Bitcoin treasury company Strategy has continued its routine of weekly BTC buys with a fresh acquisition worth $43.4 million.

Strategy Has Added Another 390 BTC To Its Bitcoin Reserves

As announced by Strategy co-founder and chairman Michael Saylor in an X post, the treasury company has made another expansion to its reserves. The latest purchase involved 390 BTC, acquired at an average price of $111,053 per token. In total, the buy cost the firm $43.4 million.

The acquisition follows one day after Saylor made the usual Sunday post with Strategy’s Bitcoin portfolio tracker. This time, the chairman used the caption, “It’s Orange Dot Day.”

According to the filing with the US Securities and Exchange Commission (SEC), the company funded the latest purchase using sales of its STRK and STRD at-the-market (ATM) stock offerings.

Following the buy, the Bitcoin treasury firm now holds 640,808 BTC with a cost basis of $47.44 billion. At the current exchange rate, these holdings are worth $73.93 billion, putting the company in a profit of about 55.8%

Last week, Strategy made an acquisition worth just $18.8 million, so this week’s buy is certainly a step up, but when compared to purchases from earlier in the year, it’s still not too significant.

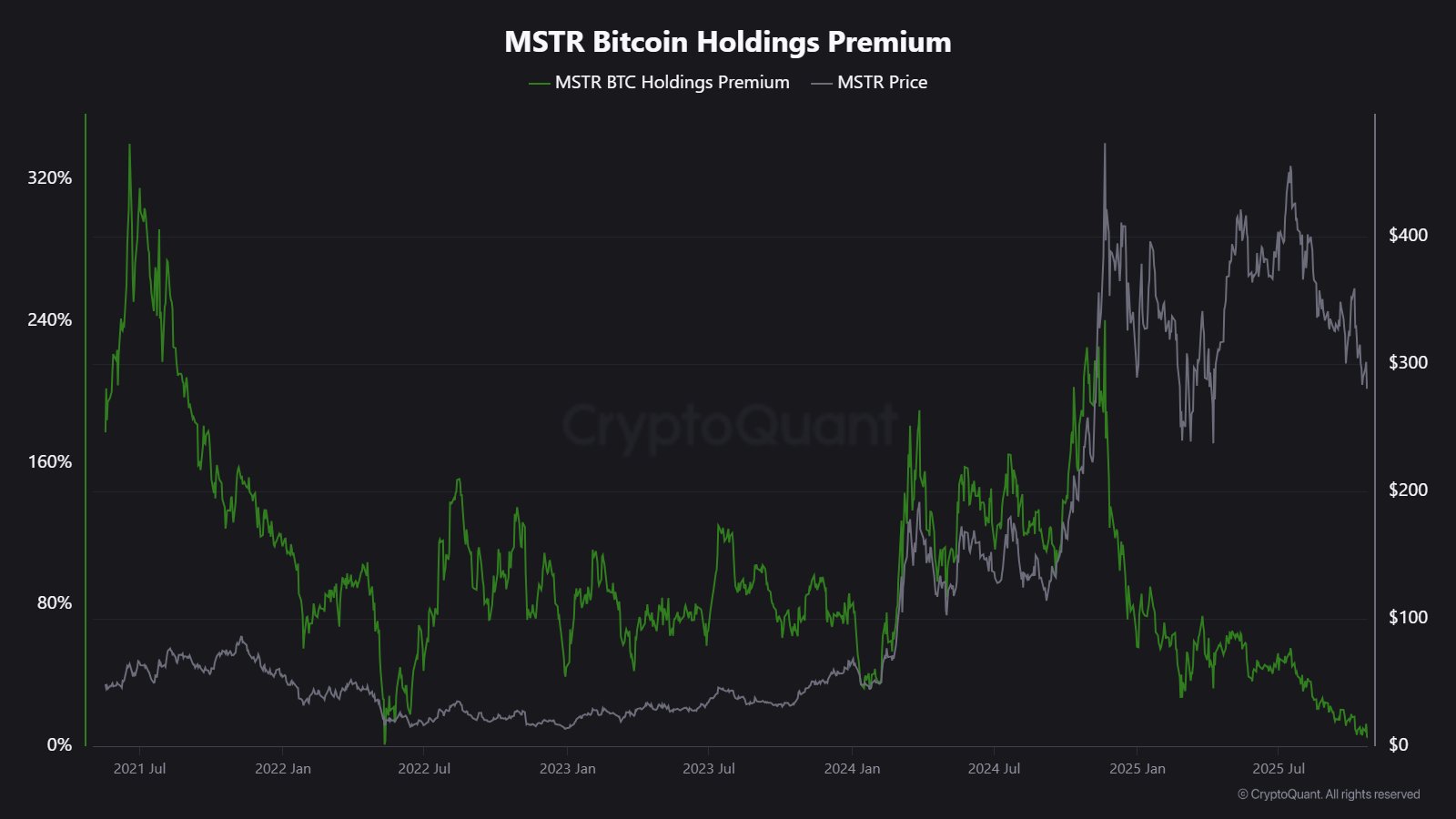

CryptoQuant community analyst Maartunn has discussed in an X thread why Strategy’s accumulation has slowed down recently. Maartunn has noted that capital is becoming harder to raise for the company, as its equity issuance premiums have dropped from 208% to just 4%.

