Bitcoin is trading above the $90,000 mark again, signaling renewed strength as bulls gain momentum despite persistent global uncertainty. The broader market remains on edge amid rising tensions between the US and China, coupled with lingering concerns over inflation and economic slowdown. However, optimism around Bitcoin continues to grow, with several analysts suggesting the possibility of a sustained rally in the months ahead.

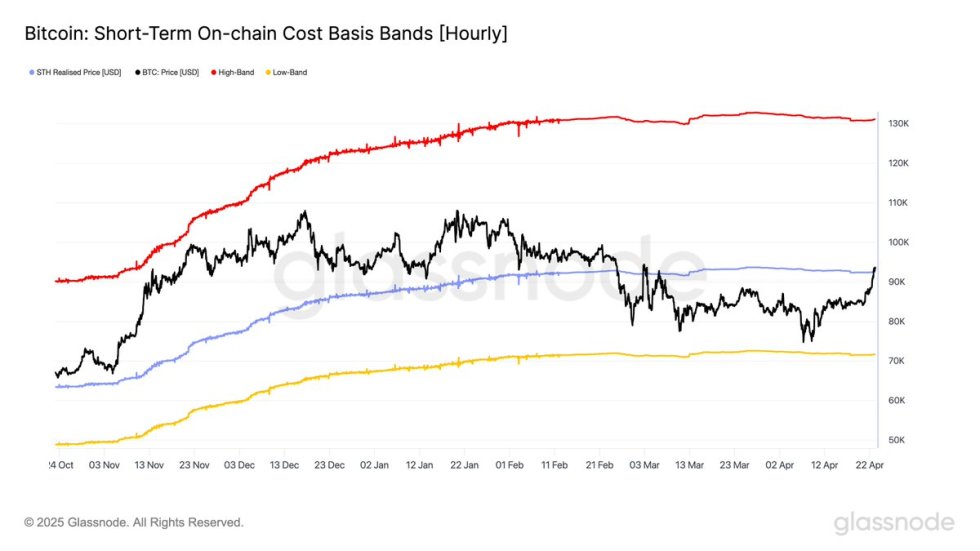

One of the key signals supporting this view comes from on-chain data shared by Glassnode. The analytics platform revealed that Bitcoin has now broken above the Short-Term Holder (STH) realized price. This metric, which tracks the average price at which recent buyers acquired their BTC, is often seen as a psychological level that influences short-term sentiment.

Glassnode has consistently highlighted this level as a benchmark for gauging market sentiment, and breaking above it is considered a significant step in confirming buyer confidence. Now, all eyes are on whether Bitcoin can hold above $90K and begin targeting new highs.

Bitcoin Tests Key Resistance as Bulls Regain Control

After weeks of persistent selling pressure and a sharp 30% drawdown from its highs, Bitcoin is finally showing signs of recovery. The asset is now testing a critical resistance zone, and the outcome of this battle will likely define the short-term trajectory. Bulls have reclaimed control in recent sessions, and the market’s attention is now focused on whether they can defend the $90,000 support level and push higher.

This recent strength comes despite continued macroeconomic turbulence. The conflict between the US and China remains unresolved, and the threat of an extended trade conflict continues to hang over global markets. A delay in any resolution could bring renewed volatility, which may influence Bitcoin’s next major move. Still, BTC’s resilience amid these headwinds is a promising sign for long-term holders.

Supporting the bullish case, Glassnode recently highlighted that Bitcoin has broken above the Short-Term Holder (STH) realized price — or cost basis — for the first time since the correction began. This level is widely viewed as a key benchmark for investor sentiment and positioning.

Historically, a sustained move above the STH realized price signals a shift toward renewed confidence and often serves as a springboard for further upside. For now, Bitcoin bulls are in control — but holding $90K is essential to avoid another wave of downward pressure.

BTC Price Update: Bulls Eye $100K After 25% Rally

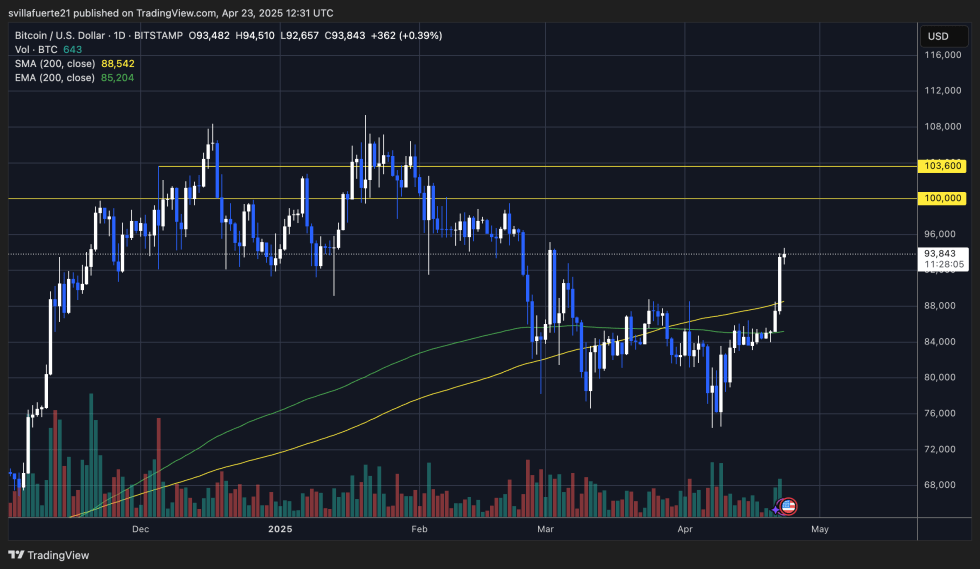

Bitcoin is trading at $93,800 after two days of strong upside momentum, marking an impressive 25% gain since April 9. The surge has propelled BTC through key resistance levels and lifted sentiment across the broader crypto market. After weeks of consolidation and uncertainty, bulls are firmly back in control — but the next move will be critical in determining whether the rally continues.

To sustain this momentum, Bitcoin must hold above the $90,000 support zone. This level now acts as a short-term floor, and defending it would solidify the current breakout. If bulls can maintain pressure and reclaim the psychological $100,000 mark, a full trend reversal will be confirmed and likely draw in fresh capital.

However, if BTC fails to hold $90K, a healthy retest of lower support around the 200-day simple moving average near $88,500 could follow. This would not necessarily invalidate the bullish trend but could reset key indicators before another leg higher.

For now, bulls are in a strong position — but volatility remains elevated, and the coming days will be decisive as the market awaits confirmation of a sustained recovery phase.

Featured image from Dall-E, chart from TradingView