The consistent retail demand for Bitcoin at the $100,000 mark, which indicates high investor confidence, has recently drawn notice. However, because short-term holders are driving the present accumulating trend, market watchers are warning of a possible fall to $95,000.

Retail Investors Accumulate At Record Pace

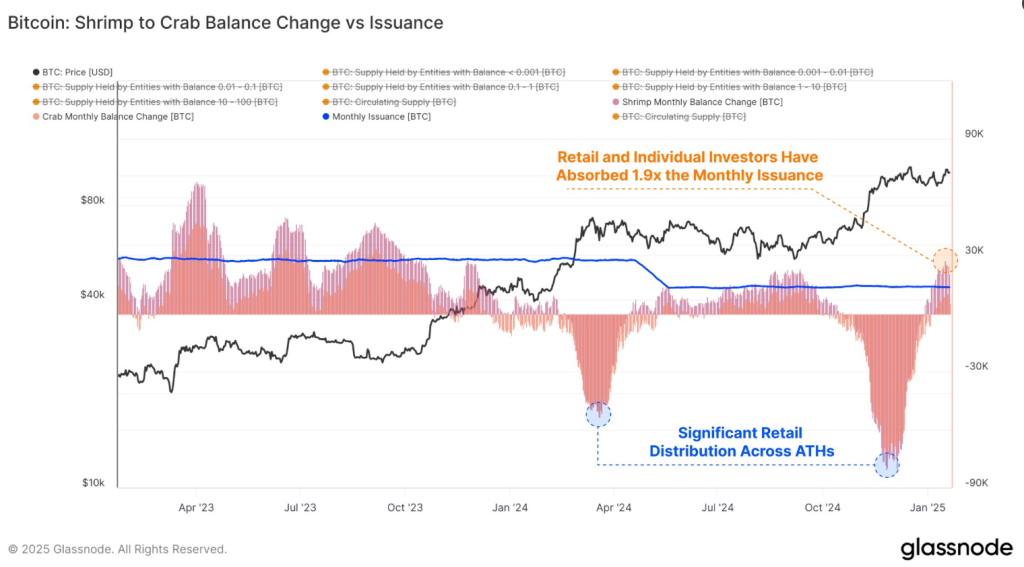

Retail investors, which include smaller holders termed as “Shrimps” and “Crabs,” have been enthusiastically accumulating Bitcoin. In the last month, Glassnode reports that these groups collectively added 25,600 BTC to their portfolios. That’s nearly twice the amount of newly mined Bitcoin over the same period, a sign of significant demand for the “digital gold” at its price peaks.

Demand from retail investors for #Bitcoin at prices around $100K remains strong – The Shrimp-Crab cohort (up to 1 and 10 #BTC, respectively) absorbed 1.9x the newly mined Bitcoin supply last month, a total of +25.6k $BTC: https://t.co/l0sjVN2Toi pic.twitter.com/UdzcCWXAGo

— glassnode (@glassnode) January 23, 2025

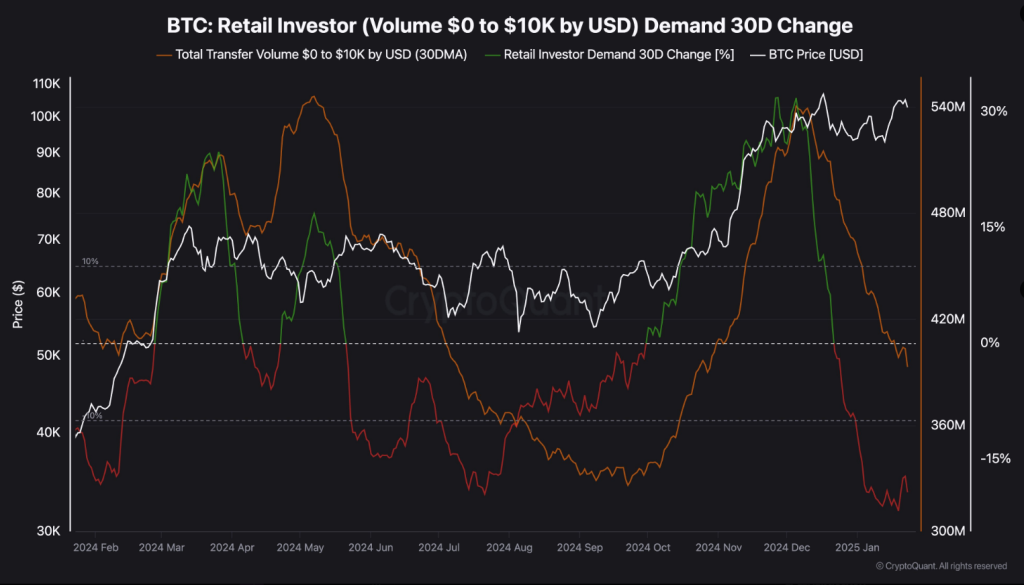

The purchasing activity of these smaller investors highlights an even more general retail enthusiasm trend. Nonetheless, experts must still exercise caution. Although this degree of accumulation is remarkable, the dominance of short-term holders (STHs) in this surge introduces an element of risk for market stability.

Short-Term Holders Pose A Risk

Often selling off during slight declines to guarantee gains, STHs are renowned for their fast responses to market changes. Particularly in cases of unexpected volatility for Bitcoin, this reflexive behavior could set off higher selling pressure. Teddy, a market analyst, underlined that the existence of STHs might have a major impact on temporary price swings.

While STHs (Short-Term Holders) have indeed absorbed a significant portion of the newly mined Bitcoin supply, it’s crucial to consider the behavioral tendencies of this group. STHs are historically more susceptible to panic during minor market fluctuations, often resulting in… pic.twitter.com/dasfRgjOFR

— Teddy (@TeddyVision) January 23, 2025

Historically, the markets are also more sensitive to the downtrends with STH. Analysts feel that along with this prevailing trend, at such levels, caution for investors would be prudent.

Glassnode: Narrow Bitcoin Range

Another anomaly which Glassnode picked out in the price action of Bitcoin is an unusually tight range over the past 60 days. Such events have been precedents for volatile times ahead.

This coincides with historical trends, which suggest that the market will experience either a breakout or a breakdown soon. While the sustained $100,000 price level reflects optimism, the market’s narrow range adds an air of unpredictability.

A Possible Pullback Soon?

Given all of these factors, some experts believe Bitcoin may be due for a slight price adjustment in the near future. Some experts, like market veteran Michaël van de Poppe, predict a retreat to $95,000, primarily due to STHs selling in the face of market uncertainty.

For the time being, retail demand remains a solid source of support at $100,000. Investors should, however, brace themselves for volatility and keep an eye out for market indicators. As Bitcoin trades near its peak, the interaction of retail euphoria and market risks will determine its next moves.

At the time of writing, Bitcoin was trading at $105,141, up 3.2% and 3.2% in the daily and weekly timeframes.

Featured image from Vecteezy, chart from TradingView