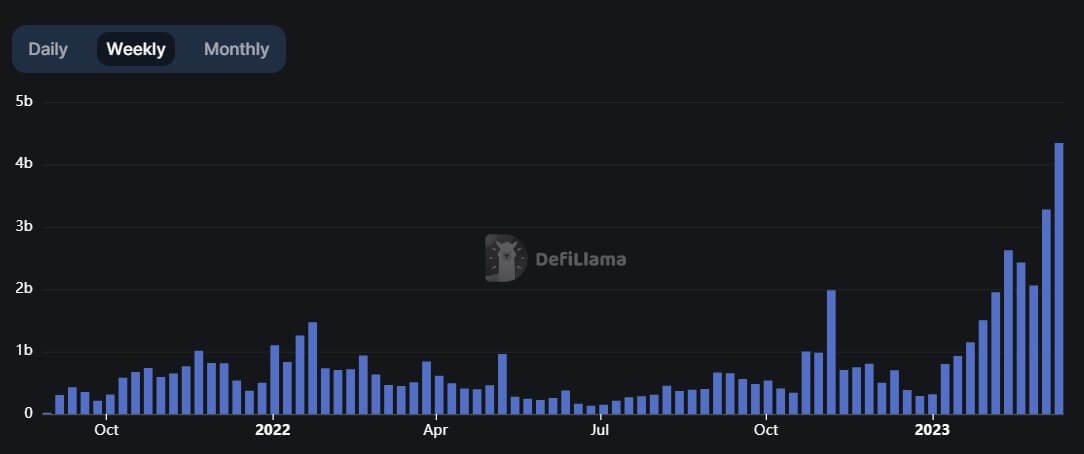

Arbitrum’s decentralized exchange (DEX) transactions volume rose to a new all-time high (ATH) in each of the last two weeks, according to DeFillama data.

Over the past seven days, DEX transactions increased 32.41% to $4.34 billion. For the week starting March 5, transaction volume on Arbitrum had surged to $3.28 billion.

Daily transaction volume stood at $535 million as of March 20 — second only to Ethereum (ETH) and almost twice that of Binance Smart Chain (BSC).

The top five DEXs on Arbitrum were Uniswap, SushiSwap, ZyberSwap, Camelot, and Balancer. In the last seven days, trading volume on these platforms grew by an average of over 40% — Camelot spiked the highest by 95% to $38.45 million, while ZyberSwap saw the most minor growth of 2.84% to $61,41 million.

Meanwhile, Uniswap remains the dominant DEX platform on Arbitrum, accounting for 48% of all trades on the layer2 (L2) network.

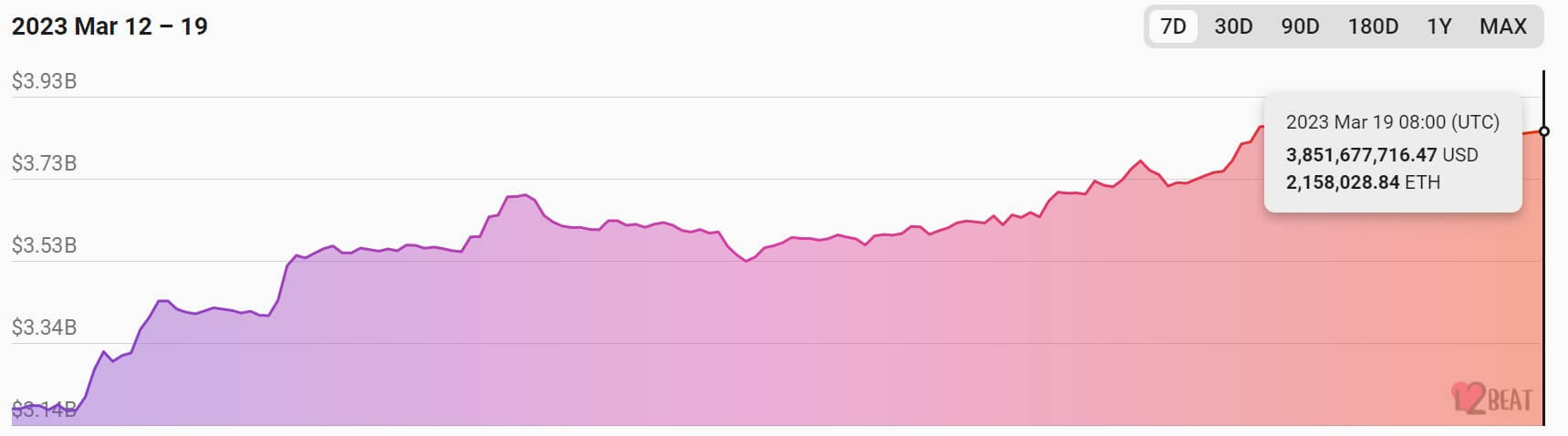

Arbitrum’s TVL and stablecoin inflow rises

The total value of assets locked on Arbitrum has risen by more than 20% in the last seven days to $3.85 billion, according to L2beats. In terms of ETH, 2.15 million tokens have been locked on the network.

The rising TVL also coincided with high-network activity on the L2 network. During the period, Arbitrum’s daily transaction per second rose 80.82% to 10.82.

DeFillama data shows that Arbitrum’s dominant DeFi protocol is GMX — the project controls 28.27% of Arbitrum’s total TVL.

Meanwhile, the L2 solution has continued to witness an increase in its stablecoin inflow. For context, Arbitrum’s USD inflow climbed 9% to $1.59 billion despite the recent issues plaguing the dominant stablecoin on its ecosystem, USD Coin (USDC).

During the period, there was more inflow of Tether’s USDT and algorithmic stablecoin DAI into the network as against USDC.

The post Arbitrum’s weekly DEX volume touches new ATH appeared first on CryptoSlate.