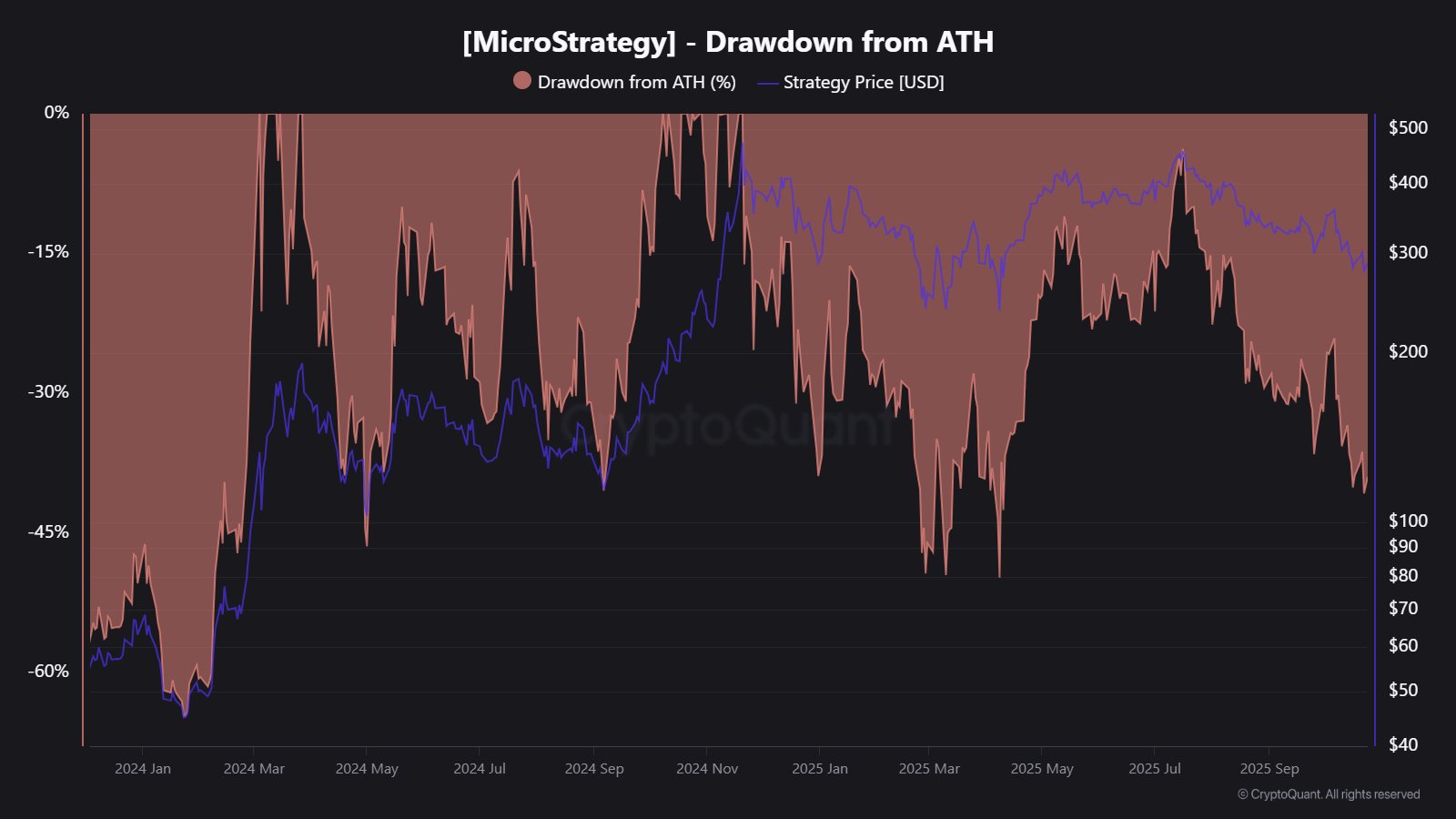

The firm’s stock price is also 50% down compared to its all-time high (ATH). Bitcoin itself is also trading below its ATH, but in its case, the drawdown is currently nowhere near as significant.

