Quick Take

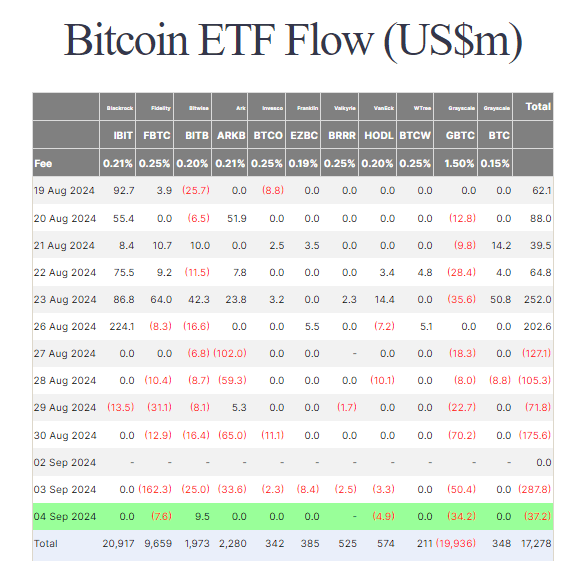

Farside data shows that Bitcoin ETFs experienced continued outflows of $37.2 million on Sept. 4, marking the sixth consecutive trading day of outflows. However, this was the most negligible outflow in the recent streak.

Grayscale’s GBTC led the outflows, losing $34.2 million, followed by Fidelity’s FBTC with $7.6 million and VanEck’s HODL with $4.9 million. In contrast, Bitwise’s BITB was the only ETF issuer to report an inflow, with a $9.5 million increase. BlackRock saw no movement, neither inflow nor outflow. Total inflows across the board amounted to $17.2 billion.

Ethereum ETFs saw more significant outflows, totaling $37.5 million. Grayscale’s ETHE recorded a $40.6 million outflow, though there was a $3.1 million inflow into Ethereum through the other Grayscale product, ETH. No other Ethereum ETF issuers reported any inflows or outflows. The cumulative outflows for Ethereum ETFs now stand at $562.3 million, according to Farside.

The post Bitcoin ETFs record lowest outflow in six-day streak appeared first on CryptoSlate.