Bitcoin and Ethereum supplies on centralized exchanges have hit record lows following the introduction of crypto-related spot exchange-traded funds (ETFs) in the United States.

According to Glassnode data, Bitcoin balances on exchanges have fallen to 11.6%, the lowest since December 2017. Ethereum balances are even lower at 10.6%, the lowest since October 2015.

Spot ETFs trigger withdrawals

Market experts have explained that the declining exchange balances coincide with the Securities and Exchange Commission’s (SEC) approval of ETF products for Bitcoin and 19-b filings for Ethereum.

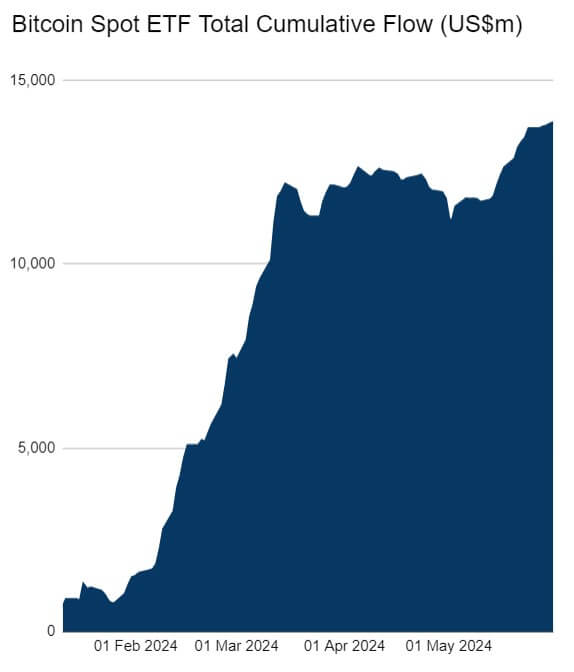

HeyApollo data reveals that spot Bitcoin ETFs have accumulated 857,700 BTC, valued at $58.5 billion, in just five months. BlackRock’s IBIT ETF leads this acquisition with around $20 billion in assets, followed by Fidelity’s FBTC, with approximately $11 billion.

While spot Ethereum ETFs have not yet begun trading, investor anticipation has driven significant withdrawals. According to CryptoQuant data, 777,000 ETH, worth about $3 billion, have been pulled from exchanges since the SEC’s approval.

Additionally, the option to stake ETH has influenced its declining exchange balance. Nansen reports that 32.8 million ETH, or 27% of its total supply, are currently staked to support the network.

Is a supply crunch on the way?

If the declining exchange balance trend continues, market experts have predicted demand for Bitcoin and Ethereum could lead to a supply crunch.

In a recent social media post, BTC Echo editor Leon Waidmaan advised investors to brace for a “supply squeeze” and the possibility of “the next big move.”

Historically, when digital assets are withdrawn from exchanges, it suggests investors plan to hold rather than sell, reflecting bullish sentiment and expectations of future growth. A supply squeeze could significantly impact prices by limiting the available supply, potentially leading to substantial price increases if current accumulation trends persist.

The post Bitcoin and Ethereum exchange balances hit record lows as spot ETFs drive withdrawals appeared first on CryptoSlate.