As Bitcoin (BTC) continues to hover just below the $120,000 level, miners have increased transfers to Binance crypto exchange. According to analysts, elevated BTC transfers to Binance could signal an upcoming price correction for the top cryptocurrency.

Bitcoin Price Correction Upcoming?

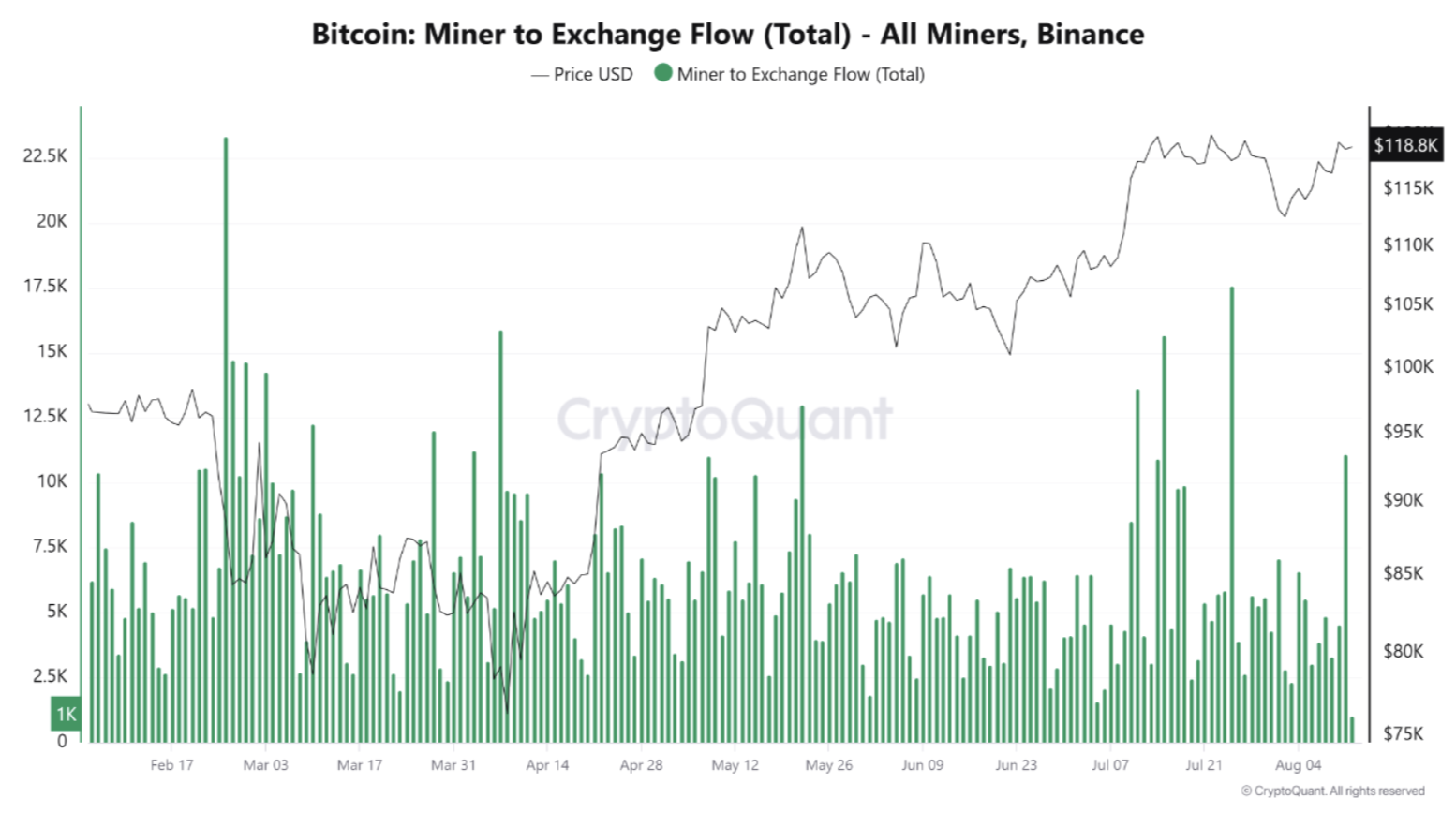

According to a CryptoQuant Quicktake post by contributor Arab Chain, there was a significant spike in BTC transfers from miners to Binance crypto exchange in late July – shown in the form of double tops in the following chart.

These spikes were followed by several days of above-average flows to the exchange. Early August saw another surge, with transfers ranging from several thousand BTC to more than 10,000 BTC at their peak.

This activity suggests that miners are continuing to distribute BTC to the exchange. The selling comes as the asset’s price remains close to its all-time high (ATH) of nearly $120,000.

Arab Chain noted that compared to the April–June period, the current miner activity resembles “stockpiling or hedging behavior” rather than typical low-noise patterns. The analyst shared several behavioral indicators to support this view.

For instance, sustained high inflows during elevated price levels suggest that miners are taking advantage of the rally to secure liquidity, cover operational costs, or manage post-halving treasury needs.

However, such large inflows are often linked to short-term resistance. The market must have sufficient buying liquidity to absorb this supply and prevent it from triggering a sharp price decline.

The high frequency of peaks over the past two weeks also indicates that this is not a one-off occurrence. Instead, it marks a phase of heightened activity among Binance miners, which increases Bitcoin’s price sensitivity to any drop in demand.

According to Arab Chain, if daily flows remain above the recent weekly average – roughly 5,000 to 7,000 BTC per day – it would point to ongoing supply pressure. Conversely, a rapid drop back to lower levels would suggest that the distribution wave was temporary and has already been absorbed.

BTC May Be Preparing For A New ATH

Despite consolidating just under $120,000, recent on-chain data shows few signs of the Bitcoin market overheating. In addition, the average executed order size in the Bitcoin futures market has been steadily declining, indicating greater retail participation in the rally.

That said, a significant portion of short-term BTC holders have moved into profit, which could set the stage for a sell-off. At press time, BTC trades at $118,970, down 0.6% over the past 24 hours.