Bitcoin is red hot again. Price reached $97,500 before dipping slightly lower to $97,000, and the markets are abuzz. Sellers anticipating Bitcoin’s upswing might be in for trouble. Figures reveal over $3 billion worth of short positions potentially being erased should Bitcoin move over the coveted $100,000 threshold.

Massive Short Positions Clustered Below $100K

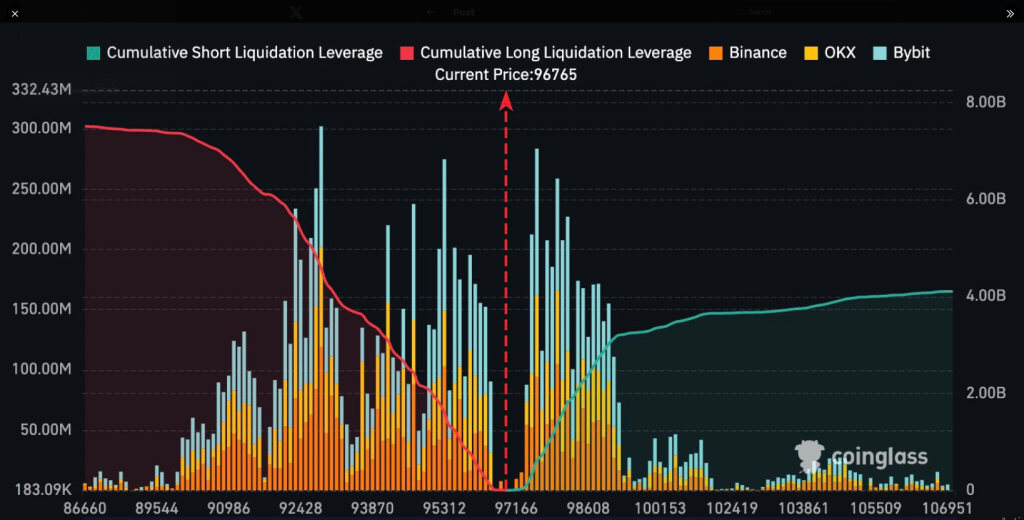

According to Coinglass, there’s a heavy concentration of short positions across major exchanges like Binance, OKX, and Bybit between the $97K and $100K range. That cluster of bets against Bitcoin is now on shaky ground. A move past $100K could lead to a wave of liquidations totaling about $3.04 billion.

If Bitcoin goes even further—to approximately $105,000—liquidations may rise to almost $3.73 billion. At the last all-time high of $109,000, the figure may reach $4 billion. Short sellers who sold the market with high leverage are most vulnerable, and the heat is on.

Long Positions Cleared In Earlier Dip

While shorts are currently in the crosshairs, long positions already lost some ground. In a recent dip, longs saw much of the bullish bets get washed out. The aggregate leverage that supported long positions has declined drastically, according to the red trendline of long liquidations.

This leaves fewer overconfident buyers propping up the market, lessening the risk of an abrupt crash from long-side liquidation. The reset also leaves a cleaner path higher, as there is less resistance from leveraged longs attempting to hold their positions.

Resistance Zone Between $96K And $98K

Bitcoin is now trading within one of its largest resistance zones. On-chain indicators on IntoTheBlock indicate that an estimated 1.06 million wallets purchased approximately 750,800 BTC between the $96K and $98K regions. That’s nearly $73 billion’s worth of Bitcoin at break-even for a good number of holders.

This region is significant. If Bitcoin manages to break above it, there will be less selling pressure in the way. The price may rise quicker with fewer hurdles between $98K and $100K.

$3B in #Bitcoin shorts will get liquidated at $100K.

Let’s send it.

pic.twitter.com/VKMePfQDhS

— Carl Moon (@TheMoonCarl) May 2, 2025

$100K In View As Analysts Monitor The Market Closely

The $100,000 level is more than a figure. It’s a psychological mark for traders, and it might be the beginning of something bigger. Crypto analyst Carl Moon responded to the situation on social media with a quick comment: “Let’s send it.” The remark captures the sentiment of most in the market.

At present, Bitcoin is probing its limits. If the bulls continue in charge, shorts may become squeezed, and the path to six figures may be nearer than it appears.

Featured image from Gemini Imagen, chart from TradingView