Bitcoin showed some muscle today, breaching the $93,000 mark, as buying saw a good amount of activity across the digital currency market. Even with prices heading north, Bitcoin stored on Binance has been retreating, according to on-chain data.

That shrinking supply on a major exchange is one of several forces traders point to as tightening available coins for sale.

Binance Reserves Shrink

Based on an analysis by CryptoQuant, Binance’s Bitcoin reserves have declined as more coins move off the exchange. Some of that shift comes from holders moving funds into private cold wallets for safekeeping.

Reports show that large buyers in the US — including spot ETF managers — are also taking coins off the market and placing them with custodians.

Those moves reduce the float available to traders and can add upward pressure on prices when demand rises.

Why Binance’s Bitcoin Reserves Are Declining

“Historically, such conditions have supported medium- to long-term price appreciation. The current trend suggests that Binance’s reserve decline is a normal re-accumulation phase.” – By @xwinfinance pic.twitter.com/g3TCG4o6GD

— CryptoQuant.com (@cryptoquant_com) December 3, 2025

ETF Buying And Self-Custody

According to analysts, US spot ETFs have been buying meaningful amounts of Bitcoin for their products. Funds from big issuers are held by trusted custodians rather than on trading platforms.

At the same time, ordinary holders and whales frequently shift holdings to self-custody during rallies, signaling they do not plan to sell soon.

Together, these trends remove supply from exchanges and help explain why reserves on Binance are shrinking.

Derivatives And Liquidations

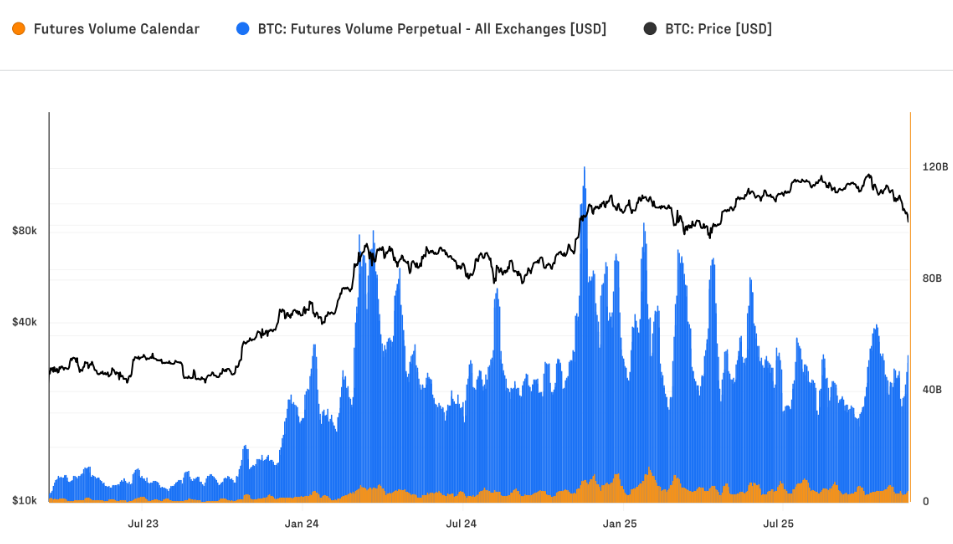

Derivatives activity also played a role in recent exchange balances. Daily futures wipeouts have climbed from averages of about $28 million long and $15 million short in the prior cycle to near $68 million long and $45 million short in the current run.

That uptick in forced exits peaked on Oct. 10, when over $640 million per hour in long positions were liquidated as Bitcoin slid from $121,000 to $102,000.

Open interest dropped roughly 22% in under 12 hours, falling from close to $50 billion to $38 billion at the time.

Still At A High

While those liquidations were dramatic, the futures market has grown overall. Open interest is at a record $67 billion and daily futures turnover reached $68 billion.

More than 90% of that activity is in perpetual contracts, which tend to amplify short-term moves. That combination raises both trading volume and the potential for sharp moves when sentiment flips.

Price Levels To Watch

Based on trader calls, the market is watching the $92,000–$94,000 zone as a key resistance area. A clean daily close above that band could speed momentum toward $100K.

Nearer-term support sits around $88,000–$89,000, where buyers are expected to step in if prices pull back. Trading volume on a busy day climbed close to $86 billion, showing renewed interest from both retail and institutional participants.

Featured image from Safelincs, chart from TradingView