The Bitcoin price has somewhat slowed down in its recovery since reclaiming the $91,000 level over the past week. According to the latest on-chain data, the flagship cryptocurrency seems to be entering a critical zone, which could see its price rebound with more momentum in the near future.

On-Chain Data Suggests Bitcoin Price Could See Rebound Soon

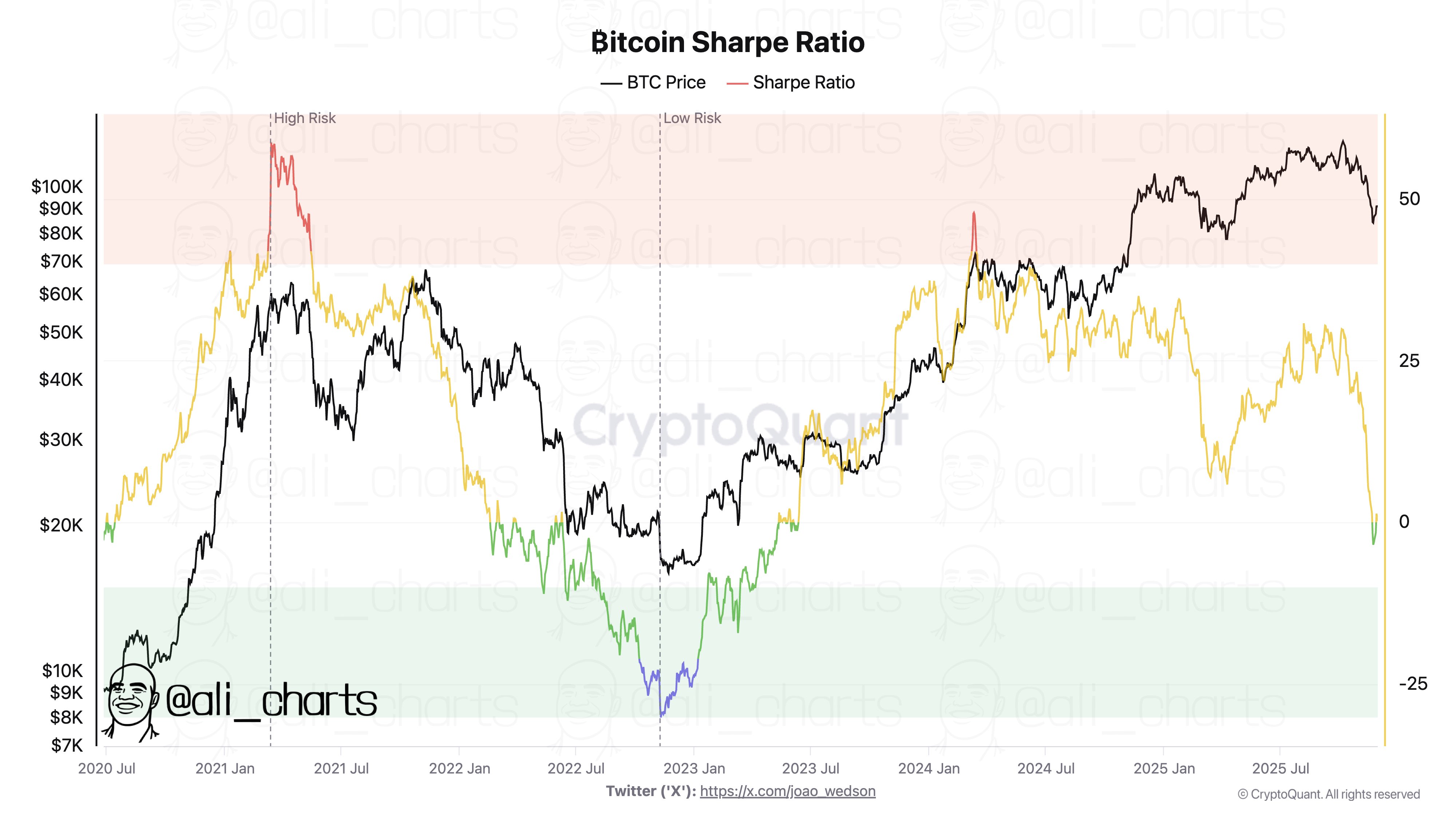

In a November 29 post on the social media platform X, crypto analyst Ali Martinez revealed that the Bitcoin price might be entering a “low-risk” zone. According to the market pundit, this low-risk area has often offered solid potential buying opportunities for investors.

This evaluation revolves around the Sharpe Ratio, an on-chain indicator that assesses the risk-adjusted returns of a specific crypto asset (Bitcoin, in this case). This metric basically evaluates the amount of profit an investment offers per unit of risk (considering risk is measured by volatility).

Typically, a rising Sharpe Ratio indicates a higher risk-adjusted performance, meaning the asset generates greater returns compared to the risk undertaken. On the other hand, when this metric is in a downward trend, it implies that the coin is in a “lower-risk zone” and the returns are becoming less significant.

As shown in the chart above, the Bitcoin Sharpe Ratio has been on a sharp downturn, approaching the low-risk region (the green area). Within this area, the market leader tends to offer lower returns and is often less susceptible to unexpected volatility-driven price movements.

Historically, the low-risk zone has been where long-term investors “buy the dip,” as they look to make less risky decisions in the market. Moreover, as observed in the highlighted chart, the Bitcoin price bottomed out (as seen in late 2022) when the Sharpe Ratio entered the low-risk zone.

In essence, the Bitcoin price could be preparing for a market rebound as the Sharpe Ratio hovers around and below the zero threshold.

Bitcoin Coinbase Premium Gap Flashes Green Again

Another on-chain metric that adds further credence to the Bitcoin price rebound hypothesis is the Coinbase Premium Gap. This indicator measures the difference between the BTC price on the US-based Coinbase exchange (USD pair) and the global Binance exchange (USDT pair).

When the Coinbase Premium Gap is positive, like it currently is, the metric implies that US-based investors are buying Bitcoin aggressively. Ultimately, this demand pressure from American investors could provide the buoy that the Bitcoin price currently needs.

As of this writing, the price of BTC stands at around $90,940, reflecting a mere 0.4% jump in the past 24 hours.