After hitting an all-time high of $73,737 in mid-March, the price of Bitcoin has not been able to sustain itself at a high level of vigor and strength. The premier cryptocurrency did, in fact, enter a new era with the April halving event, but its price performance in the past weeks has yet to reflect this.

However, Bitcoin enjoyed a stroke of fortune in the past week, with its price climbing above $67,000 for the first time in nearly a month. Although the sentiment around the crypto market and its leader has not been particularly encouraging in the last few weeks, the recent bullish rally seems to be driving a shift in that regard.

Can Bullish Sentiment Push BTC Price To $70,000?

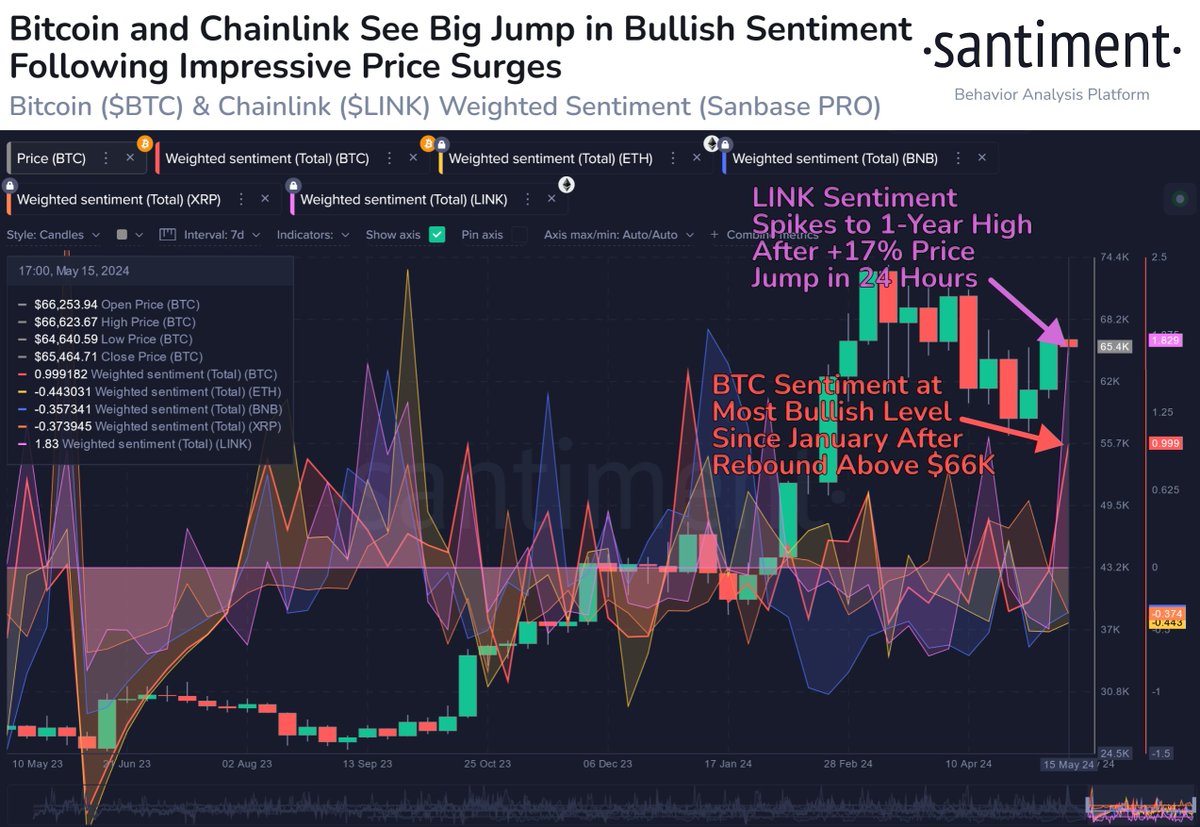

According to a recent report by on-chain analytics firm Santiment, the sentiment of the crypto crowd has shifted toward Bitcoin following its latest rally above $67,000. This revelation is based on the Weighted Sentiment metric, which measures the overall positive or negative sentiment towards a cryptocurrency.

This indicator is based on two sub-metrics; namely sentiment score and social volume. The sentiment score metric checks whether the crowd is negative or positive about the asset, while social volume tracks the total amount of discussion around an asset on social media.

Weighted sentiment is a product of both sentiment score and social volume. And there is a significant change in the metric when the social volume is high and there is a distinct average sentiment (either positive or negative).

According to Santiment, Bitcoin’s weighted sentiment recently hit its most bullish level since January, triggered by the latest price surge. The last time sentiment around the premier cryptocurrency was this bullish was after the Securities and Exchange Commission approved BTC spot ETFs in the United States.

Interestingly, Bitcoin is not the only top 20 cryptocurrency enjoying a positive sentiment at the moment. Sentiment’s data shows that the Chainlink (LINK) token, which has seen its value swell by nearly 20% in the past week, is witnessing its most bullish sentiment in over a year.

While a bullish sentiment is not necessarily a bad sign, FOMO (fear of missing out) can easily set in as a result, often leading to a price crash. Santiment did note in its posts that “FOMO staying low” is necessary for a sustained Bitcoin price rally and a potential move to $70,000.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at $66,924, reflecting a 2.3% increase in the past day. More notably, the premier cryptocurrency is up by 10% on the weekly timeframe.