Bitcoin has been moving lower ahead of the Halving event, going against analysts’ expectations. This price action has been unexpected and shows how the coin tends to go against predictions, basically charting its path.

Bitcoin Breaking The Mold

In light of Bitcoin’s randomness, especially in the past few months following the approval of spot exchange-traded funds (ETFs), one analyst expects the coin to continue defying expectations by clocking in a bull run that defies historical trends.

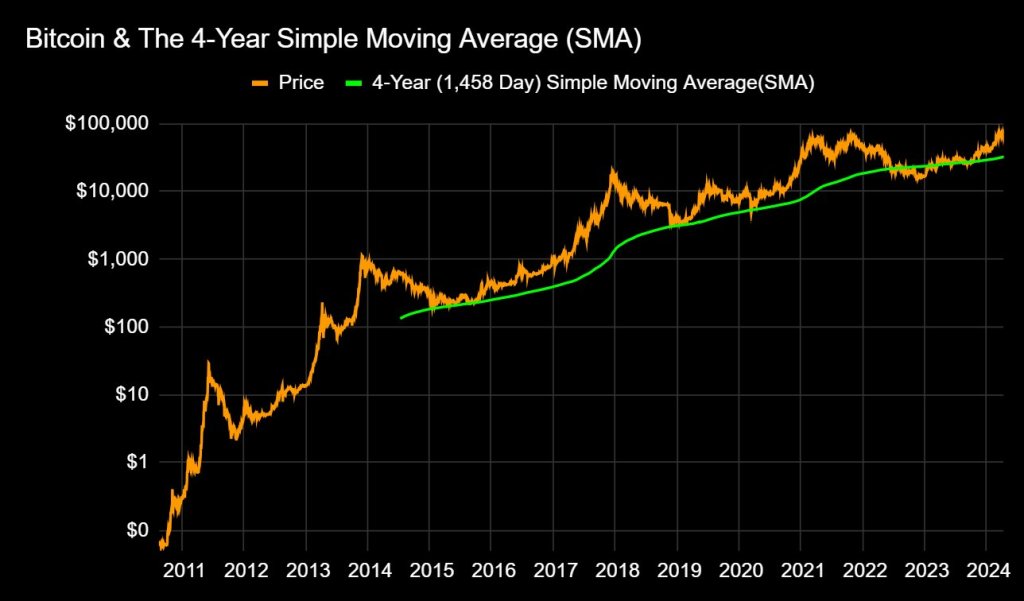

The analyst cites two recent instances where Bitcoin defied expectations to justify this bullish outlook. First, following the rapid expansion in the 2020 to 2021 bull run that saw Bitcoin soar from less than $10,000 to fresh all-time highs of around $70,000, prices sharply contracted in 2022.

Then, the United States Federal Reserve shifted its monetary policy to curb raging inflation by rapidly increasing interest rates. Following this and other market-related events, Bitcoin prices dipped below the all-time high of the previous cycle of $20,000.

By November 2022, prices fell to as low as $15,000, accelerated by the collapse of FTX. This retest of previous highs and fall below $20,000 had never happened before.

Another anomaly occurred last month. For the first time, Bitcoin prices expanded and broke the previous all-time highs of around $70,000 before the Halving event. As Bitcoin’s past price action shows, prices only rally to fresh all-time highs after Halving.

However, this changed when BTC soared to $73,800, possibly paving the way for bulls to join in and push the coin back to unchartered territory post-Halving.

Is BTC Ready For A Multi-Year Rally?

With this in mind, the analyst believes Bitcoin will continue uniquely shaping its path, deviating from history. For instance, the analyst thinks BTC will outperform altcoins in the coming months.

The analyst adds that increased regulatory scrutiny following high-profile collapses like FTX and Luna could dampen altcoin enthusiasm.

The coin will ride on the fact that it is the only one with an ETF from the United States SEC receiving investments. As a result of this capital injection, Bitcoin will likely register a multi-year “up only” phase, just like gold did once its ETF was approved.

Prices remain depressed ahead of this. Though prices are increasing at spot rates, the coin is within a bear formation. Currently, BTC has local resistance at around $65,000.