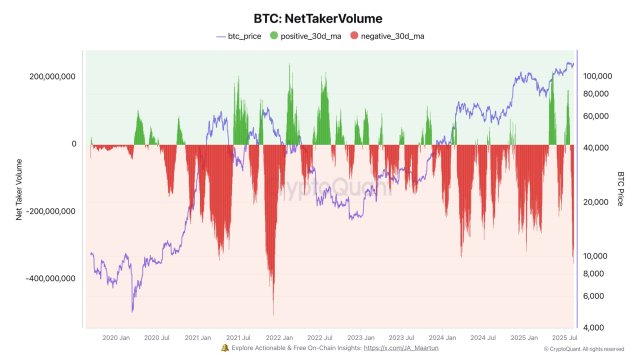

Following a resurgence in the broader crypto market, Bitcoin has ventured into a bullish state once again as the flagship digital asset surges sharply towards its current all-time high. As Bitcoin’s price gains a notable upward trend, several key metrics are still in the red, such as its Net Taker Volume.

A Deep Negative Bitcoin Net Taker Volume

Bitcoin’s Net Taker Volume appears to be moving in a separate direction from its price, which has rebounded strongly to key resistance levels. While BTC’s price has turned notably bullish, this crucial metric continues to demonstrate bearish action.

Darkfost, an author and on-chain expert, outlined the waning activity after examining the metric in the 30-day time frame. This development signals a market environment in which the pressure from sellers outweighs buy-side aggression.

Presently, the metric, which monitors the variation in taker purchase and taker sell volumes, is showing that traders are more eager to sell BTC rather than accumulate it at current price levels. Furthermore, it is a very useful tool for reading the derivatives order book and determining the general sentiment.

Such situations frequently imply a cautious or negative mindset among active market participants. It is likely pointing at short-term price headwinds even while long-term fundamentals remain intact.

According to the on-chain expert, BTC is currently experiencing a significant decline in buying pressure from the derivatives market, as the metric remains in the red. Within the 30-day timeframe, the Net Taker volume decreased significantly on Tuesday, indicating that buy-side position volumes have declined substantially.

Darkfost highlighted that the development is rather a negative sign in the short term. However, when it hits crucial levels like what was seen on Tuesday, it can also be useful in planning a buying strategy. In the meantime, Darkfost has stressed the importance of waiting for a resurgence in buying pressure and for this negative value to decrease.

BTC Volatility Has Fallen Sharply

Amid the recent and sudden price growth, Bitcoin’s volatility levels took a hit, falling sharply to fresh lows. Glassnode, a well-recognized on-chain data analytics platform, reported the notable drop in volatility in an X post.

According to the data, the Bitcoin realized volatility in the 3-month time frame has dropped to 29.79%, marking its lowest since September 2023. The on-chain platform noted that the volatility profile of this cycle is notable since it has remained largely below 50%, in contrast to the previous two bull markets’ regular readings of 80–100%.

At the time of writing, Bitcoin’s price was trading at $119,354, with a 24-hour increase of just 0.27%. Data from CoinMarketCap shows that investors’ sentiment is slowly turning bearish, as evidenced by a nearly 4% increase in trading volume in the past day.