The post Billionaire Bitcoin Whales Waking Up; More Than 80,000 BTC Moved—Should You be Worried? appeared first on Coinpedia Fintech News

As the Bitcoin price is heading close to the ATH, interesting events unfold within the crypto markets. Not long after, a whale that had remained dormant for over 14 years woke up, transferred 10,000 BTC, and reportedly sold. Many more ‘Billionaire’ whales have also emerged. Despite this, the BTC price continues to remain calm with fewer signs of a massive pullback. This raises concerns over the upcoming rally as the price remains unaffected by the whale movements.

80,000 BTC Moved—Will They Be SOLD?

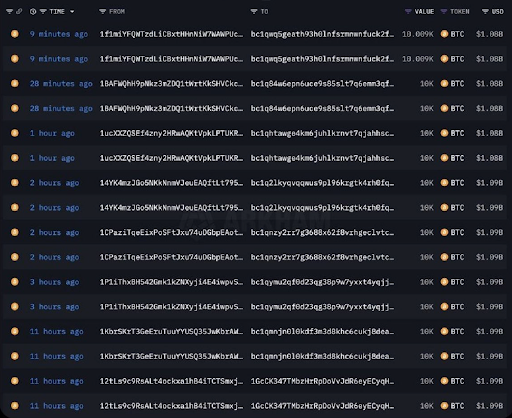

During the earlier days of BTC, addresses held more than 10,000 BTC. There are 20 such dormant addresses, which collectively hold 1% of all BTC mined in 2010-2011. Interestingly, 8 out of 20 addresses have just woken up and have transferred more than 80,000 BTC collectively.

The question is not whether the whales are preparing for a sell-off, but why they have moved now. Previously, when Bitcoin surged above the $100K milestone and went on to mark a new ATH above $111K, these whales remained passive. Now that the price has hit $110K yet again, these whales have become active. This suggests either the whales may not be confident of the upcoming price action, or they may be feeling that the markets may face a liquidity crunch as BTC marks a new ATH.

Hence, they may be preparing to accumulate as much liquidity as they can. However, many believe this whale is an old miner from 2011, having originally controlled around 200,000 BTC. Meanwhile, the rumors are also that these are Satoshi-linked funds, but there is no evidence to support this. Historically, Q1 2025 has seen more BTC token transfers than Q1 2024, marking a 121% year-on-year increase, which signals a broader trend of awakening old coins.

What Does it Mean Going Forward?

The Bitcoin price may face high short-term volatility, such as large transactions that usually spook the markets. In this case, there is no clear sell-off potential, as no immediate sign of deposits to exchanges was seen. However, the market participants need to closely monitor the price actions and a few watchpoints, like,

- Further movement from the remaining 4 dormant wallets

- Any BTC transferred to exchange addresses or OTC desks

- Bitcoin (BTC) price action around the key levels—$110,000 resistance to $108,000 support.