After days of trading above the $90,000 price mark, Bitcoin has officially lost this key support level as the market turns increasingly volatile on Wednesday. While the price of BTC continues its downward trend, the ongoing selling pressure from long-term holders does not seem to be slowing down.

Long-Term Bitcoin Holders Extend Their Selling Trend

A persistent negative action from key investors is meeting Bitcoin’s current price pullback. Long-term Bitcoin holders, who are usually the most steadfast and resilient players in the cryptocurrency market, are increasingly showing signs of strain and uncertainty.

Related Reading: Veteran Whales Blamed For Bitcoin’s Sharp Slide, Crypto Boss Says

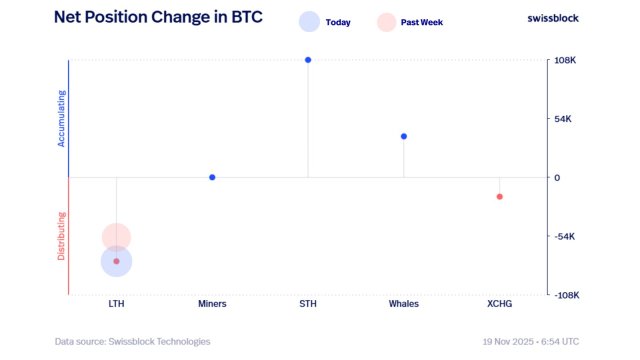

After examining the Net Position Change in BTC, Swissblock, an investment pioneer and on-chain data analytics platform, detected a continued selling pressure among long-term BTC holders. The cohort has continued to sell off sizable chunks of their holdings even as the flagship crypto asset battles to find stability.

This steady selling pressure from seasoned investors outlines a rising sense of caution and fear, pointing to weakening confidence in the current market structure. With these key investors persistently selling off their holdings, BTC’s price outlook becomes increasingly complicated, triggering crucial questions about where true market conviction currently resides.

During BTC corrections, the platform highlighted that long-term holders typically halt their distribution and slowly go into accumulation mode. However, the current trend is shifting away from this dynamic as selling pressure from the cohort is not fading.

According to the investment pioneer, these shifting market dynamics are pointing to additional downside in price before long-term holders return to accumulation mode. When this happens, the price of Bitcoin is likely to undergo a rebound and possibly restore the bull market.

BTC Supply In Loss Is Steadily Increasing

With Bitcoin’s price dropping, it is starting to leave a deeper imprint beneath the surface. Darkfost, an author at the CryptoQuant platform, reports that the portion of BTC supply held at a loss has increased following the recent market pullback.

Related Reading: Bitcoin Current Downward Trend Fails To Shake Long-Term Holder Profitability – Here’s What To Know

The development indicates increasing pressure on the network as a whole, especially among investors who entered close to recent highs. A steady increase in BTC supply in loss puts the market in a more precarious state, which might influence the asset’s next major move.

In the report shared on X, the market expert revealed that more than 6.96 million BTC accumulated by investors are currently positioned at a loss as of Wednesday. Data from the BTC Supply in Profit/Loss metric shows that this is the largest level of unrealized loss since January 2024.

What makes this so interesting is that the ongoing correction is still below the deepest drawdown of this market cycle. This implies that a significant amount of Bitcoin was recently amassed when it was trading close to its prior ATH, which helps to explain some of the panic selling, particularly from short-term BTC holders.

However, Darkfost noted that this kind of increase in unrealized loss levels during a bullish trend has historically created strong buying opportunities. According to the expert, this is the moment when the famous change of hands narrative, which is highly discussed in the sector, often takes place.