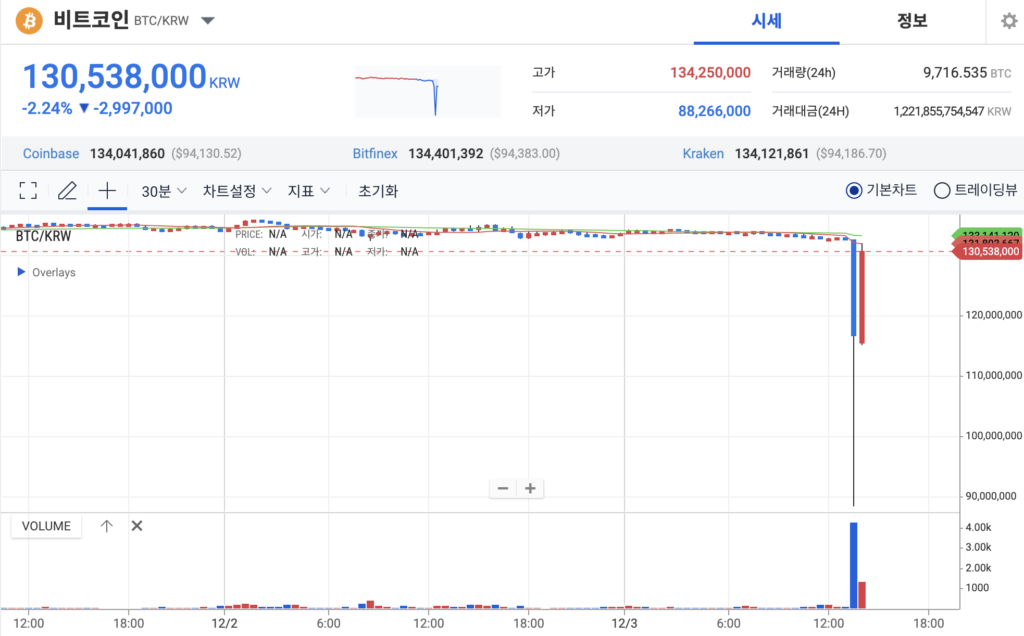

Bitcoin’s price fell from $96,000 to $93,700 today after South Korean President Yoon Suk Yeol declared emergency martial law. The decline appears driven by selling pressure from South Korean won (KRW) trading pairs, where Bitcoin experienced sharper drops.

On South Korean exchanges like Upbit, Bitcoin’s price plummeted to as low as $61,674, significantly below global averages. While the price recovered quickly, the sustained disparity has created an arbitrage opportunity of around $8,000 for traders able to navigate the situation. Wu Blockchain reported that all KRW trading pairs on Korean exchanges began to plummet, with Bitcoin and XRP experiencing steep declines before a partial recovery.

President Yoon’s martial law declaration accuses the opposition-controlled parliament of anti-state activities and sympathizing with North Korea. In a televised briefing, Yoon vowed to “eradicate pro-North Korean forces and protect the constitutional democratic order.” The announcement has led to uncertainty in the country’s financial markets, with all crypto exchanges in South Korea reportedly down and trading nearly impossible.

The opposition Democratic Party has called an emergency meeting in response to Yoon’s actions. The political turmoil is adding to market volatility, affecting cryptocurrencies and broader economic sentiments in the region.

The post Bitcoin falls to $61k on South Korean exchanges as President declares martial law appeared first on CryptoSlate.