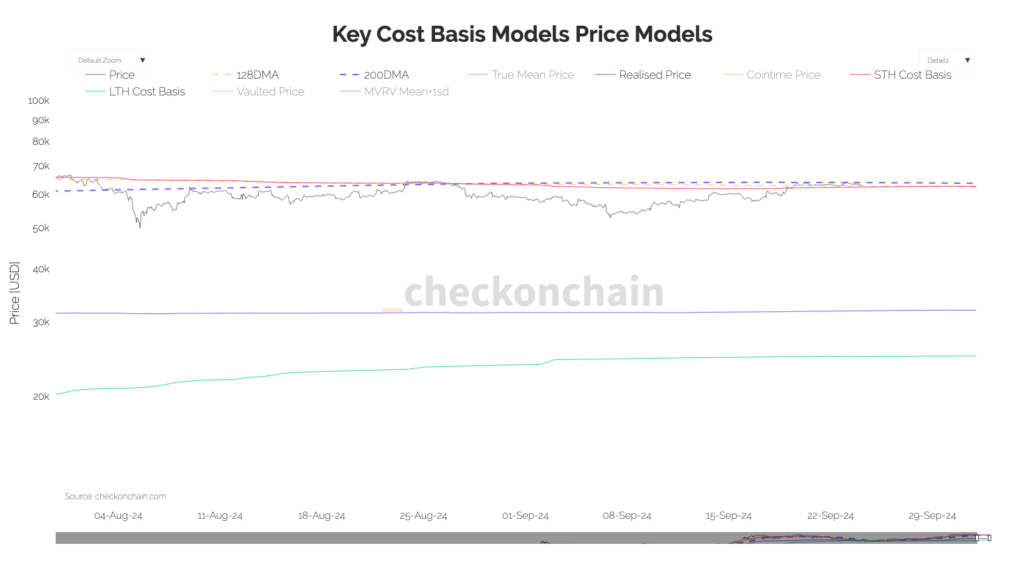

Bitcoin’s price fluctuation between $50,000 and $66,000 since early August continues to see activity around the short-term holding cost basis, according to checkonchain. The market price began at approximately $66,000 in early August, dipped below $50,000, and climbed back to the $64,000 mark through late September.

Short-term holders (STH) had a cost basis closely tracking the 200DMA, staying near the $63,000 range, suggesting that recent investors experienced minimal gains or losses relative to the current market price.

In early August, Bitcoin price fell below the STH cost basis before touching it again at the end of the month when the STH and 200DMA converged. The price broke about the STH cost basis in late September and the price decrease following Iran’s attack on Israel has caused Bitcoin to touch the STH once again, now potentially acting as a support.

Long-term holders (LTH) maintained a significantly lower cost basis, hovering between $20,000 and $24,000. This disparity indicates that investors holding Bitcoin over extended periods are sitting on substantial unrealized gains.

The 200-day moving average (200DMA) remained relatively flat, around under $63,000 during this period, indicating a stable longer-term trend.

The 128-day moving average (128DMA) also decreased from $65,000 to $61,000, reflecting short- to medium-term price movements. The convergence of the 128DMA and the market price may signal potential shifts in market sentiment.

These cost basis models provide insight into investor behavior and market forces following the Bitcoin halving in April. The data suggests a consolidation phase, with the market price aligning closely with the cost basis of short-term holders and moving averages.

The post Bitcoin hits support from key level at short-term holder cost basis appeared first on CryptoSlate.