Fresh data from Binance suggests that Bitcoin’s (BTC) illiquid supply has reached historically high levels, a development that could set the stage for BTC to eye the $150,000 milestone by the end of 2025.

Bitcoin Illiquid Supply On Binance Hit Record Highs

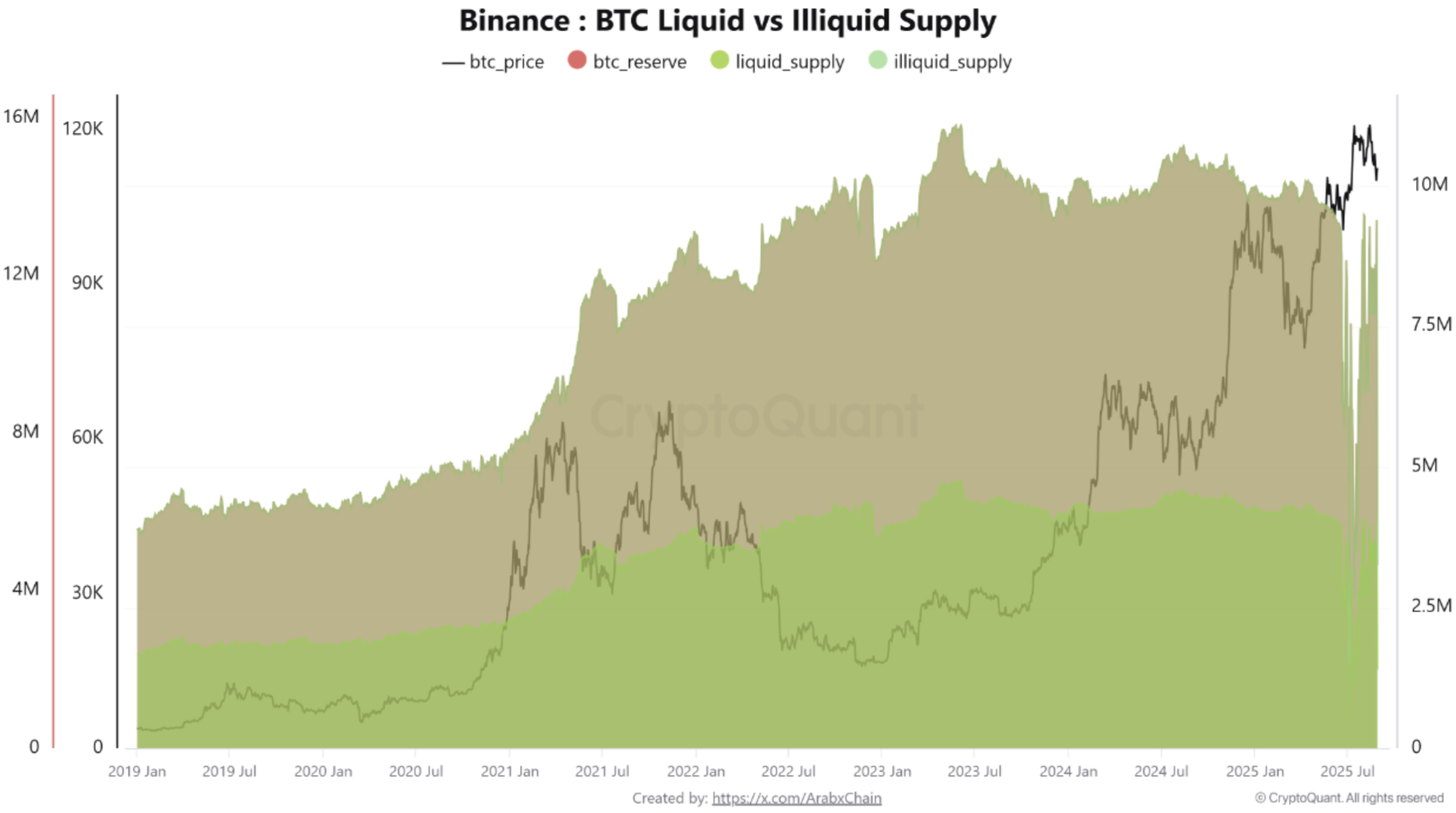

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s illiquid supply recently touched new highs on the Binance exchange. In contrast, BTC’s liquid supply has seen a significant decline.

The CryptoQuant contributor shared the following chart which shows the difference between BTC’s liquid vs illiquid supply on Binance. Bitcoin recently hit a fresh all-time high (ATH) above $120,000 before a price correction, showing that the market is currently in a state of “liquidity scarcity” supporting an upward trend.

A high level of illiquid supply essentially means that more BTC is locked away in wallets with minimal movement, effectively removing it from circulation on exchanges. This reduces the amount of Bitcoin available for trading.

A lack of BTC readily available on exchanges increases buying pressure on the limited supply that remains. This dynamic helps explain how BTC has continued to reach new highs even without massive inflows of external liquidity.

That said, there remain some risks. BTC’s low liquid supply means that whales or large holders can exert significant pressure on the cryptocurrency through any sudden sell-off. Such pressure could result in sharp price correction for the digital asset due to the lack of liquidity to absorb the new supply.

At the same time, current on-chain data indicates that whales and institutions appear to be adopting a “hold for the long haul” strategy, underscoring their confidence in Bitcoin’s role as a long-term strategic asset. However, analysts caution that any sudden shift in this behavior would be felt almost immediately across the market.

BTC In A “Fragile Bull Run”

Arab Chain described the present market situation as a contradictory one. On one hand, rising illiquid supply provides a foundation for further price appreciation. On the other, the lack of liquid supply creates a fragile market structure where even moderate selling could cause significant volatility.

As a result, Bitcoin is currently in a “fragile bull run” in that it is supported by long-term holders but susceptible to sudden selling from whales. However, if BTC illiquid supply continues to rise, then it could move toward levels exceeding $150,000 by the end of 2025.

On the flipside, if the liquid supply increases due to persistent sell-offs, then the market could face challenges, leading to a price decline to as low as the $90,000 to $100,000 range.

Despite BTC’s fragile price momentum, some experts continue to remain optimistic. Crypto analyst Timothy Peterson recently predicted that BTC can surge as high as $160,000 by Christmas. At press time, BTC trades at $109,286, down 3% in the past 24 hours.