The post Analysts Explain Why Remittix Might Be A Better Bet Than Ripple Despite XRP vs SEC Case Ending appeared first on Coinpedia Fintech News

The long-running legal battle between Ripple and the SEC may finally be nearing its conclusion, but analysts are already shifting focus to what comes next. While the XRP price could see short-term gains, some experts argue that Remittix offers a stronger long-term opportunity. Built for global payments and backed by real-world adoption potential, Remittix is emerging as a serious contender in the utility altcoin space, possibly outpacing Ripple in the years ahead.

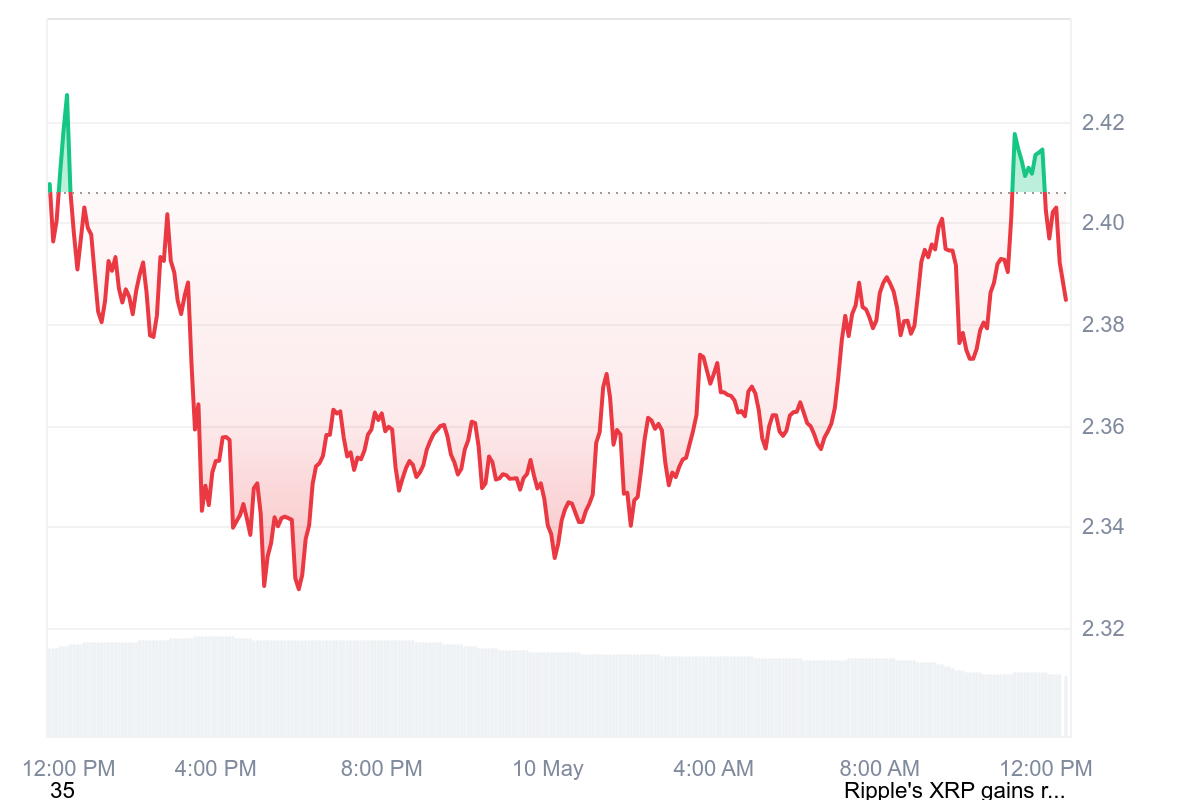

Ripple gains clarity as XRP futures prepare to launch

XRP is getting increased attention after CME Group announced plans to launch XRP futures on May 19, 2025, subject to regulatory approval. This shift would enable institutions to access XRP exposure without owning the token, thus paving the way for wider participation.

The announcement follows Ripple’s much-awaited legal settlement with the SEC, which had accused the company of unregistered securities sales. With that case behind it, XRP now appears on firmer ground.

Source: CoinMarketCap

Legal clarity and potential futures trading have given Ripple breathing room to rebuild market trust. Still, analysts like EGRAG remain cautious. While the XRP price has jumped to $2.37 a 7.77% weekly gain it’s hovering in a tight zone between $2.15 and $2.41.

Crypto analyst EGRAG says anything within this range is “just micro noise.” A decisive three-day close above $2.41 would signal a breakout. Until then, despite strong headlines, Ripple remains in wait-and-see territory.

Remittix shows stronger upside as Ripple steadies

While Ripple now enjoys legal stability and institutional buzz, Remittix (RTX) draws attention for a different reason: growth. Unlike XRP, which is battling resistance at $2.41, Remittix is still early in its journey and rising fast.

Priced at just $0.0757, it has already gained over 400% during presale, raising over $14.8 million. Analysts say this momentum is driven by real-world demand, not courtroom wins or futures speculation.

Remittix offers something Ripple does not: complete crypto-to-fiat conversion that lands directly in global bank accounts. It allows users to send crypto like BTC, SOL or XRP and have it arrive as local currency, all without hidden fees.

It also supports over 40 cryptocurrencies and 30+ fiat currencies, positioning itself as a practical solution for everyday users and global businesses. That’s a far cry from Ripple, which still relies on institutional deals and large-scale partnerships to fuel its vision.

What sets Remittix apart isn’t just speed, it’s flexibility. Businesses can open merchant accounts, manage crypto withdrawals and access over 50 crypto pairs alongside 30 fiat currencies.

All it takes is an internet connection to unlock the platform’s powerful Pay API, which helps merchants reduce costs and streamline global payments. The native RTX token fuels every platform transaction, conversion and payout, making it the engine behind one of crypto’s most promising real-world use cases.

Conclusion

For investors looking at long-term adoption, Remittix appears better positioned. Its business model connects directly to the $250 trillion cross-border payments market. Meanwhile, Ripple remains in a narrow technical range and is waiting on confirmation from traders. That contrast is why analysts believe Remittix could be the more rewarding bet in 2025.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix