As Bitcoin continues to establish new milestones, including a recent all-time high past the 108k mark, market analytics tools like CryptoQuant and Glassnode offer predictions for its future growth.

Both sites demonstrate that Bitcoin still has a lot of room to expand. CryptoQuant predicts a price range of $145,000 to $249,000 by 2025, with Glassnode’s research indicating even higher potential targets.

Market Analysis By CryptoQuant

The CryptoQuant analysis is based on a number of critical elements, including institutional capital flows, a favorable regulatory environment, and past cyclical trends.

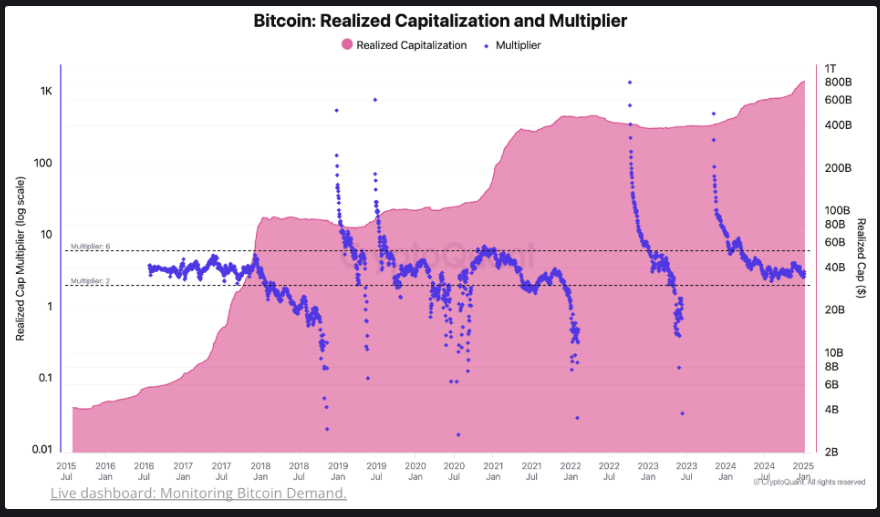

According to the analytics platform, an anticipated flood of fresh capital might lift Bitcoin’s price, using a realized cap multiplier that generally varies between 2 and 6 during bull markets.

This indicates that for every dollar of fresh investment, Bitcoin’s market value may rise by $2 to $6, indicating the possibility of large price increases. It is a rosy forecast, but one that must be carefully considered in light of market volatility.

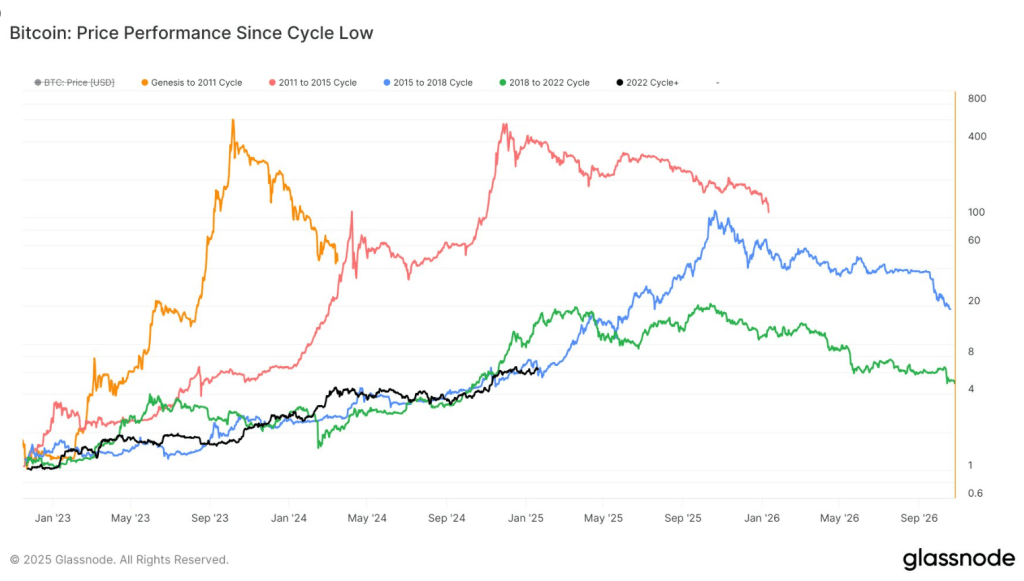

#Bitcoin‘s current cycle continues to echo historical trends, particularly aligning with the 2015-2018 cycle.#BTC performance since the cycle low at the current stage of the cycle (no. of days since low):

2022 Cycle+: +630%

2015-2018 Cycle: +562%https://t.co/9YVv2m2I0p pic.twitter.com/vBSwC8qm5T

— glassnode (@glassnode) January 21, 2025

Glassnode’s Historical Perspective

Conversely, Glassnode emphasizes historical trends and notes that the present trajectory of Bitcoin corresponds with the 2015–2018 cycle. Bitcoin surged in this cycle; if history repeats itself, it may rise far higher.

Glassnode’s projections, meanwhile, are more speculative; some models suggest that Bitcoin might perhaps hit $1.7 million, but this is quite improbable. These projections predate on the idea that Bitcoin would keep growing at its present pace.

Technical Signs And Market Mood

Technically, Bitcoin’s recent price fluctuations indicate strong momentum. Indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) point to even greater upside potential, with some experts predicting objectives of over $125,000.

However, holding onto current support levels is essential to keeping momentum going. Any notable drop in Bitcoin’s price would put investor trust in jeopardy.

Global Economic Factors And Risks

Though the future seems bright, global economic events put a heavy pressure on the price trajectory of Bitcoin. Rising unemployment and geopolitical tensions could affect market confidence; meanwhile, regulatory reforms remain a major issue.

Featured image from Pexels, chart from TradingView