Avalanche (AVAX), the token powering the smart contracts platform Avalanche, is stirring excitement in the crypto sphere. Bullish technical indicators and upcoming developments within the Avalanche ecosystem are fueling speculation of a significant price surge, with some analysts eyeing a potential rally above $100.

Technicals Flash Green: A Bounce In Sight?

Technical analysis based on historical data and chart patterns paints a promising picture for AVAX. Analysts point to a recent corrective phase that the token appears to have overcome, potentially setting the stage for a new uptrend. Charts on trading platforms like Binance depict a support zone between $9.45 and $10.00, suggesting a strong base from which the price could bounce higher.

$AVAX looking for 100+ pic.twitter.com/GUXx2EeB5e

— ᴀʟᴛꜱᴛʀᴇᴇᴛ ʙᴇᴛꜱ (@AltstreetBet) June 5, 2024

Avalanche ICO Season On The Horizon?

Beyond technical indicators, the buzz surrounding Avalanche stems from exciting developments brewing within its ecosystem. The project’s developers are gearing up to launch Layer 1 blockchains (L1s) that inherit Avalanche’s secure and scalable consensus mechanism.

This innovation could significantly simplify the process of launching new blockchains, similar to how ERC-20 tokens are built on top of the Ethereum network. Furthermore, Avalanche’s CEO, Emin Gun Sirer, recently teased a novel concept – Initial Chain Offerings (ICOs). Unlike the traditional Initial Coin Offering (ICO) model where individual tokens are sold, ICOs would involve offering entirely new blockchains to investors.

This paves the way for a potential “Avalanche ICO season,” mirroring the ICO boom witnessed in the early days of cryptocurrencies. Market observers believe this could attract a surge of interest and investment into the Avalanche ecosystem, potentially boosting the price of AVAX.

Key Resistance Levels To Watch

Moving on to the price targets, analysts have identified key resistance levels at $50 and $60. Overcoming these hurdles could propel AVAX towards its ambitious long-term target of $100. However, the confluence of bullish technical indicators and groundbreaking developments within the Avalanche ecosystem is undeniable.

AVAX Price Forecast

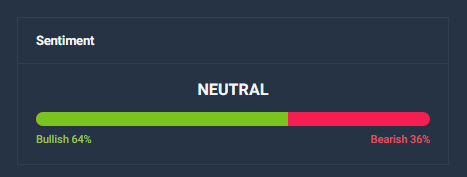

Meanwhile, according to the latest analysis, the price of AVAX is expected to surge by an impressive 227%, potentially reaching $119 by July 5, 2024. The current market sentiment, as indicated by technical indicators from CoinCodex, is Neutral.

This is in sync with the Fear & Greed Index, which stands at 75, indicating a prevailing sentiment of Greed among investors. Over the past 30 days, Avalanche has experienced 11 green days, constituting 37% of the period, with a price volatility rate of 5.59%. These factors suggest a relatively stable yet bullish outlook for AVAX in the near term.

The high Fear & Greed Index indicates strong buying interest, which could drive prices higher. Despite the neutral sentiment, the significant projected price increase reflects positive market dynamics and investor confidence in Avalanche.

Featured image from LinkedIn, chart from TradingView