On-chain data shows Bitcoin could have significant support between $66,900 and $68,900, which may help provide solid ground for a fresh surge to higher levels.

A Large Amount Of Investors Bought Their Bitcoin Between $66,900 & $68,900

According to data from the market intelligence platform IntoTheBlock, BTC is currently floating above a major demand zone. In on-chain analysis, the strength of any support or resistance level is based on how much “demand” was present at it.

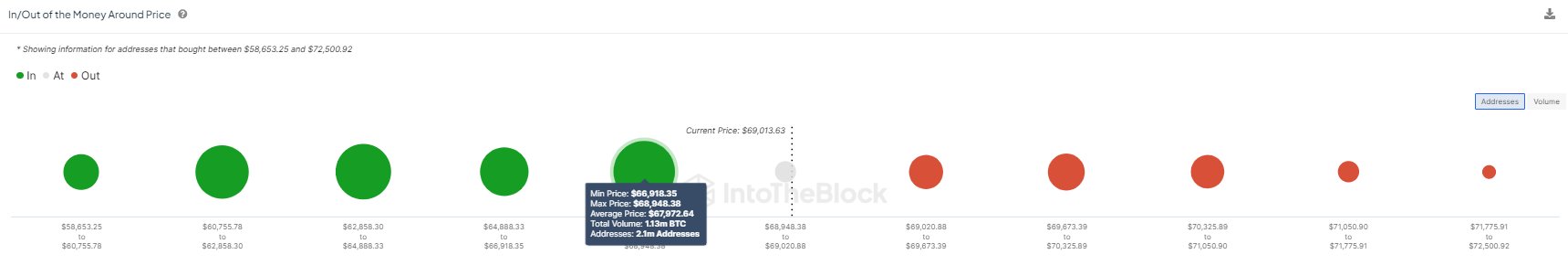

Below is a chart that shows the various Bitcoin price ranges near the current spot value and how they compare in terms of the total amount of the asset the investors purchased.

Here, the size of the dot correlates to the total number of tokens that were last acquired at the corresponding price range. It would appear that, out of these zones, the levels between $66,900 and $68,900 currently host the cost basis of the greatest amount of BTC.

More than two million addresses have acquired 1.1 million BTC inside this range. Since the current BTC spot price is above these levels, all investors who buy there will make slight profits.

Investor cost basis is important in the on-chain analysis because the level has special psychological significance. A potential retest of it can result in a flip of the profit-loss balance for the holder.

As such, investors may be prone to making some moves when a retest like this takes place. A holder carrying losses before the retest (that is, the retest is happening from below) may be tempted to sell for fear that the price will go down in the future.

On the other hand, an investor in the green before the retest may have reason to believe the price would go up again and, thus, could decide to accumulate more.

When retests of price ranges thick with investors, one of these reactions may arise on a scale that could be relevant for the wider market, therefore, major demand zones below can act as support points, while those above can act as resistance blocks.

Bitcoin has a large support range of $66,900 to $68,900 right now, which could help cushion any falls should the asset’s price decrease.

From the chart, it’s also apparent that, at the same time, the Bitcoin ranges ahead are thin with holders. This could, in theory, provide the ideal conditions for a rally towards higher levels.

BTC Price

Bitcoin surged past the $70,000 level earlier in the day, but the asset has since retraced to $69,100.