Although Strategy’s buying has seen a slowdown in terms of scale recently, it has nonetheless been regularly accumulating, cementing its place as by far the largest corporate Bitcoin holder in the world.

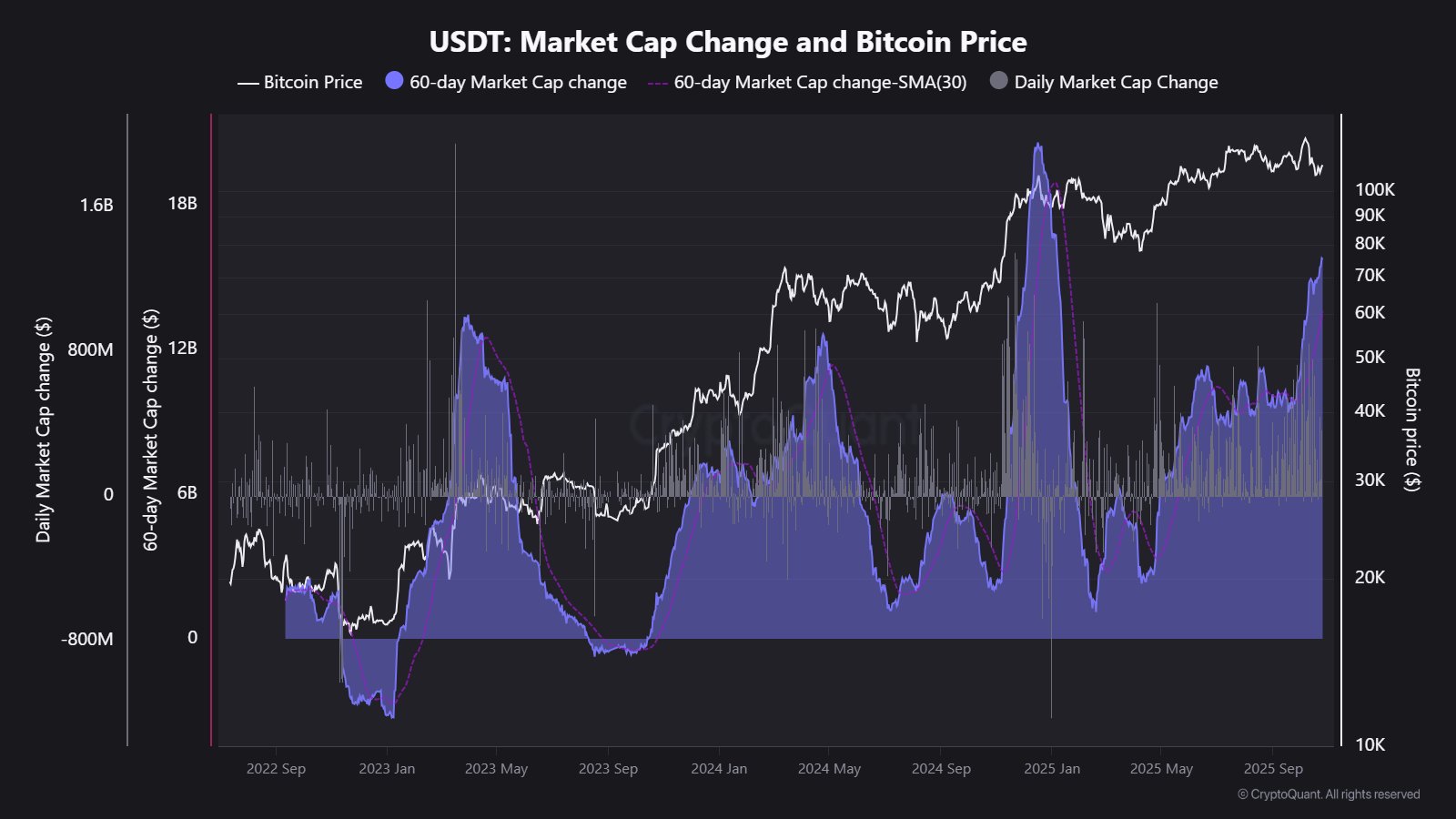

In some other news, the supply of the largest stablecoin in the world, USDT, has been witnessing some sharp growth, as Maartunn has pointed out in another X post.

From the above chart, it’s visible that USDT’s market cap has witnessed a highly positive 60-day change, indicating a large amount of capital has flowed into the stablecoin during the last two months. The growth has been sharp enough to be notably above the 30-day simple moving average (SMA). The analyst has noted that this kind of trend is “historically linked to short-term BTC upside.”

BTC Price

Bitcoin has enjoyed a recovery surge over the last couple of days as its price has returned to the $115,500 level.