Data shows the Bitcoin Futures Open Interest has witnessed a massive plunge recently, flushing the excess of leverage in the sector.

Bitcoin Futures Open Interest Has Seen A Reset

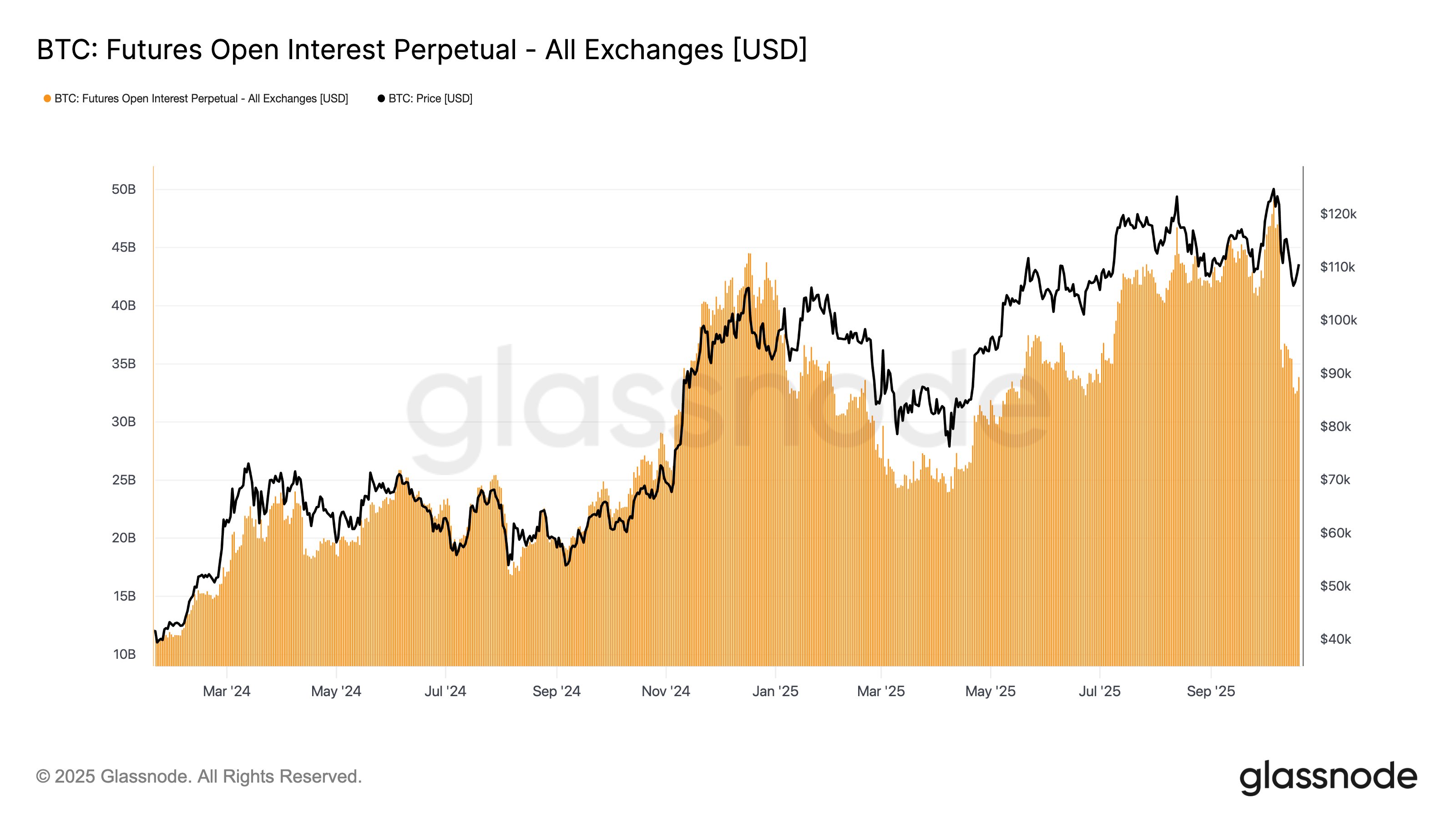

As explained by on-chain analytics firm Glassnode in an X post, the Bitcoin Futures Open Interest has gone through a sharp decline. This metric measures the total amount of perpetual futures positions related to the cryptocurrency that are currently open on all centralized derivatives exchanges.

When the value of this indicator rises, it means the investors are opening up fresh positions related to the asset. Generally, the overall leverage in the sector goes up whenever this trend develops, so a rise in the Open Interest can lead to more volatility for BTC.

On the other hand, the metric going down implies holders are either closing positions of their own volition or getting forcibly liquidated by their platform. Since a washout of leverage accompanies it, such a trend can result in calmer price action for the coin.

Now, here is the chart shared by Glassnode that shows the trend in the Bitcoin Futures Open Interest over the last couple of years:

As is visible in the above graph, the Bitcoin Futures Open Interest shot up to an extreme level when the cryptocurrency’s price set its all-time high (ATH) above $126,000.

As mentioned before, an increase in the indicator can make the asset more volatile. This happens because the risk of a squeeze taking place rises as leverage piles up in the market.

A squeeze is an event where a sharp swing in the price triggers a mass amount of liquidations. These liquidations feed back into the move, elongating its length, and unleashing a further cascade of liquidations.

Such an event followed Bitcoin’s ATH and led to a rapid decline in the Open Interest as positions were flushed out. More liquidation events have followed since as BTC has continued to be volatile, but with the metric now standing around 30% down from its peak, perhaps enough excess leverage may have been washed out.

Glassnode has also pointed out that the Funding Rate, a measure of the amount of periodic fee that futures market traders are exchanging between each other, is also near neutral right now.

A neutral value in this metric indicates that no side in the market, whether long or short, is dominant at the moment. Based on this and the trend in the Open Interest, the analytics firm has noted, “the market is far less vulnerable to another liquidation cascade.”

It now remains to be seen whether the decline in the Open Interest will prove enough to avoid another squeeze, or if more chaos is yet to come in the derivatives market.

BTC Price

Bitcoin saw a sharp surge toward $114,000 earlier in the day, but the coin’s price has since witnessed a retrace again as it’s now back at $110,800.