Quick Take

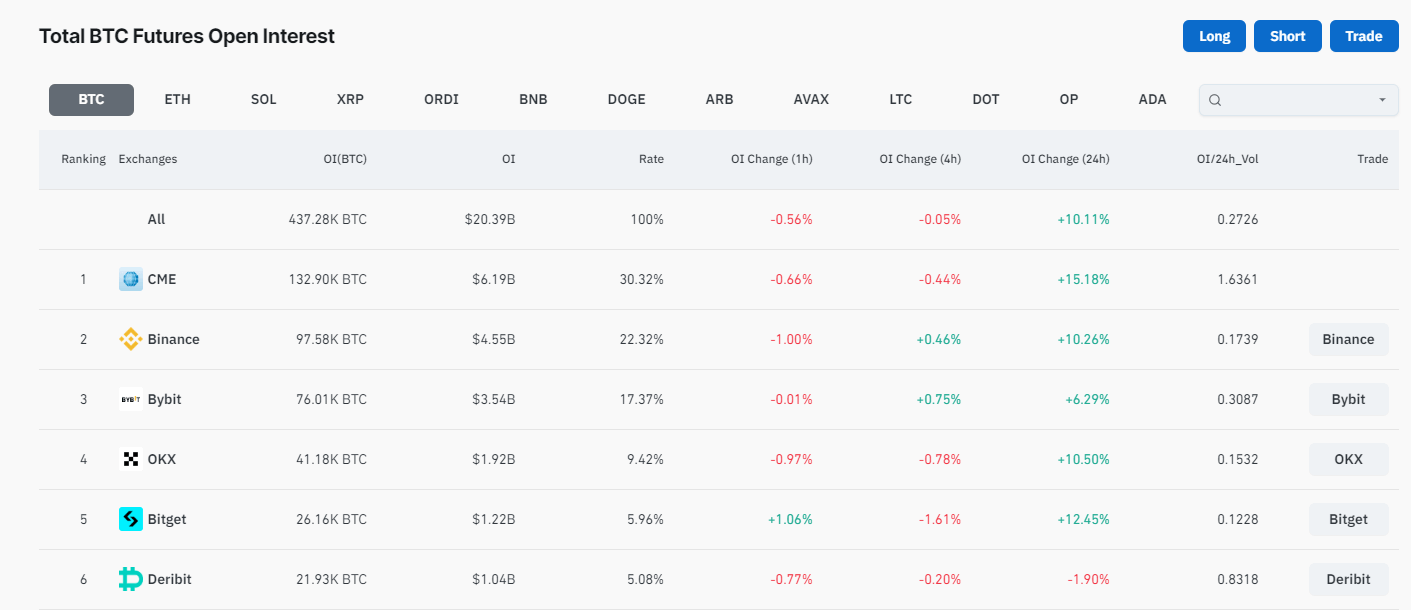

Bitcoin open interest has witnessed an impressive increase in the past 24 hours, catapulting over $20 billion in notional value, a peak not observed since Dec. 2021, according to Coinglass. This surge appears to rekindle the market vigor exhibited during Bitcoin’s all-time high in Nov. 2021.

In the past 24 hours, the open interest has experienced a marked 10% growth. Notably, CME has registered a significant 15% uptick, with a current allocation of 133,000 BTC in open interest contracts, translating to a notional value of $6.20B. Binance has mirrored this trend, escalating by 10% within the past 24 hours, with a notional value of $4.55 billion, represented by 98,000 Bitcoin. These figures contribute to the 437,000 BTC now allocated in open-interest contracts.

