Quick Take

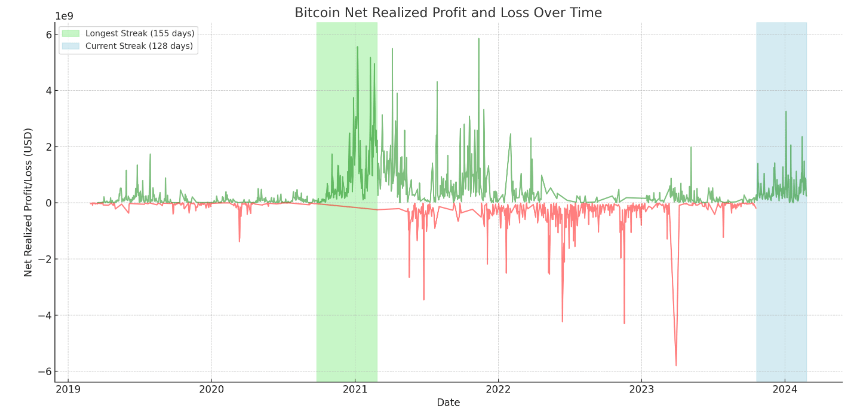

Net realized profit-taking for Bitcoin has witnessed an unbroken streak of 128 days, starting from Oct. 20, 2023, until Feb. 25, 2024. This period saw Bitcoin’s price catapult from below $30,000 to $50,000, providing lucrative opportunities for investors.

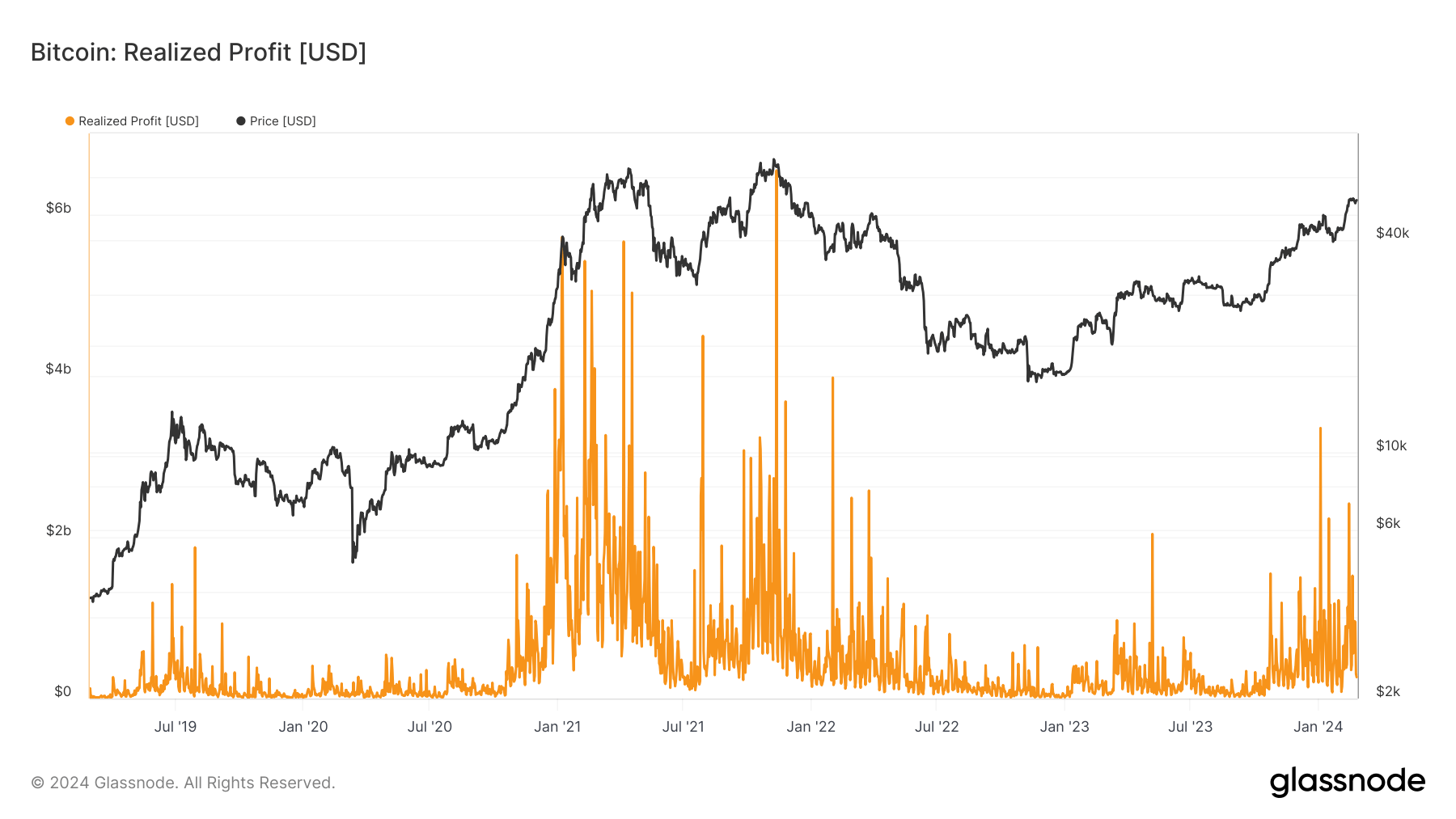

Defined by Glassnode, the net realized profit/loss represents the cumulative profit or loss from all coin transactions. It is calculated by deducting the realized loss from the realized profit.

This is not the first time such a trend has been noted. Looking back over the past five years, we find an even more extended period of consecutive net profit-taking: a staggering 155-day run from September 2020 to Feb. 26, 2021, during the significant bull run of 2021.

Interestingly, the frequency of profit-taking has dipped considerably in recent weeks as Bitcoin’s price has stabilized above $50,000. Notably, when Bitcoin’s price crossed significant milestones at $40,000 and $50,000, we noticed an intense surge in profit taking.

However, a contrast emerges when comparing the current trend with the 2021 bull run. The 2021 bull run witnessed multiple days where the profit-taking figures reached staggering heights of over $4 to $5 billion. In contrast, the highest profit-taking in 2024 peaked at $3.2 billion in a single day. This indicates a notably subdued level of profit-taking activities in the current year when compared to the intense trading during the 2021 bull run.

The post Bitcoin investors realize net profits for 128 consecutive days appeared first on CryptoSlate.