Bitcoin has seen a 9% retracement from its all-time high of $99,800, but its long-term bullish structure remains intact. This correction, though notable, hasn’t dampened investor optimism, as many are prepared to buy the dip and drive BTC past the elusive $100,000 mark.

According to key metrics shared by Axel Adler, a prominent CryptoQuant analyst, Bitcoin’s recent pullback is part of a healthy correction within a larger bullish cycle. Adler’s analysis highlights that on-chain activity and demand from long-term holders continue to support the case for further price appreciation.

If BTC recovers quickly and breaks above $100,000, it could trigger a wave of aggressive buying, fueling a new leg up in the ongoing rally. Alternatively, the price may consolidate around current levels, allowing the market to establish a stronger base before resuming its upward trajectory.

As investors and traders monitor key support and resistance levels, Bitcoin’s ability to maintain its bullish sentiment will be critical in defining its next price action phase. All eyes remain on the market as it navigates this crucial juncture.

Bitcoin Metrics Support Bullish Continuation

Bitcoin has surged nearly 50% since November 5, and despite recent price action showing signs of slowing down, the outlook remains bullish for the leading cryptocurrency. After reaching new all-time highs, Bitcoin’s recent price consolidation is seen as a natural part of the market cycle, with many investors cautiously watching for further momentum to push BTC beyond the $100,000 mark.

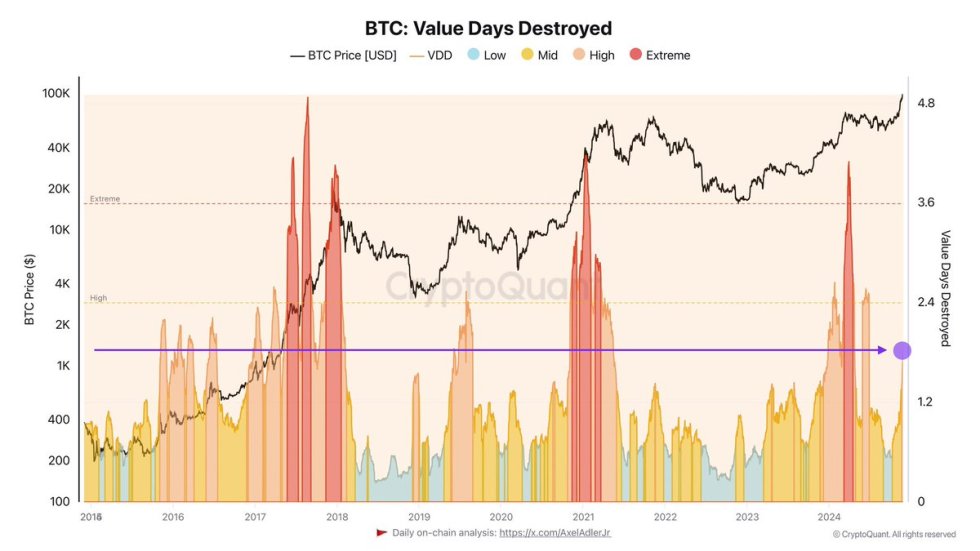

Top analyst and macro investor Axel Adler recently shared on-chain data on X, revealing key insights supporting BTC’s bullish trend. One important metric he highlighted is the BTC Value Days Destroyed (VDD), which tracks the activity of long-term holders.

Adler explained that the appearance of red bars in this indicator signals that the market is nearing the end of its current cycle, suggesting a top or a trend reversal. However, as of now, there are no red bars, which means the market is still in a healthy bullish phase.

This data confirms Bitcoin’s ongoing bullish outlook, even as the market remains somewhat doubtful of further continuation. With VDD showing no signs of exhaustion and no indication that the cycle is nearing its end, BTC appears poised to continue its upward trajectory in the coming weeks. Investors should remain watchful for key resistance levels, but the lack of red bars signals that the current rally has room to run.

BTC Testing Demand Levels

Bitcoin recently retraced to $90,800 after a failed attempt to break above the key $100,000 level. Despite this pullback, the price is steady above this crucial support level, indicating that BTC is poised to continue its upward momentum. The $93,800 mark has become an important short-term support, and if Bitcoin remains above this level in the coming days, the path to reclaiming the $100,000 resistance appears imminent.

However, if BTC loses the $90,000 support, further consolidation below this level could occur, pushing the price lower and limiting short-term upside potential. This would suggest the market is still testing its strength and could delay a breakout beyond $100,000.

For now, the market remains uncertain, but if BTC can stay above the $90,000 level and push through $93,800, the bullish trend is likely to continue. Investors will closely watch these levels to gauge whether BTC can regain its momentum and reach new all-time highs shortly.

Featured image from Dall-E, chart from TradingView