Data shows that Bitcoin Coinbase Premium has plunged into the red territory, which may explain why the asset’s price has crashed to under $68,000.

Bitcoin Coinbase Premium Index Has Turned Red

As explained by the on-chain analytics firm CryptoQuant in a post on X, the BTC Coinbase Premium Index dropped into negative territory just hours before BTC went through its correction.

The “Coinbase Premium Index” here refers to an indicator that tracks the percentage difference between the Bitcoin prices listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

When the value of this metric is positive, it means that the price listed on Coinbase is greater than on Binance right now. Such a trend implies that the users of the former platform are doing more buying than those of the latter.

On the other hand, negative values imply the presence of higher selling pressure on Coinbase since the price of the cryptocurrency on Binance is currently greater.

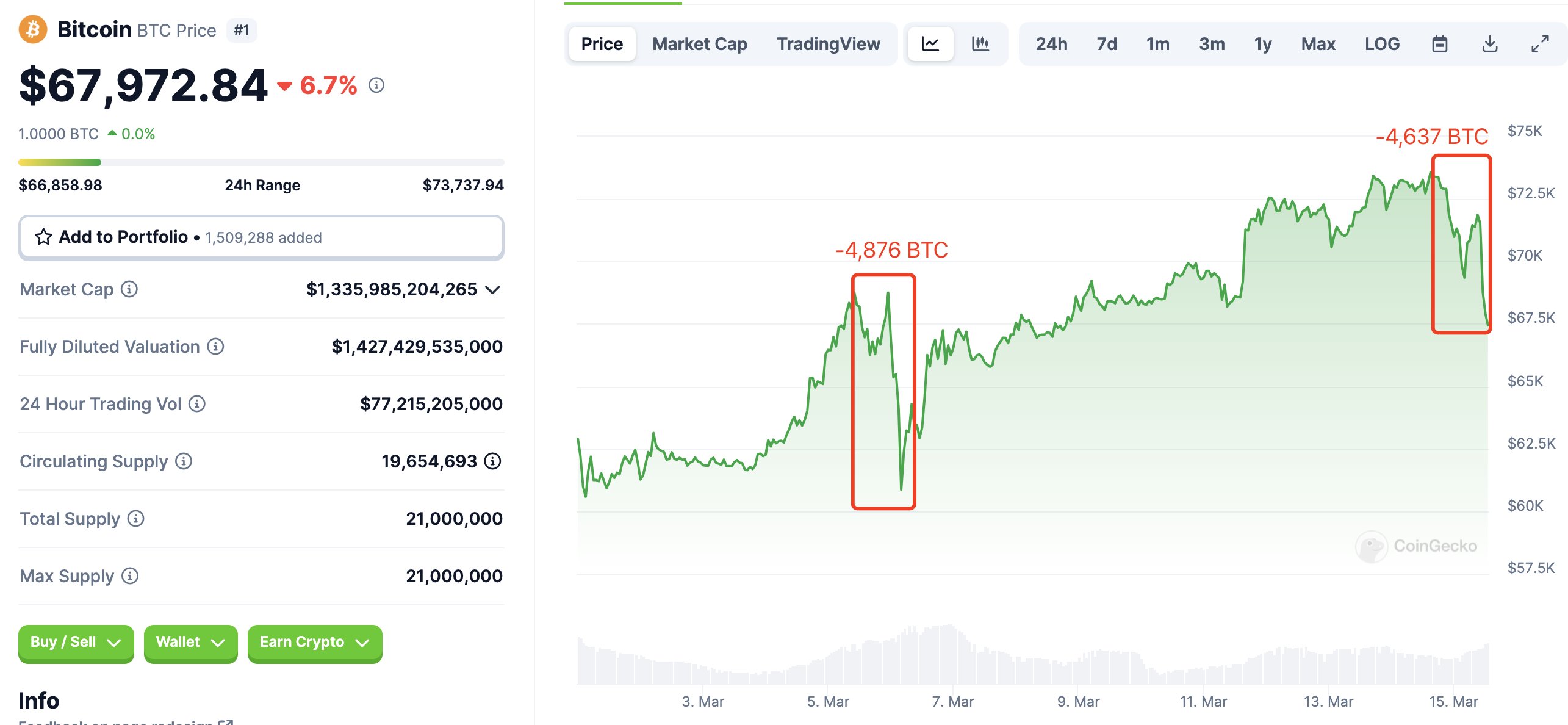

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Index over the past few days:

As the above graph shows, the Bitcoin Coinbase Premium Index had been positive earlier. Still, yesterday, the indicator dipped into the negative region and has since mostly remained inside it.

Alongside these red values of the metric, the cryptocurrency’s price has taken a deep hit, as it has come back down to the $68,000 level. Given the close timing, the high selling pressure on Coinbase may have something to do with this drawdown.

Coinbase is popularly known to be the preferred platform of US-based institutional investors, while Binance has more global traffic, so the Premium Index’s value can reflect the difference in the behaviors of American whales and world users.

In this rally, the Coinbase Premium Index has generally remained positive as large US-based entities have accumulated. Given the change to red values, these investors may have now taken to selling instead, thus leading to the coin’s plunge.

This indicator could be worth watching in the coming days. If it turns back positive for a sustained period of time, it would be a sign that the buyers are back and with them, so it might be an uptrend.

Regarding the latest correction, smart-money tracker Lookonchain has pointed out that a Binance deposit wallet has moved BTC worth $329 million to a Binance hot wallet in the past 24 hours.

Interestingly, this same whale also moved a similar amount of Bitcoin back during the correction earlier in the month, as the below chart shared by the X user shows.

BTC Price

At the time of writing, Bitcoin is trading at around $68,100, down 4% in the past 24 hours.