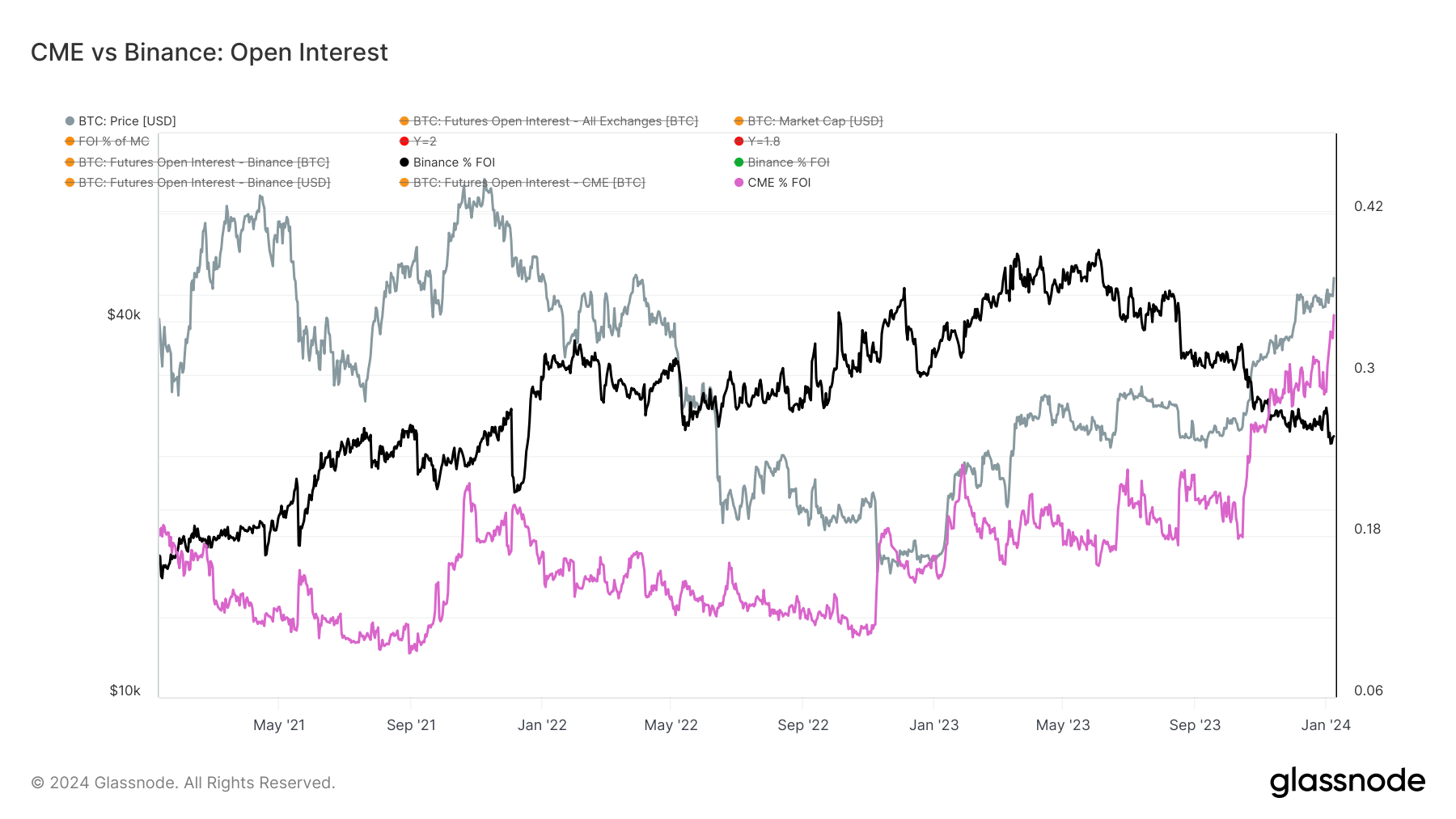

Amid these dynamics, CME continues its dominance, reaching unprecedented highs at 30%. These developments reflect a heightened market engagement and point towards potentially crucial shifts in the Bitcoin landscape.

The post Bitcoin open interest soars past $20 billion, hits 16-month high appeared first on CryptoSlate.