Data shows the Bitcoin Fear & Greed Index has remained outside the extreme greed zone even after the price surge above $104,000.

Bitcoin Fear & Greed Index Is Still Inside Greed Territory

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment present among the investors in the Bitcoin and wider cryptocurrency markets.

The metric makes use of the data of the following five factors to determine the trader mentality: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends.

To represent the market sentiment, the index uses a numeric scale running from zero to hundred. All values under 47 suggest the dominance of fear in the market, while those above 53 imply that of greed. Values lying between these cutoffs correspond to a net neutral mentality.

Besides these three main sentiments, there are also two special regions known as the extreme greed and extreme fear. The former occurs above a value of 75, while the latter below 26.

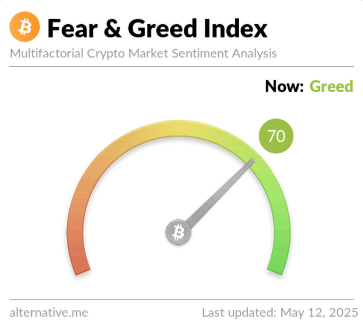

Now, here is how the latest value of the Bitcoin Fear & Greed Index is like:

As is visible above, the Bitcoin Fear & Greed Index has a value of 70 at the moment, which suggests the investors as a whole share a sentiment of greed. This greedy mentality is also decently strong, as it’s only a few units away from the extreme greed territory.

Earlier in the month, the trader mentality declined to a neutral level as the price surge took a pause, but with the latest continuation to the rally, the market mood has improved once more.

Interestingly, though, despite Bitcoin approaching its all-time high (ATH), the investors have still not become extremely greedy. If history is to go by, this could actually play into the favor of the asset’s price.

The reason behind this is that the cryptocurrency has often tended to move in a direction that’s opposite to the crowd opinion. The probability of such a contrary move taking place has only gone up the more sure the investors become of a direction, so the extreme zones, where sentiment is the strongest, is where major tops and bottoms have formed.

The Fear & Greed Index still staying out of the extreme greed region could be an indication that an excess of hype hasn’t developed among the investors just yet, so Bitcoin could potentially have more room to run before a top.

BTC Price

Bitcoin briefly managed to cross beyond the $105,000 level earlier, but it seems the coin has seen a small pullback since then as its price is now back at $103,000.