Reports have disclosed a sharp rebound in crypto markets this week, with Bitcoin jumping 8% to trade above $93,000 after sliding from lows under $85,000 earlier in the week.

Traders are watching the Federal Reserve’s December actions closely as they try to gauge how much liquidity will return to markets. The move pushed bitcoin back within reach of a roughly $2 trillion market cap.

Sovereign Funds Building Longer Positions

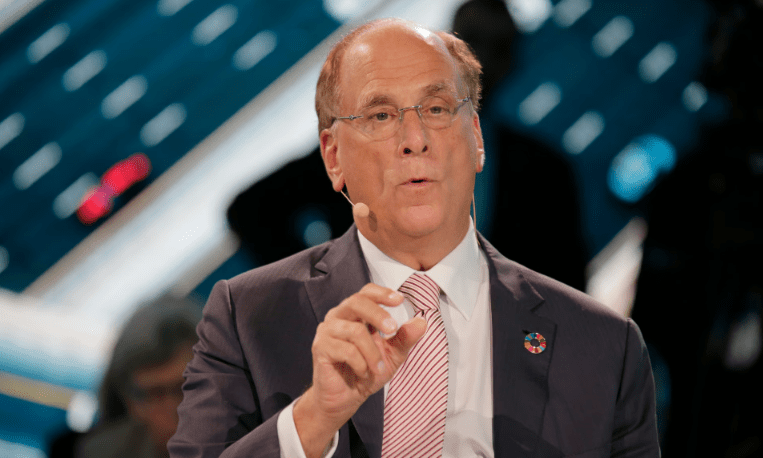

According to BlackRock chief executive Larry Fink, several sovereign wealth funds have been quietly adding to positions as prices fell from a peak near $126,000.

“There are a number of sovereign funds that are standing by…. and they’re buying ‘incrementally’ as the Bitcoin price has retreated from its $126,000 peak,” Fink said.

He said these buyers are taking a gradual approach — adding over time rather than making quick bets — and treating holdings as multi-year positions.

Reports have disclosed that public funds in Abu Dhabi and Luxembourg have bought into BlackRock’s IBIT bitcoin fund in recent months.

Fink warned that markets remain skewed and that volatility will persist while many players remain highly leveraged.

Tokenization Seen As A Long-Term Story

Fink has been vocal about tokenization as a major theme for the coming years. Based on reports, he wrote in The Economist that tokenization could grow as quickly as the internet did in its early days, noting that Amazon had only $16 million in sales in 1996.

BlackRock, the $10 trillion asset manager he runs, has pushed the idea that a digital wallet could one day hold stocks, bonds and tokenized assets together.

Coinbase chief executive Brian Armstrong said some of the largest banks are already working with Coinbase on stablecoins, custody and trading services, though he did not name the banks.

On Ownership & Worry

According to remarks made at a DealBook event alongside Andrew Ross Sorkin and Brian Armstrong, Fink described bitcoin in emotional terms: ownership often reflects worries about physical safety or financial security.

He tied demand to concerns over the debasement of financial assets and rising deficits. Reports have also quoted him warning that the US risks falling behind other governments if it does not speed up adoption of tokenization and other digital tools.

US President Donald Trump has similarly warned about competition from China in crypto innovation.

Market Reaction And Risks Ahead

Traders are already pricing in a variety of scenarios. Some are betting on a major development in 2026 that could reshape demand; others remain focused on short-term policy moves from the Fed.

Bitcoin’s recent 8% gain was the largest daily jump since May, but it came after sharp swings that highlighted how quickly positions can reverse.

With significant capital now involved — and big names publicly backing tokenization — the market is likely to see more headline-driven moves.

Featured image from Pexels, chart from TradingView