Ethereum is entering a decisive phase as it battles to hold the $2,500 support level after several failed breakout attempts above $2,700 in recent weeks. The broader market is under pressure, but Ethereum remains a focal point for analysts who believe a breakout from this range could ignite a full-blown altseason. While volatility remains elevated, sentiment is slowly shifting as on-chain and market activity reveal encouraging trends.

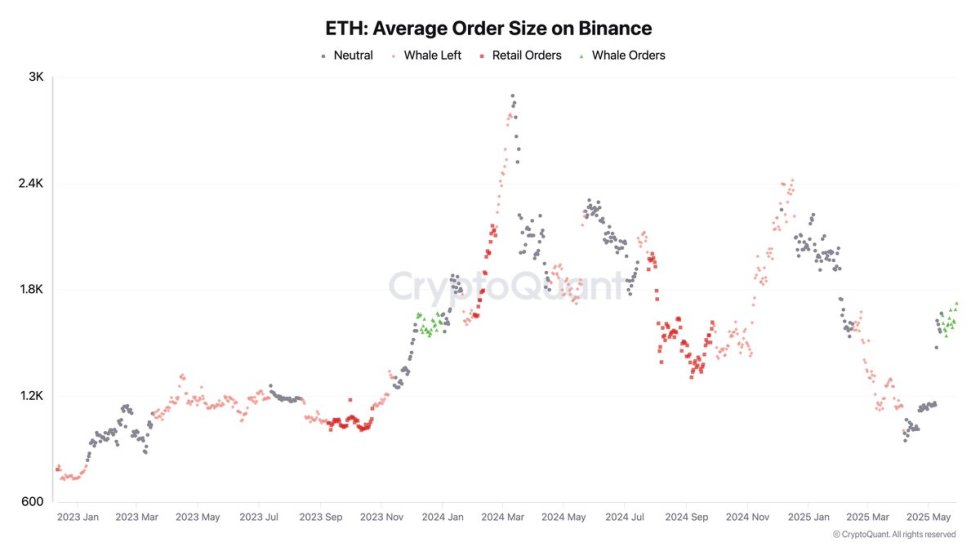

One of the strongest signals comes from Binance, where Ethereum whale activity is once again surging. According to recent data, large orders have begun to flood back into the exchange since May 19 — the same signal that preceded ETH’s explosive rally from $2,200 to $4,000 in late 2023. This return of deep-pocketed investors signals renewed confidence and growing interest in Ethereum at current levels.

As macroeconomic uncertainty continues to shape financial markets, ETH’s ability to hold above $2,500 could determine the next major move for the crypto market. If buyers step in with strength, Ethereum could lead the charge for altcoins in the coming weeks. For now, all eyes are on price action and whale behavior as traders prepare for what could be a pivotal breakout.

Ethereum Whales Return As Bullish Signal Flashes On Binance

Ethereum has spent the past year trailing behind Bitcoin, underperforming and struggling to build momentum as it faced continuous selling pressure and indecisive price action. While BTC rallied to new all-time highs, ETH remained locked in a range, disappointing investors and leaving many questioning its leadership in the altcoin space.

However, recent price action tells a different story. Over the past few weeks, Ethereum has entered a more constructive phase. Despite ongoing geopolitical tensions, particularly between the US and China, Ethereum has shown resilience, holding above $2,500 and attempting to reclaim higher levels. The shift in sentiment is now being reinforced by on-chain and market data.

Top analyst Darkfost shared a compelling metric showing that Ethereum whales are once again active on Binance. His chart combines spot and futures market activity, cumulative volume, and moving averages — producing a rare all-in-one signal. The last time this signal lit up was in December 2023, just before Ethereum exploded from $2,200 to $4,000 in a matter of weeks.

According to Darkfost, since May 19, large buy orders from whales have been appearing in force on Binance. This surge in high-volume activity is a highly encouraging sign and may mark the early stages of a new bullish trend.

Ethereum Price Analysis: Bulls Defend Key Support In Range Consolidation

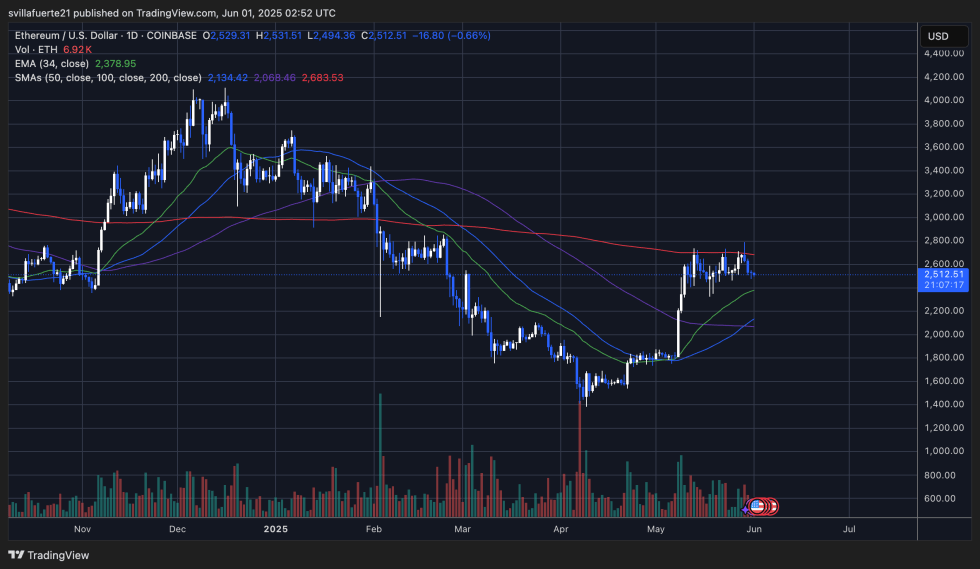

Ethereum (ETH) is currently trading around $2,512 after rejecting the $2,700 resistance zone multiple times over the past few weeks. As seen in the daily chart, ETH has entered a sideways consolidation phase, fluctuating between the 34-day EMA ($2,378) and the 200-day SMA ($2,683). Despite recent pullbacks, bulls are still defending the $2,500 area, which now acts as critical short-term support.

The chart shows a clear range formation with decreasing volume, suggesting that the market is waiting for a breakout decision. ETH remains above its 34-day EMA and all short-term moving averages (50/100 SMA), signaling that the uptrend structure is intact for now. However, any strong daily close below $2,480–$2,500 could shift momentum and invite deeper retracement toward $2,350.

To resume bullish momentum, Ethereum must reclaim the $2,700–$2,800 resistance area with conviction, as this level has capped every upside attempt since early May. If successful, a breakout could open the door to a push toward $3,000 and beyond.

Featured image from Dall-E, chart from TradingView