Bitcoin (BTC) has been facing significant volatility and downward pressure lately. However, analysts warn that the downtrend may not be over yet, as projections point to a deeper price crash toward $94,000 soon. According to Bitcoin’s Elliott Wave count, the cryptocurrency is currently in a vulnerable phase that may trigger more losses, despite the market’s efforts to rebound. Still, the analyst notes that the next move after this projected crash could see Bitcoin potentially reversing upward to new levels.

Bitcoin Faces Epic Crash As Wave 2 Unfolds

Luca, a crypto analyst on X (formerly Twitter), has unveiled a foreboding forecast for the Bitcoin price, warning that the flagship cryptocurrency could still be headed for more pain in the short term. The analyst has outlined an Elliott Wave count for Bitcoin that suggests that the cryptocurrency has not bottomed yet.

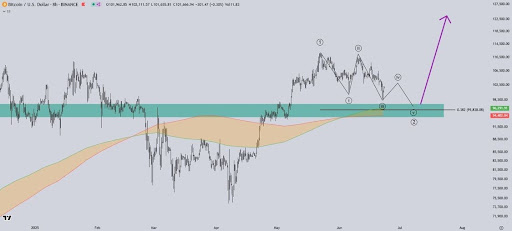

According to the 8-hour chart breakdown, Bitcoin is in the midst of completing a Wave 2 correction within a broader bullish trend. The chart shows a five-wave corrective structure unfolding, with the final leg potentially leading to a price crash toward the $94,000 support region. This level aligns with both the 0.382 Fibonacci Retracement and a key support zone.

While Luca reveals that some signs indicate that the correction might have bottomed already, the analyst maintains that one final push lower remains possible before Bitcoin’s next bullish move. The projected dip toward $94,000 is framed as the concluding move of the internal Wave (v) of Wave 2, creating what could be a textbook completion of a corrective cycle.

With the Bitcoin price currently sitting above the $100,000 psychological level at $105,574, a decline to $94,000 would represent a massive blow to its slowly recovering value. Despite the possibility of an upcoming bullish move, this 11.3% decline from current prices could significantly slow down BTC’s momentum, putting more strain on the already volatile market. Nevertheless, Luca suggests that this decline could present a prime accumulation opportunity, indicating that now may be a favorable time to buy Bitcoin.

Game-Changing Reversal With Wave 3 Push

Despite the potential for a further pullback, Luca’s broader outlook for Bitcoin remains highly bullish. The Elliott Wave count on the chart signals that BTC is preparing to exit Wave 2 and initiate Wave 3—one of the most powerful phases in the five-wave structure. Once the projected correction to the $94,000 level concludes, Luca expects a strong reversal that could catapult the cryptocurrency to new ATHs.

A large purple upward arrow on the chart visualizes the anticipated Wave 3 surge, pointing toward a possible target zone above $122,000. This projection is rooted in the technical and historical tendency for Wave 3 to be the steepest and most aggressive wave in the Elliott Wave cycle. With Bitcoin still hovering near a high-confluence support zone, the stage appears set for a decisive rebound in the coming weeks, provided macro conditions don’t shift dramatically.