Bitcoin (BTC) premium trades on Binance.US is a symptom of an illiquid market and not evidence of market makers exiting the platform, according to blockchain analytical firm Kaiko.

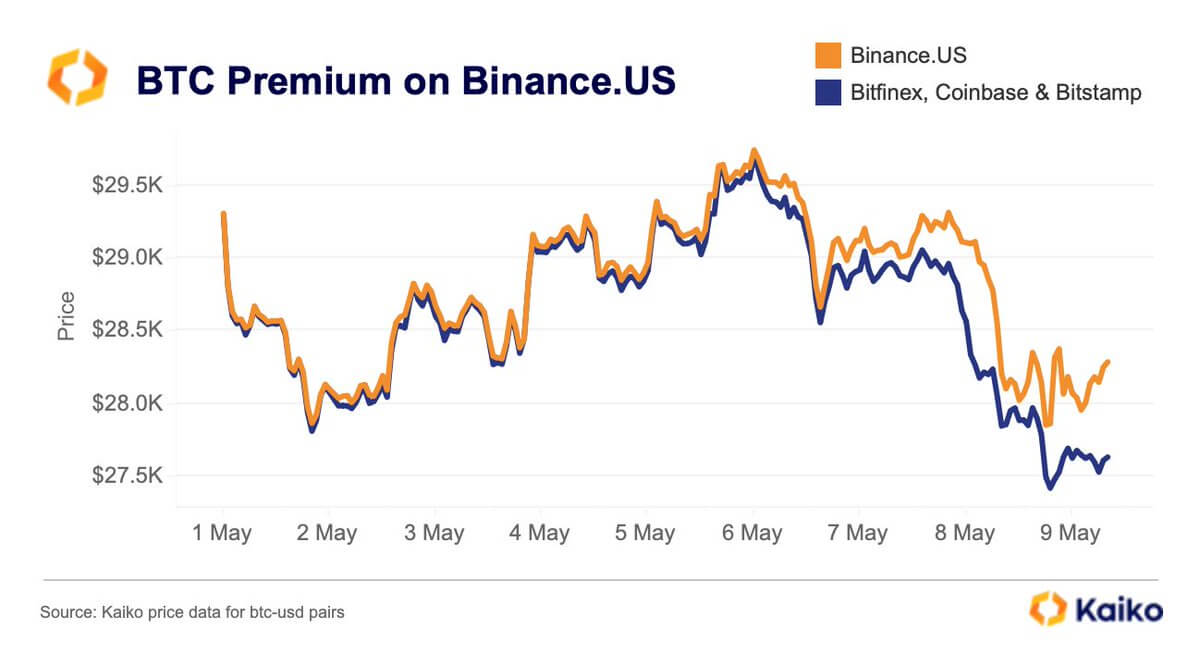

In its May 9 report, the data aggregator explained why the flagship digital asset traded at a 2.5% premium on Binance.US compared to other U.S.-based exchanges.

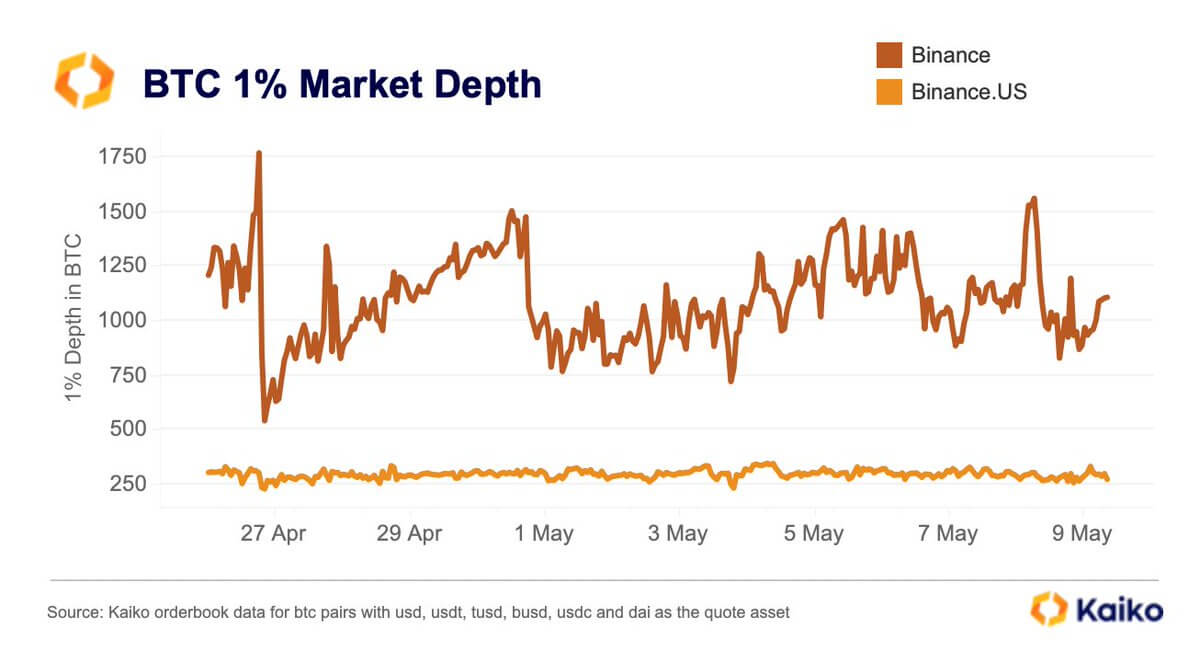

According to the firm, speculations that market makers might be exiting the platform were mere rumors as there are no changes in its market depth.

Since April, several crypto community members have highlighted the increasing premium BTC trade on the platform — with many inferring that market makers and insiders might be leaving because of possible legal action.

However, Kaiko rejected such assertions noting that the exchange’s struggle for a banking partner could play a role in the trades.

Kaiko said:

“The premium on Binance.US is more likely related to the exchange’s struggles to find a banking partner since the closure of Signature and Silvergate. With a surging demand for BTC generally, investors on Binance.US are likely looking at quicker withdrawal times for BTC compared to USD, and are rushing to trade into BTC at the same time, resulting in a premium on the exchange.”

Compared to the global Binance exchange, whose BTC’s 1% market depth has alternated between several highs and lows, Binance.US’s depth has remained stable. Kaiko data noted that this would not be so if a major market maker had left the platform.

Following the U.S. banking crisis that claimed three major crypto-friendly banks in March, the crypto industry has been exposed to low liquidity risks. At the time, CryptoSlate Insight reported that BTC’s order book reached a 10-month low.

Another report noted that U.S.-based exchanges and market makers became less liquid as they seem most affected by Silvergate’s implosion.

The post Bitcoin premium on Binance.US is symptom of illiquid market: Kaiko appeared first on CryptoSlate.