The price performance of Bitcoin in the final quarter of 2025 has been a major source of worry for the crypto crowd — and rightly so. At some point in the past few weeks, the premier cryptocurrency looked set to end the year deep in the red zone.

Over the past week, the Bitcoin price has shown signs of a healthy recovery, having reclaimed the significant $90,000 support level. According to a crypto expert, the market leader may be performing better than the charts currently indicate.

What Has BTC Priced In Already?

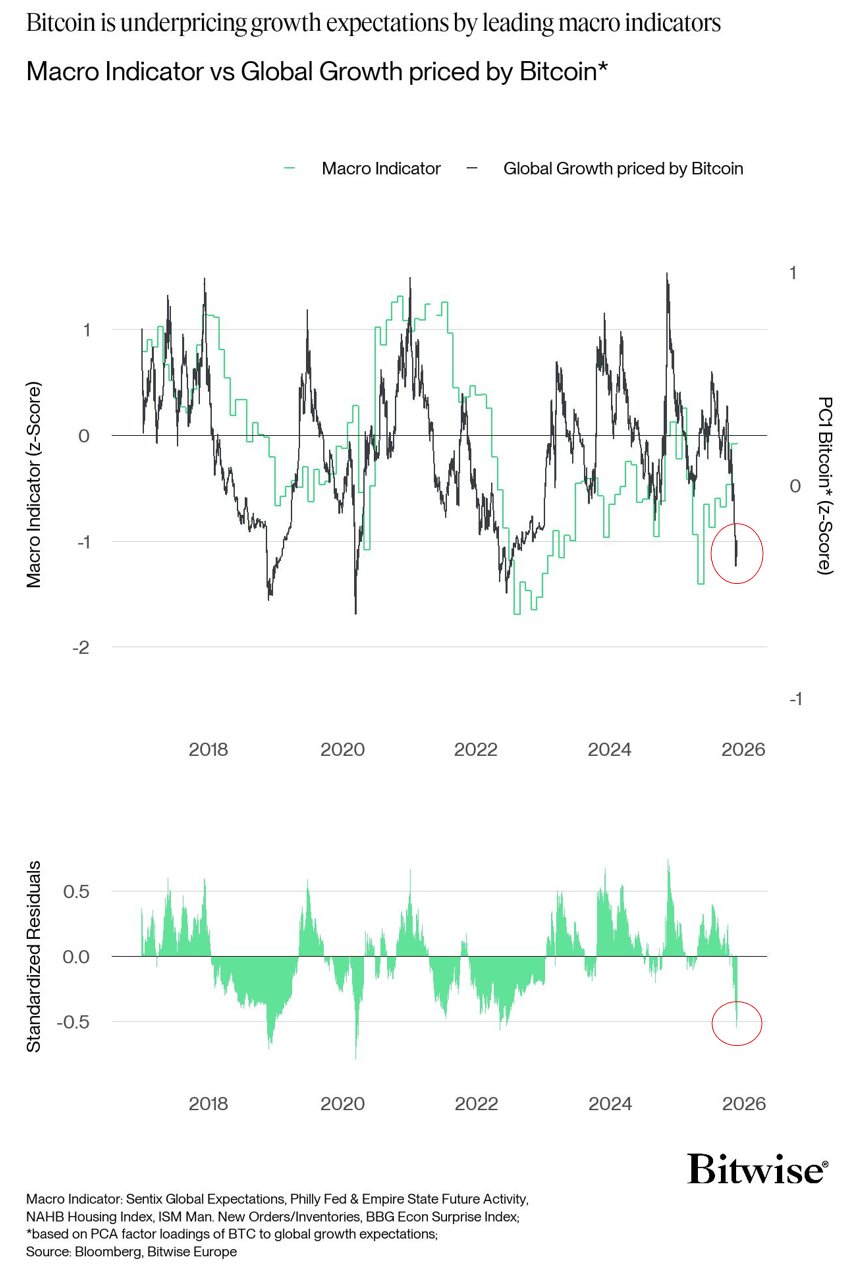

In a November 28 post on the social media platform X, Bitwise’s European Head of Research, Andre Dragosch, provided an answer to the “what is priced in already?” question being constantly faced by Bitcoin investors.

According to the macro analyst, the flagship cryptocurrency is pricing in the most bearish global growth outlook since 2022 (marked by Federal Reserve tightening and FTX’s collapse) and 2020 (during the depths of the Covid-19 pandemic).

Dragosch revealed that he was able to determine the level of global growth expectations Bitcoin is already pricing in by employing a set of leading macro surveys. “Bitcoin is essentially pricing in a recessionary growth environment,” the Bitwise researcher wrote.

Dragosch added:

Personally, I tend to be a macro contrarian because Bitcoin can both under- and overshoot the prevailing macro outlook. Pricing of any asset is essentially macro sentiment. This is also where most of the alpha is made, in my view.

As earlier mentioned, the last time macro expectations were this pessimistic was in 2020 and 2022 — with Bitcoin undershooting the macro outlook before making a strong comeback. Dragosch believes that a reenactment of this scenario is currently at play.

The Bitwise European Head of Research then noted that “global growth expectations will accelerate from here, based on the amount of preceding monetary stimulus, which points to a reacceleration well into 2026.”

Dragosch mentioned that the last time there was this asymmetric risk-reward was during the pandemic, where the Bitcoin price had surged 6x by year’s end after initially crumbling under the March 2020 shock. This macro setup can be likened to a “coiled spring or a ball under water.’

According to the macro analyst, Bitcoin’s current trajectory seems to be taking the form of a “coiled spring”—meaning its price could be readying for a violent move after a period of compression. Dragosch then concluded his analysis, saying that investors are not even remotely bullish enough.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $90,880, reflecting no significant movement in the past 24 hours.