Crypto analyst Melika Trader has warned about a bearish pattern that could be forming for the Bitcoin price. Based on this, the analyst predicts that the largest crypto by market cap could crash to as low as $78,000.

Bitcoin Price Forming Head And Shoulders Pattern

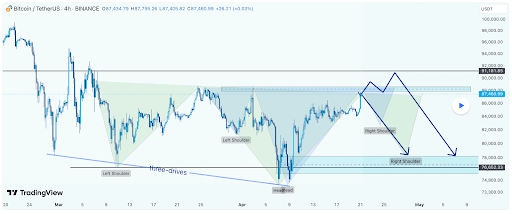

In a TradingView post, Melika Trader revealed that the Bitcoin price is forming a complex head-and-shoulders pattern. He remarked that the left shoulder and double head had already formed while the right shoulder is currently forming, with BTC at risk of suffering a massive crash once this happens.

As part of the expected move, Melika Trader suggested that the Bitcoin price could show a possible fake breakout above the resistance between $87,000 and $88,000. Once that happens, the analyst predicts that a strong drop will follow, with BTC dropping to as low as $78,000, which is the first support area.

The Bitcoin price has surged past the $90,000 mark on the back of the US Dollar dropping to new lows and has continued to reach new highs, leading to optimism that it could soon reclaim $100,000. There is the possibility that BTC could still rally to as high as $98,000 before any massive correction.

Crypto analyst Ali Martinez revealed that on-chain data shows that the next key area of resistance for the Bitcoin price is between $95,600 and $98,290. That range acts as a major supply wall, as 1.65 million addresses bought 1.09 million BTC around that area. Bitcoin’s next move will depend on whether these holders choose to hold or offload their coins as soon as it reclaims this range.

However, it is worth mentioning that crypto whales are actively accumulating BTC, which is bullish for the Bitcoin price. Martinez revealed that over 17,000 BTC have been withdrawn from exchanges in the past week.

BTC Eyeing Rally To A New All-Time High

Crypto analyst Titan of Crypto has predicted that the Bitcoin price could soon rally to as high as $137,000, marking a new all-time high (ATH) for the leading crypto. He stated that BTC has finally broken out of a bull pennant, with two strong consecutive daily bullish candles, confirming this move. The analyst added that the projected target is $137,000 if this bull pennant is confirmed.

Crypto analyst Egrag Crypto stated that a daily close above $93,000 will send a strong bullish signal, while raising the possibility of BTC rallying above $100,000. He claimed that any retracement fears will be eliminated if the leading crypto closes above $103,000.

At the time of writing, the Bitcoin price is trading at around $93,000, up over 5% in the last 24 hours, according to data from CoinMarketCap.