Quick Take

The landscape of Bitcoin Futures trading at the Chicago Mercantile Exchange (CME), the largest provider of open interest, highlights some intriguing patterns.

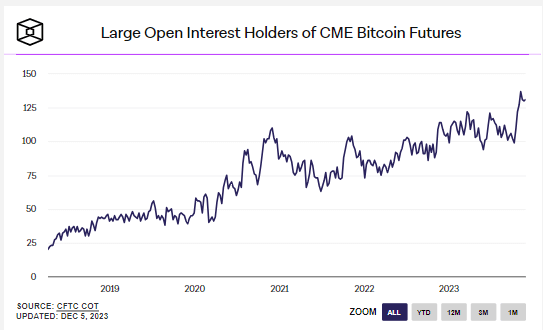

Large Open Interest Holders (LOIH) of CME Bitcoin Futures – those traders holding at least 25 contracts open (>125BTC) – registered a count of 131 between Nov. 28 and Dec. 5, marginally short of a record high. Due to the sizeable open interest, the spike in LOIH aligns with CryptoSlate’s previous discussions about the premium in CME Bitcoin futures.

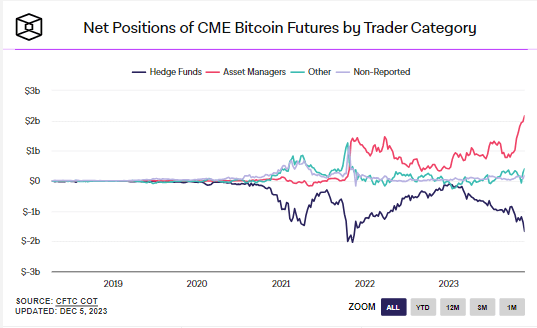

An examination of LOIH preference reveals an interesting dichotomy: Asset Managers are approximately $2 billion in net position longs on Bitcoin futures. At the same time, Hedge Funds are short by a roughly equivalent sum.

This data illustrates the net positioning of open interest, reflecting the total value of open long positions subtracted by the full value of open short positions, categorized by Commodity Futures Trading Commission (CFTC) trader classifications. However, it’s important to note that this analysis only accounts for positions in CME Bitcoin futures, excluding the broader net exposure funds may possess outside of CFTC-regulated futures products.

The post Asset managers long, hedge funds short in divergent CME Bitcoin futures landscape appeared first on CryptoSlate.