The crypto market faced in recent months, as both Bitcoin and Ethereum broke below important support levels. Bitcoin broke below $110,000, while Ethereum also slipped under $4,000. This downturn triggered billions in liquidations and pushed the Fear and Greed Index into fear territory.

However, data from on-chain analytics platform Sentora (formerly IntoTheBlock) reveals that accumulation is quietly underway. Despite the price declines, exchange outflows for both assets have remained strongly negative.

Key Weekly Metrics

An extended decline carried over from the previous week saw the Bitcoin price falling below $110,000 with increasing selling pressure and liquidations of leveraged positions. However, despite this sharp move to the downside, on-chain data illustrates an interesting different trend occurring beneath the surface of the volatility. According to figures provided by the on-chain analytics platform Sentora, more than $5.75 billion worth of BTC flowed out of centralized exchanges over the course of the week.

This outflow, although small compared to periods of strong bullish action, shows a lingering investor conviction, especially among some investors that might be taking advantage and buying the dip.

Ethereum’s price movement over the same period was even more pronounced than that of Bitcoin. The price crash saw the leading altcoin break down beneath the psychologically significant $4,000 support level and proceed to briefly test lower zones around $3,850. Still, despite the depth of this decline, the exchange flow data makes it clear that the bearish price action did not manage to deter accumulation activity across the network.

Over $3.08 billion worth of ETH exited exchanges during the week, which serves as evidence of a continued willingness among investors to steadily accumulate Ethereum, even in the face of short-term losses and market pressure.

Despite negative price performance, exchange outflows remained strong for both ETH and BTC, indicating accumulation across the market pic.twitter.com/eAqZTk6Vof

— Sentora (previously IntoTheBlock) (@SentoraHQ) September 26, 2025

Outflows Drive Exchange Balances To Multi-Year Lows

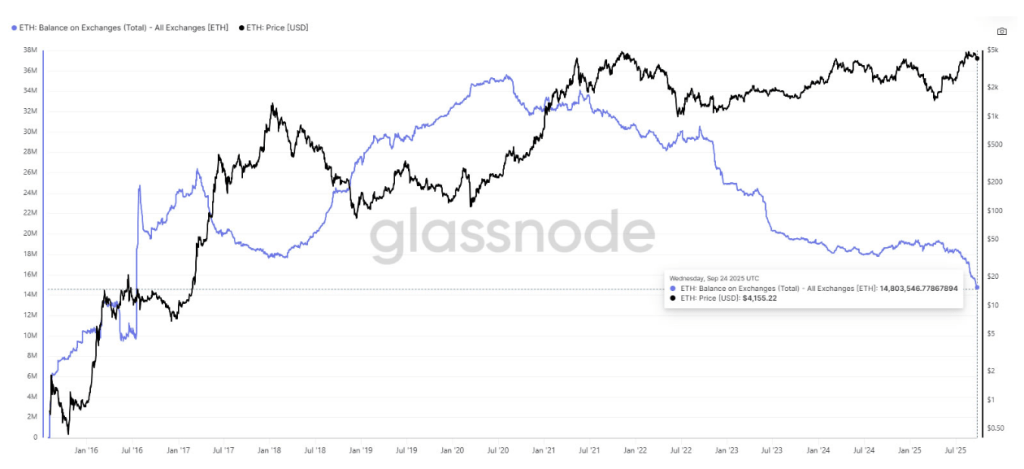

Interestingly, Ethereum last week’s outflows ties into a notable trend that has been developing in recent months. Data shows that Ethereum’s total supply on exchanges has dropped to just 14.8 million ETH, its lowest level since 2016. Much of this supply has been redirected into staking, long-term cold storage, and DeFi protocols, which have all led to a drastic decline in the ETH on trading platforms.

ETH balance on exchanges. Source: Glassnode

Data from a CryptoQuant Quicktake post by contributor CryptoOnchain adds further weight to this trend of heavy outflows. Between August and September 2025, Ethereum’s 50-day Simple Moving Average (SMA) netflow dropped below -40,000 ETH per day, the lowest level seen since February 2023. This persistent negative netflow shows that investors have been steadily shifting their ETH away from exchanges and placing it into staking, cold storage, or other long-term holding options. “Lower exchange balances equals reduced short-term supply,” the analyst said.

At the time of writing, Bitcoin was trading at $109,585, while Ethereum traded at $4,011.

Featured image from Unsplash, chart from TradingView