The post AVAX Open Interest Explodes, 30% Price Rally Incoming? appeared first on Coinpedia Fintech News

After experiencing a notable upside rally in recent days, Avalanche’s (AVAX) price action confirms that the rally is likely to continue in the coming days. This bullish outlook has attracted significant attention from traders and investors, leading to a record surge in Open Interest.

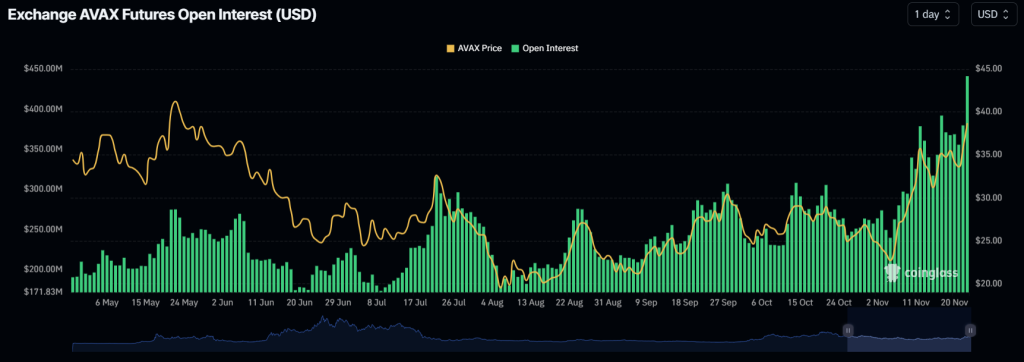

Record Surge in Open Interest

According to the on-chain analytics firm Coinglass, AVAX’s open interest has skyrocketed to $441.09 million, the highest since May 2024. Notably, following the election of pro-crypto Donald Trump as President of the United States, its open interest surged from $262 million to the current $441.09 million.

As of November 22, 2024, AVAX’s open interest has jumped by 21% in the past 24 hours and 14.56% in the past four hours. This significant rise in OI suggests growing interest from traders amid a bullish price action pattern.

Why AVAX Price is Increasing?

The potential reason for traders’ interest in AVAX is the recent breakout from its consolidation zone, which has cleared the path for the altcoin to potentially soar 30% in the coming days.

Avalanche’s (AVAX) Technical Analysis and Upcoming Level

According to AVAX’s daily chart, it has broken out from a strong resistance level of $32 on November 11, 2024. Since then, the altcoin has traded within a tight range of $32 to $36.

With notable interest from traders and investors, today, AVAX has broken out of that tight range, shifting market sentiment towards bullishness.

Based on recent price action and historical momentum, there is a strong possibility that AVAX could soar by 30%, potentially reaching the $50 level in the coming days.

Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend. Additionally, its Relative Strength Index (RSI) suggests that AVAX still has room to rally in the coming days.

Current Price Momentum

At press time, the asset is trading near $39.55 and gained a price surge of over 12% in the past 24 hours. During the same period, AVAX’s trading volume surged by 52%, indicating heightened participation from traders and investors amid a bullish outlook.