The post Bitcoin Crosses $93K but Faces Correction – What’s Next? appeared first on Coinpedia Fintech News

Bitcoin just hit a huge milestone, breaking past $93,000, even if it didn’t stay there for long. It’s been testing that resistance level for days, and finally, demand from the U.S. market seems to have pushed it over the line. While things cooled down a bit after the initial high, this jump is raising a big question for everyone watching: could Bitcoin be gearing up for an even bigger climb?

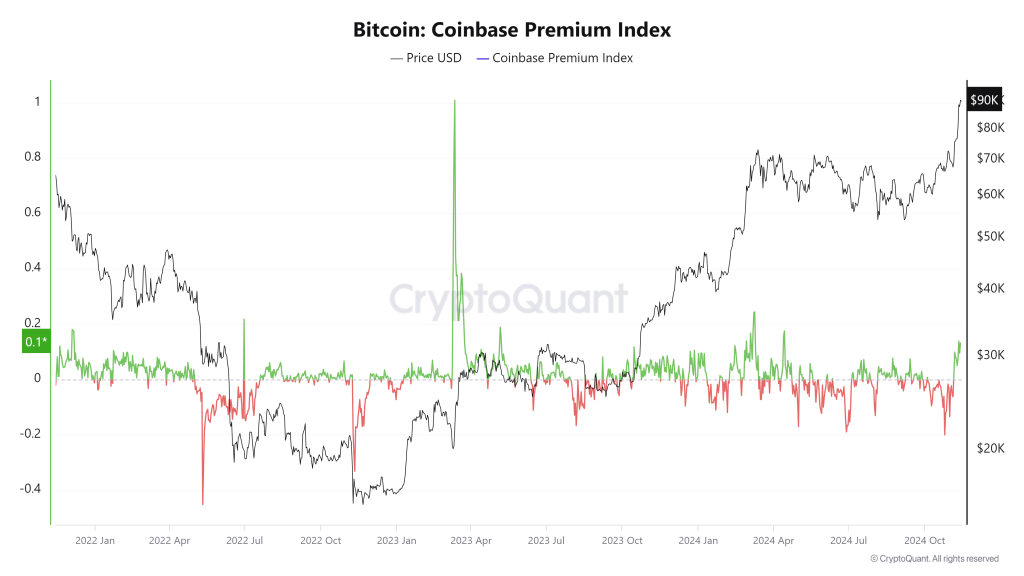

U.S. Investors Jump In – Coinbase Premium Shows the Heat

Bitcoin’s leap above $93,000 happened right as the U.S. markets opened, hinting that American investors are definitely behind this push. The Coinbase Premium Index, which measures the price difference between Coinbase and Binance, hit 0.2. That might not sound big, but it’s actually the highest we’ve seen since April! Basically, this premium means U.S.-based investors are buying at higher prices, indicating some strong demand.

Plus, it’s not just individuals driving this. BlackRock’s iShares Bitcoin Trust (IBIT), a popular U.S.-listed Bitcoin ETF, was trading hot, with a whopping $1.2 billion in volume within the first hour. It even became one of the most-traded ETFs on the market. This kind of volume from big players shows Bitcoin’s appeal is still very much alive in the U.S. market.

Spot Markets Take the Lead Over Futures

This isn’t just futures contracts at play; actual Bitcoin purchases are driving this rally. According to analysts, the cumulative volume delta (CVD) from spot markets is showing a lot of buy-side pressure. That might sound technical, but it just means the demand we’re seeing is real buying, not just bets on future prices. This is good news if you’re hoping for a lasting rally since spot purchases often make for a more solid price foundation than futures-driven ones.

A Dip but Not Done Yet

Of course, Bitcoin didn’t stay at $93,376 for long. Prices dipped back down to around $89,852, which means a 4.34% drop. It’s still about 3% higher than the day before, though, so all is not lost! This correction could be a sign of Bitcoin’s usual volatility at play. Bitcoin surpassed silver and momentarily climbed above Saudi Aramco to become the 7th largest global asset. Although it slipped back a bit, it’s clear Bitcoin’s influence is growing on a global scale.

What’s Next?

With U.S. demand staying strong and ETFs still pulling in big trading volumes, it’ll be interesting to see if Bitcoin keeps this momentum. If spot purchases keep leading the charge, this could be the start of a steady upward trend. But as we know with Bitcoin, anything can happen. It’s safe to say the crypto market isn’t getting any less exciting—so hang on tight for what comes next!