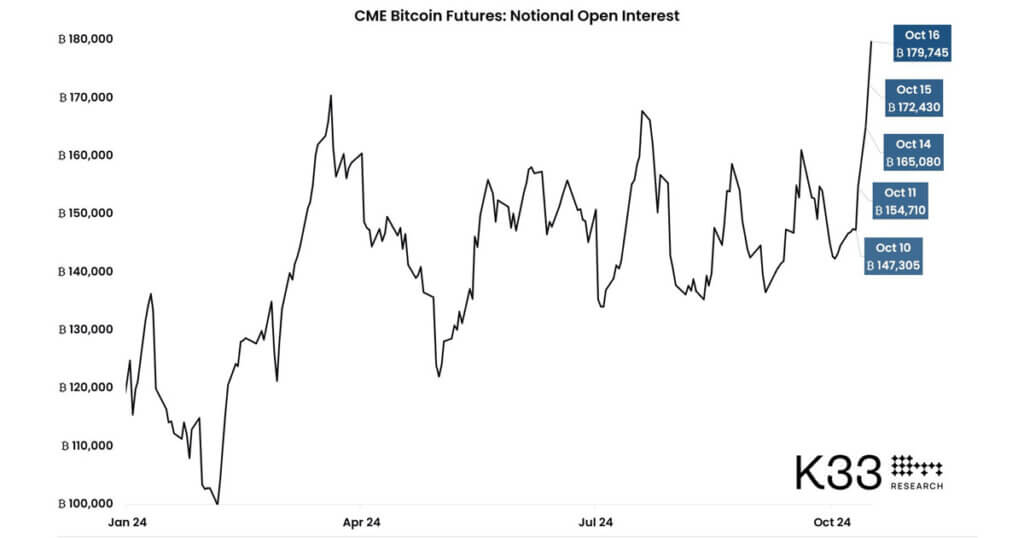

Bitcoin’s open interest has reached another all-time high, with CME’s notional open interest closing at 179,745 BTC, according to Vetle Lunde, Head of Research at K33 Research. Open interest has grown by 32,440 BTC since Oct. 10, representing a 40% weekly growth in exposure driven by active market participants.

Two days earlier, data from CryptoQuant indicated that Bitcoin derivatives activity surged as open interest hit $19.8 billion. Analysts observed that funding rates reached their highest positive level since August, suggesting most positions are long on Bitcoin.

The increase in open interest reflects growing liquidity and heightened participation in the crypto market. Positive funding rates typically indicate traders are paying a premium to maintain long positions, pointing to prevailing bullish sentiment. However, accumulating leveraged positions may elevate risk levels and potential market volatility.

Elevated open interest and funding rates could lead to sharper price movements, as leveraged positions often amplify market reactions.

The post Bitcoin open interest hit another all-time high adding 32,440 BTC in 7 days appeared first on CryptoSlate.