Michael Saylor, founder of Strategy, suggested this week that a rumored move by the US to impose tariffs on gold imports could push money out of the metal and into Bitcoin.

According to a Bloomberg interview, Saylor argued that Bitcoin cannot be taxed at the border because it “lives in cyberspace, where there are no tariffs.”

He said the coin’s lack of physical weight and its speed of settlement make it more attractive than gold in a world where import duties on bullion are being discussed.

Saylor Frames Bitcoin As Tariff-Proof Asset

Reports have disclosed that others in the industry agree. Simon Gerovich, president of Metaplanet, called gold “heavy, slow, and political,” and labeled Bitcoin “light, fast, and free.”

Based on reports, Metaplanet — a Japanese company that manages a Bitcoin treasury — bought nearly $54 million in Bitcoin recently, bringing its total holdings to 17,595 BTC, roughly $1.78 billion at current values.

Those numbers matter to investors watching whether corporate treasuries will switch allocation from stored metal to digital coins.

Market Reaction And Price Moves

Markets reacted in different ways. Gold futures hit an all-time high after the tariff news, as traders scrambled to price the possible cost impact of new import rules.

Bitcoin, meanwhile, traded roughly sideways in the same period, moving down by less than 1% in the last 24 hours. The split response shows that a policy shock can push some capital into metal while other buyers may sit on the sidelines or look to crypto for a different kind of hedge.

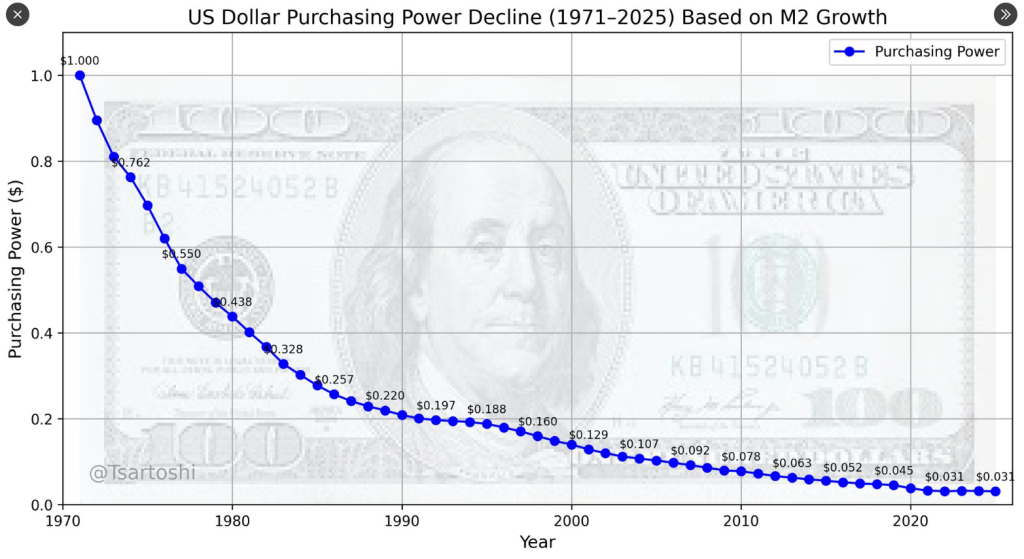

This is the purchasing power of the U.S. Dollar

This is the ultimate chart pattern for all fiat currencies

Some think Gold is a great store of value (preserving its purchasing power) – and it is

But the ultimate store of value will prove to be Bitcoin $BTC pic.twitter.com/4rdar3TRtT— Peter Brandt (@PeterLBrandt) August 8, 2025

Brandt Highlights Dollar Decline Over Decades

Veteran trader Peter Brandt added fuel to the debate by posting a long-run chart that traces the US dollar’s purchasing power from $1.00 in 1971 to about $0.031 in 2025, based on M2 money growth.

Brandt pointed to a roughly 95% decline in that period and said this trend shows fiat currency can lose value over decades. He argued that while gold has held value for many years, Bitcoin is now positioned to serve as a store of value going forward.

According to market watchers, the tariff talk has changed the short-term mood but not resolved which asset is the better long-term refuge.

Institutional buyers like Strategy and Metaplanet are making public bets on Bitcoin, and that shapes expectations. At the same time, gold’s record high reminds investors that demand for tangible stores of value can spike on policy risk.

Featured image from Unsplash, chart from TradingView