U.S. inflation is red hot and a number of analysts and economists are predicting America will face further economic issues as politicians and the Biden administration blame corporations. This perspective on rising inflation has led finance authors like Isabella Weber to believe that price controls could ease America’s economic burdens.

Biden Administration Blames Inflation on Corporate Greed, Monopolistic Behavior

America is dealing with the worst inflation in over four decades and the White House thinks that tougher anti-monopoly policy could fix the situation. Furthermore, a few congressional leaders want to stifle online ecommerce giants like Amazon with proposals like Senator Amy Klobuchar’s (D-Minn.) American Innovation and Online Competition Act. Senator Tom Cotton’s (R-Ark.) Platform Competition and Opportunity Act (PCOA) is also aimed at reforming anti-trust laws.

The White House is blaming the loss of purchasing power in America on monopolistic behavior. Last month, the White House shared data that claimed four corporate entities in the meat-processing industry have been fueling inflation. NYU professor Marion Nestle told the New York Times in an interview that “their goal is to control the market so that they can control the price.” Despite the opinion from Biden’s administration, the North American Meat Institute says the claims are false.

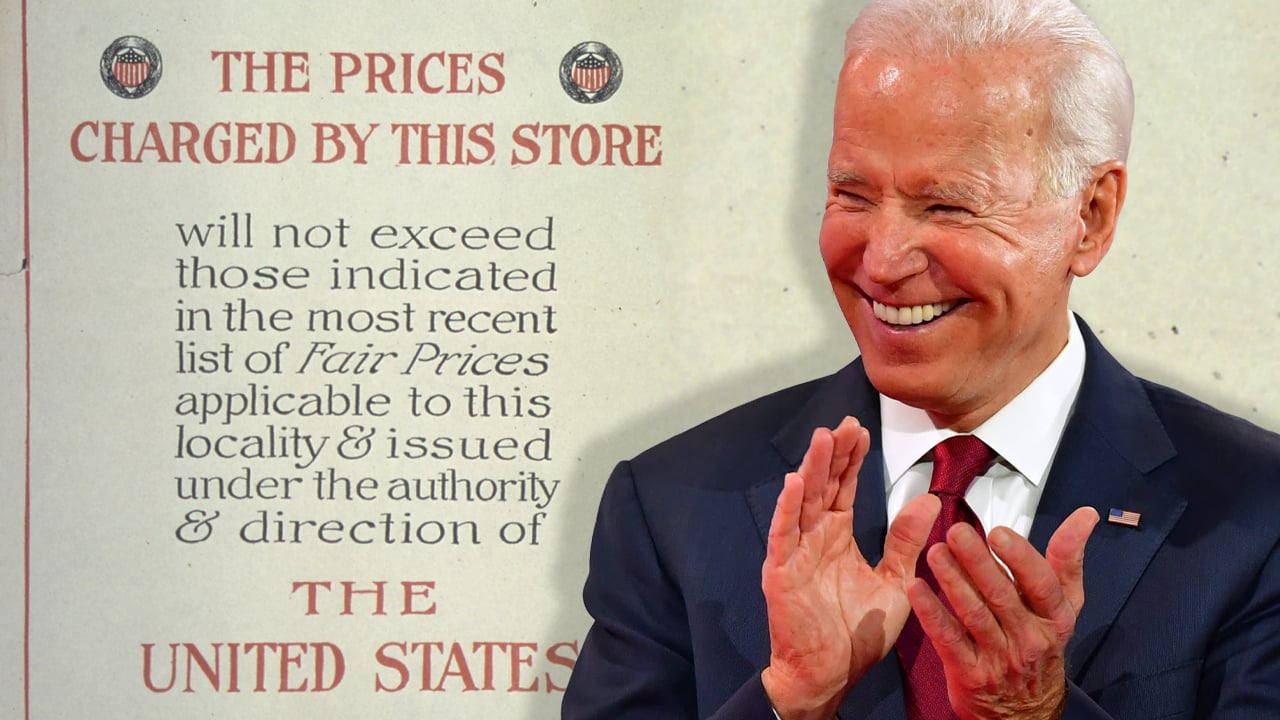

Economist Believes It’s Time to Consider Price Controls

This has led to a raging debate and just recently finance author Isabella Weber published an opinion editorial via the Guardian that says “we have a powerful weapon to fight inflation: price controls. It’s time we consider it.” Weber’s editorial says that during World War II, U.S. economists “recommended strategic price controls.” Essentially, price controls restrict free market activity as mandated prices and restrictions are set in place and enforced by governments. It means that the manufacturer has no say in pricing goods and services and the government has full control.

Weber ideas are not very popular and even the Nobel laureate and economist Paul Krugman blasted the concept. In a now-deleted tweet, Krugman wrote: “I am not a free-market zealot. But this is truly stupid.” However, the following day, Krugman apologized to Weber and said he deleted the tweet. Krugman said:

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

Price Control Concept Mocked, Harvard Economist Insists There’s ‘No Basis Whatsoever Thinking That Monopoly Power Has Increased’

Another individual mocked the price controls idea and said: “We’ve gone from ‘inflation is temporary’ to ‘f***, we need price controls’ in the space of a quarter.” “Anyone calling themselves an economist who is also a proponent of price controls deserves to be mocked, shamed, and spoken down to,” the Twitter account dubbed Hazlitt tweeted. The host of the “Smart People Sh*t” podcast Dennis Porter said:

Price controls are the thing every government does before the whole thing collapses.

Even the Democrat economist and senior official for the Obama administration, Larry Summers, insists bolstering antitrust laws will not help the U.S. economy. In a tweetstorm, Summers said: “The emerging claim that antitrust can combat inflation reflects ‘science denial.’ There are many areas like transitory inflation where serious economists differ. Antitrust as an anti-inflation strategy is not one of them.” Lastly, the Harvard economist stressed that monopolistic behavior has not accelerated like inflation.

“There is no basis whatsoever thinking that monopoly power has increased during the past year in which inflation has greatly accelerated,” Summers tweeted.

What do you think about the rising inflation in the U.S. and the White House blaming monopolistic behavior? What do you think about the concept of leveraging price controls? Let us know what you think about this subject in the comments section below.