APE/USD displaces COMP/USD to claim the first position on the crypto daily mover list. APE/USD was able to move 9.15% today. Interestingly, COMP/USD moved just about the same magnitude yesterday.

ApeCoin present price Price: $4.83

ApeCoin Market Capitalization: 1.6 Billion

ApeCoin Total Supply: 1 Billion

ApeCoin Rank: 35

Crucial Levels:

Resistance: $4.83, $5.5, $6

Support: $4.5, $4.0, $3.5

APE/USD Price Prediction: Apecoin Achieving Minimal Gains

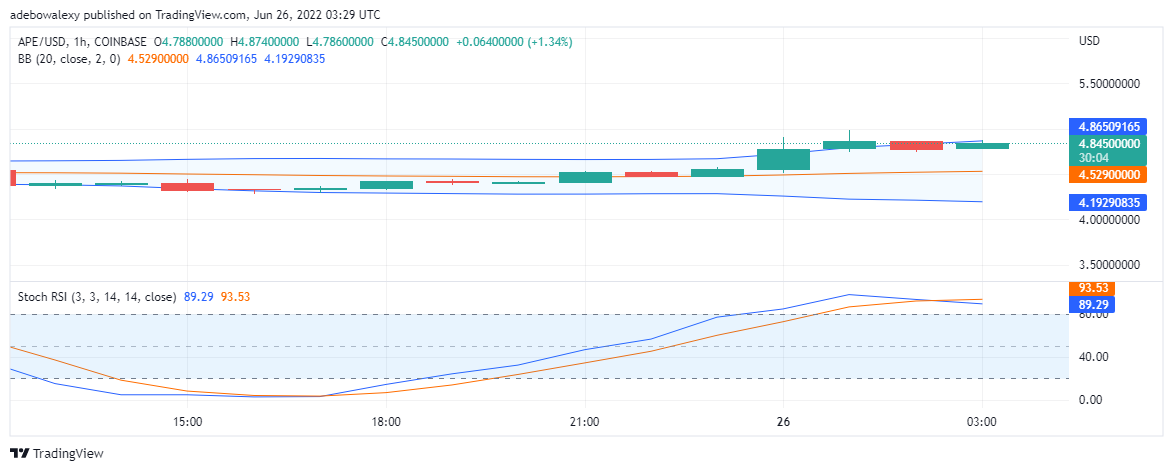

As reflected on the daily mover list, we can see the result of such magnitude of movement is seen on the APE/USD 4-hour chart. We can see that some of the bulls had a very tough time going by the last fee candlesticks. Also, we can perceive that the value activity rose to touch the upper boundary of the Bollinger band. Consequently, this reflects the value increment that this crypto has witnessed.

Furthermore, the relative strength indicator has already crossed in the highly bought area which ought to result in a downtrend. Nevertheless, it seems that the ApeCoin isn’t ready to reverse as the trend strength indicator continues to move sideways. ApeCoin strength remains in the highly bought region, which implies that APE/USD value may sustain this mark for some time. Nevertheless, any crossing here any crossing of this curve may result in a downtrend.

Ape/USD Price Prediction: Apecoin at the Point of Trend Reversal

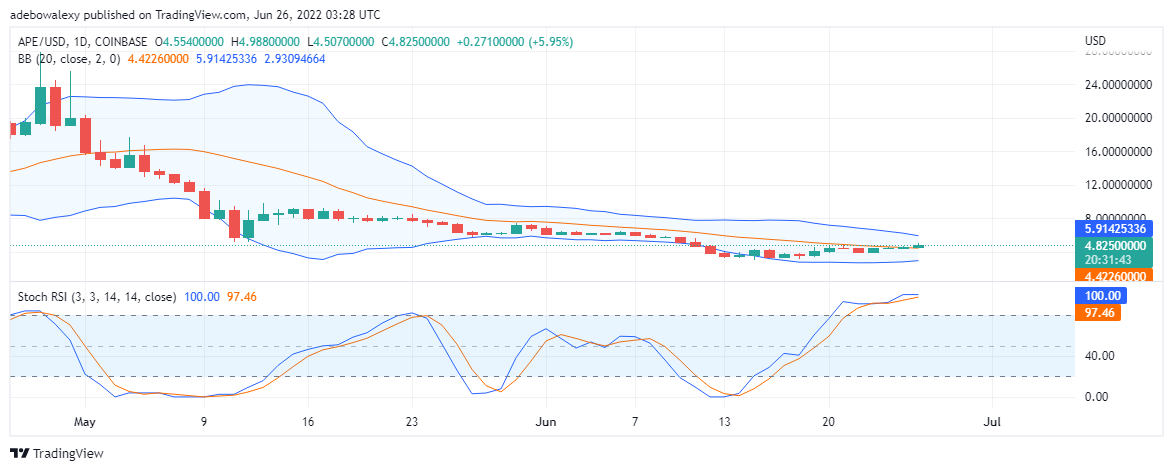

Moving on, APE/USD one-day chart reveals that the price activity is on the verge of a correction. We can see that the price activity has perched on the middle band of the Bollinger band. In addition, the Bollinger band is contacting which signifies that the volatility of ApeCoin is low. Also, from the Bollinger band indicator, we can predict that there may not be a big value jump in the APE/USD value.

Finally, the RSI indicator crossed twice to reach the 100% mark. Consequently, this confirms that the crypto value isn’t likely to rise beyond this.

eToro – Our Recommended Trading Platform

- CySEC, FCA & ASIC regulated – Trusted by Millions of Users

- Trade Crypto, Forex, Commodities, Stocks, Forex, ETFs

- Free Demo Account

- Deposit via Debit or Credit card, Bank wire, Paypal, Skrill, Neteller

- Copytrade Winning Traders – 83.7% Average Yearly Profit