The post Binance’s CZ Declares CBDCs ‘Outdated’ as Stablecoins Rise appeared first on Coinpedia Fintech News

Digital currencies are becoming increasingly important in the financial markets.

It is changing how people and governments handle money, and stablecoins are quickly taking the lead. More countries are starting to recognize their potential, while CBDCs struggle to keep pace with the rising popularity of stablecoins.

Let’s take a closer look at how this shift is taking place.

CBDCs Struggle to Keep Up: Changing Zhao

At the WebX conference in Tokyo on August 25, Binance founder Changpeng Zhao discussed how digital currencies are shaping global finance. He pointed out that governments are increasingly supporting stablecoins, citing examples like Hong Kong’s Stablecoin Ordinance and the U.S. GENIUS Act.

“Central Bank Digital Currencies (CBDCs) are already outdated. In contrast, stablecoins are gaining more attention,” he said.

CBDCs were tried in a few countries back in 2013–2014, but most projects didn’t last due to a lack of demand, and only a few moved to actual adoption.

Stablecoins Gaining Traction, CBDC Plans Stalled

CZ highlights that stablecoins are widely accepted because they are backed by real assets and allow for more transactions.

Several countries have suspended or abandoned their plans to launch CBDCs. In January 2025, President Donald Trump signed an executive order prohibiting any U.S. institution from issuing or using a CBDC, effectively halting federal research into a digital dollar.

In June, the Bank of Korea suspended its CBDC project, which had reached the stage of developing a pilot program with participating banks. Japan, Denmark, Finland, and Singapore have also stepped back from their CBDC projects.

While some countries pause their CBDC projects, the European Central Bank (ECB) is gearing up to launch the digital Euro by October this year.

Global Adoption Trends

On the other side, the passage of the GENIUS Act has fueled global interest in the stablecoin race.

China is considering a major shift in its digital currency policy by allowing the use of yuan-backed stablecoins. Hong Kong is also actively developing its own stablecoin ecosystem. Japan is also set to launch its first yen-backed stablecoin this fall.

Stablecoins To Reach $2 Trillion

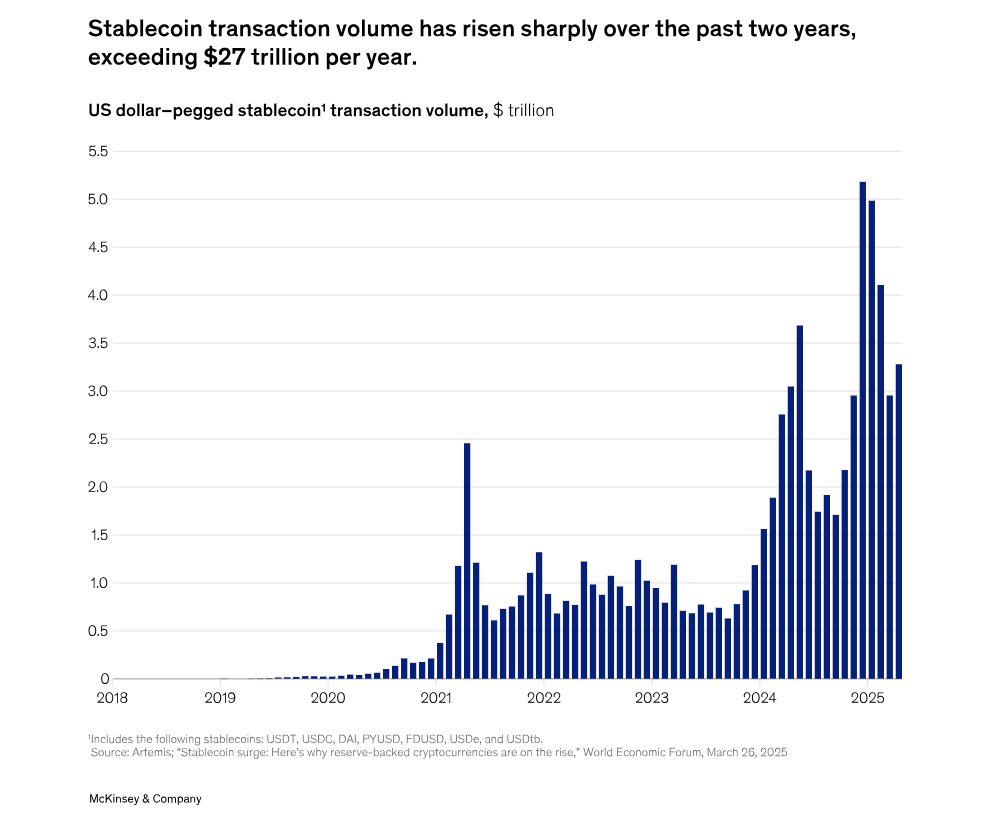

According to McKinsey, the total value of issued stablecoins has doubled in 18 months to $250 billion, and is projected to reach $2 trillion by 2028.

While still under 1% of global money transfers, stablecoins are growing fast, with the potential to surpass traditional payments within a decade. Their ability to offer instant settlement, lower operational risks, and global access makes them attractive for both remittances and capital markets.