The price action of Bitcoin over the past week was largely redemptive, as the premier cryptocurrency reclaimed its place above the psychological $100,000 mark. This recent burst of bullish momentum mirrors a healthily growing sentiment amongst investors.

On Friday, May 15, the Bitcoin price reached as high as $103,800 — its highest level since January. However, the latest on-chain data shows the absence of investor activity in the derivatives market, typically seen when BTC’s value hits this level.

BTC Price Rally About To Hit A Roadblock?

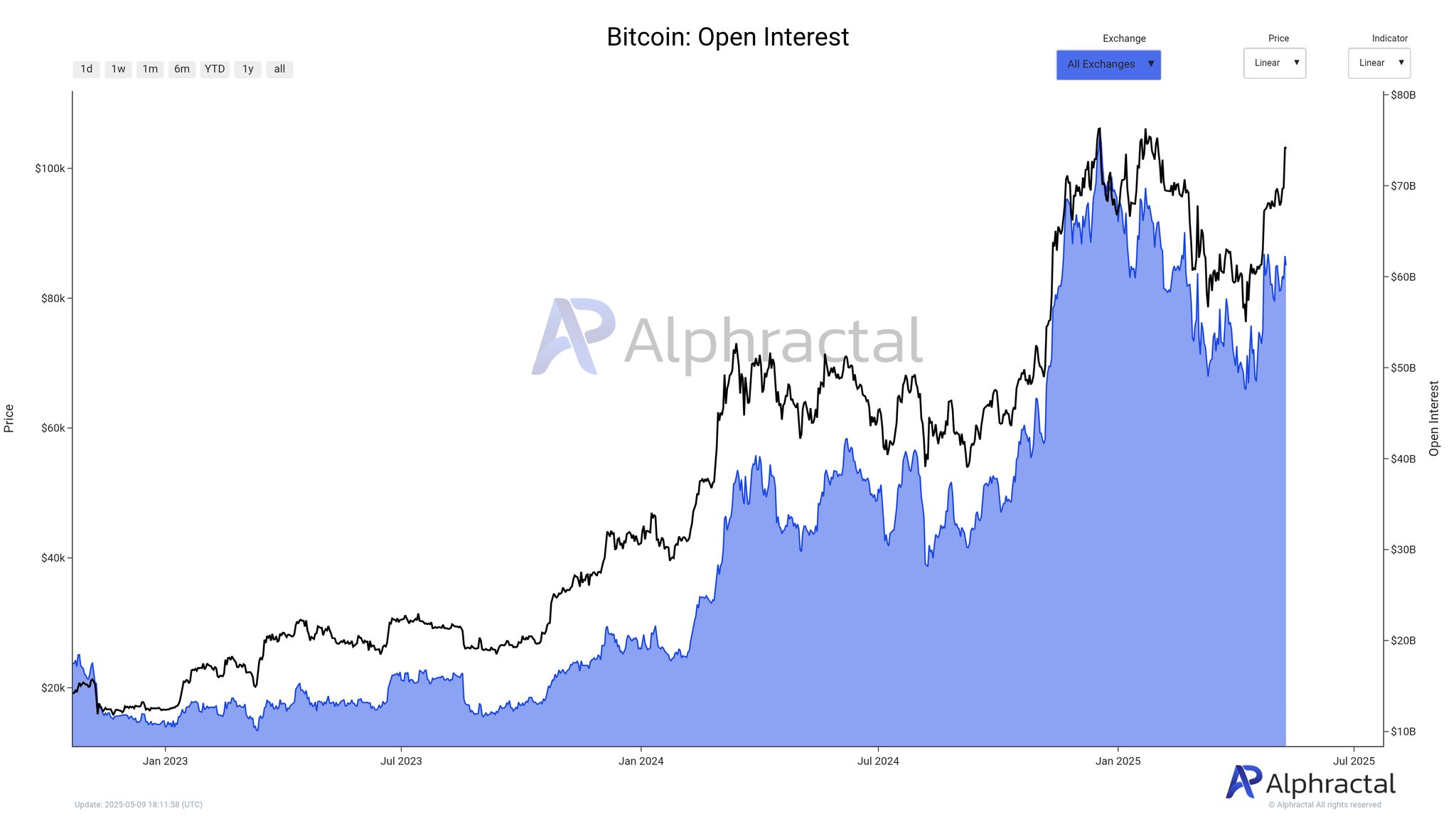

In a recent post on the social media platform X, crypto analytics platform Alphractal shared that the open interest (OI) has not quite moved in tandem with the Bitcoin price over the past few days. The open interest metric measures the total amount of money flowing into BTC derivatives at any given time.

Rising open interest is often considered a bullish signal for the premier cryptocurrency, especially as it suggests fresh capital influx into the market. Ultimately, this trend suggests improving investor sentiment and surging trader confidence.

According to data from Alphractal, the current aggregated OI for Bitcoin (valued at around $103,000) stands at an estimated $61.3 billion. The last time BTC was at this monumental price, the open interest was more than $68 billion.

With the current Bitcoin open interest less than the OI the last time price was at $103,000, Alphractal noted that this trend suggests lower leverage and reduced activity in crypto’s largest market. The analytics firm further explained that this phenomenon could be due to either recent waves of liquidations or position closures.

In the post on X, Alphractal revealed other reasons why the flagship cryptocurrency’s price might be at risk of a short-term correctional movement. The relevant on-chain metric backing this bearish projection is the Whale Position Sentiment.

The Whale Position Sentiment metric tracks both the directional bias and trading behavior of large holders. It typically reflects the net positioning of whales, their market sentiment, and also changes in open positions.

Alphractal concluded that the drop in the Whale Position Sentiment reflects large investors’ interest in closing long positions, thereby shifting market sentiment. If the metric continues to drop, the on-chain analytics firm inferred that it could lead to price stagnation, or worse, a correction.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at $103,035, reflecting no significant movement in the 24 hours. While the recent bullish momentum suggests that the premier cryptocurrency could hit a new all-time high in the coming days, investors might want to exercise caution, considering recent on-chain observations