather around a Ripple rival that could move even faster — a new DeFi entrant called Paydax Protocol, powered by its native token, PDP.

Source: CoinMarketCap

The $100 XRP Price Prediction: Ambitious or Achievable?

According to reports from one popular analyst, the XRP price could reach $100 by the end of the decade. The analyst cited Ripple’s growing institutional adoption, cross-border transaction efficiency, and partnerships with legacy banks. These are all legitimate drivers of confidence.

But markets evolve. What made XRP revolutionary in 2015 — frictionless settlements, bank-grade security, and high transaction speed — is now being reimagined and decentralized by the next wave of innovators. The Ripple rival narrative isn’t about opposition, but evolution.

The Ripple Rival With DeFi DNA

If XRP built the rails, Paydax Protocol is building the next-generation financial ecosystem that rides on them. The platform’s architecture doesn’t just enable transfers — it unlocks liquidity across every layer of decentralized finance.

Paydax Protocol has positioned itself as a Ripple rival not because it seeks to replace XRP, but because it is completing the vision Ripple began: creating a truly borderless, permissionless financial layer. Through smart lending and collateralization, users can borrow, stake, and earn yield without the institutional gatekeeping that slowed traditional finance. And at the heart of it all lies PDP, the native token of the Paydax Protocol.

PDP: The $0.015 Underdog Positioned For A $150 Surge

Every cycle births an underdog, and PDP is quickly claiming that place. The Ripple rival is currently priced at $0.015, in early-stage presale, with over $872,000 raised and nearly 58 million tokens sold. But what makes the upside intriguing is not the hype, it’s the utility.

The PDP token fuels staking pools, governance mechanisms, lending incentives, and insurance protection through the protocol’s Stability Pool. This built-in protection model — something the XRP price never directly benefited from — ensures system stability even in volatile conditions. It’s a subtle but powerful evolution by the Ripple rival.

Where XRP connects banks, PDP connects DeFi users, investors, and real-world asset holders. Through Paydax Protocol, PDP enables users to securely collateralize assets, from stablecoins to NFTs to tokenized real-world assets, and borrow against them instantly.

That’s not a speculative utility; that’s financial infrastructure in motion.

| Metric | XRP | PDP |

| Current Price | $3.03 | $0.015 |

| Target Price | $100 (2030) | $150 (2026) |

| Use Case | Cross-border settlements | Liquidity, lending, RWA tokenization |

| Governance | Centralized | Community-driven |

| ROI Potential | 3,200% | 10,000x+ |

| Sector | Banking integrations | DeFi banking & tokenized finance |

Both assets share the same mission, but they approach it from opposite ends of the spectrum. Ripple works top-down with institutions; Paydax Protocol works bottom-up, with the people who actually use DeFi. Besides, as the XRP price garners headlines and market attention, money naturally seeks the next opportunity. PDP’s timing aligns perfectly with that migration.

Why PDP Could Benefit Most From The Ripple Momentum

A rising XRP price lifts the entire liquidity narrative. Every analyst projection, every institutional adoption headline, and every remittance partnership brings renewed attention to tokens designed for movement, value transfer, and financial access.

PDP, as a Ripple rival, thrives in that same environment. Investors looking to capitalize early are recognizing that while XRP’s room to 50x is constrained by market cap, PDP’s runway from $0.015 to $150 represents a radically asymmetric opportunity.

If the XRP price hits $100 by 2030, PDP doesn’t need to wait that long. Its DeFi-driven mechanics and early-stage tokenomics could trigger accelerated growth by 2026, especially once Paydax Protocol’s lending infrastructure and tokenized asset systems go live.

How To Position For DeFi’s Future

In essence, Ripple built the bridge between traditional banking and crypto. The Paydax Protocol is building the vaults that will store and circulate that liquidity in the open economy. Both have roles to play. But for early-stage investors, the path of exponential growth leans toward the Ripple rival, PDP.

The XRP price narrative represents the legacy power of crypto infrastructure. But the Ripple rival, PDP, embodies what comes next — decentralized liquidity, automated lending, and tokenized asset access. As one paves the way, the other accelerates the journey.

Would you rather wait on the XRP price for five more years or join the DeFi accelerator today? PDP’s token presale is running out fast as investors scoop the token in several thousand-dollar tranches. Interested investors who buy the token today can enjoy a 25% bonus when they use the promo code PD25BONUS.

Join The Paydax Protocol (PDP) presale and community:

- Website: https://pdprotocol.com/

- Telegram: https://t.me/PaydaxCommunity

- X (Twitter): https://x.com/Paydaxofficial

- Whitepaper: https://paydax.gitbook.io/paydax-whitepaper